All eyes and ears were on the European Central Bank (ECB) decision, plus another batch of U.S. inflation data.

How did the markets react to these catalysts?

Here’s what happened in the latest trading sessions.

Headlines:

-

ECB kept interest rates on hold at 4.50% for the fifth straight meeting as expected

- The official statement noted that “it would be appropriate to reduce the current level of monetary policy restriction” if inflation continues to move toward its 2% target

- During the press conference, ECB head Lagarde said that “We are not assuming that what happens in the euro area will be the mirror of what happens in the United States,” in response to policy speculations after a strong U.S. CPI report

- During the Q&A, Lagarde mentioned that a few ECB members felt sufficiently confident to cut interest rates

- U.S. headline producer price index for March: +0.2% m/m (+0.3% forecast, +0.6% previous); core PPI at 0.2% m/m as expected (+0.3% previous)

- U.S. Weekly Initial Jobless Claims fell to 211K (218K forecast; 222K previous); continuing claims rose from 1.79M to 1.82M

-

FOMC officials shared insights on latest inflation data in their testimonies:

- NY Fed President John Williams said that there is no need to change monetary policy in the very near term

- Richmond Fed President Thomas Barkin mentioned that the latest inflation reports did not increase confidence that disinflation is spreading

- New Zealand’s BusinessNZ manufacturing index for March: 47.1 (49.1 previous)

- New Zealand food price index for March: -0.5% m/m (-0.6% previous)

Broad Market Price Action:

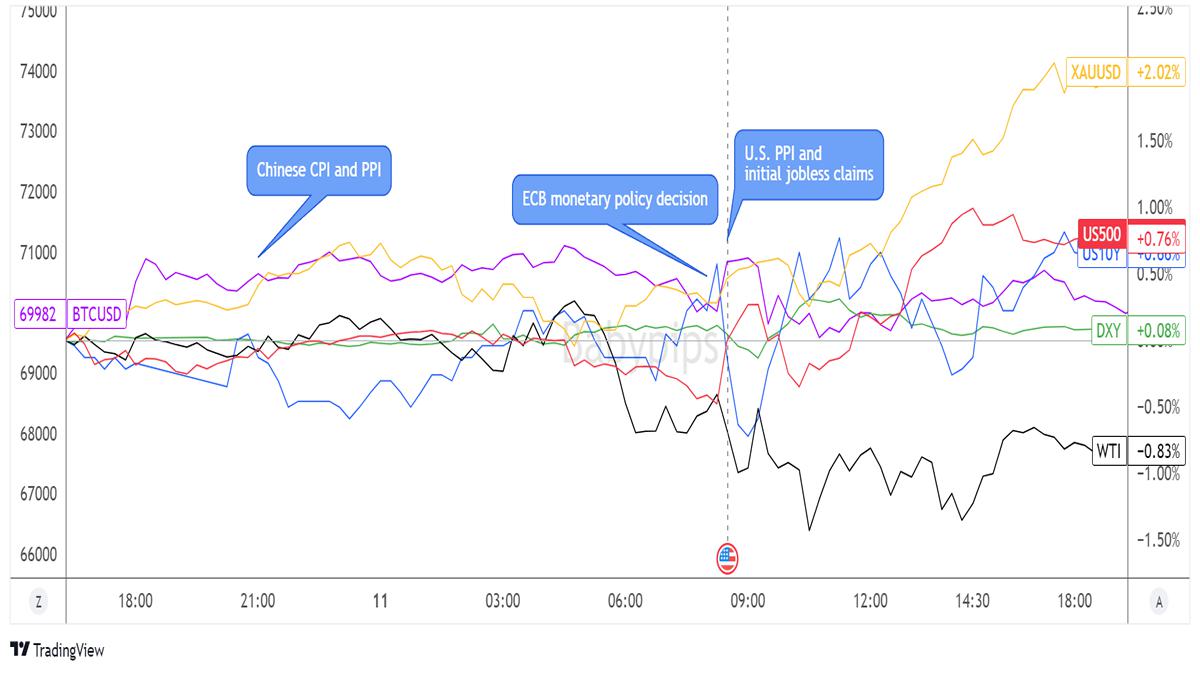

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Weaker than expected Chinese inflation reports greeted traders in the Asian trading session, with the headline CPI printing a meager 0.1% year-over-year uptick for March versus the projected 0.6% increase.

This sparked a tiny bit of volatility during the release, triggering a dip for U.S. bond yields and a slight pop higher for gold and bitcoin. Crude oil and the dollar continued to cruise sideways while other asset classes returned to the ranges later on.

Price action picked up once again leading up to the ECB decision and the release of the U.S. PPI figures, which then spurred another dip in yields as the headline reading fell short of estimates with a 0.2% monthly gain versus the projected 0.3% rise and previous 0.6% rise. The core PPI came in line with expectations of a 0.2% uptick, slower than the previous 0.3% increase.

This coincided with the release of the U.S. weekly jobless claims, which showed a smaller than expected 211K increase in joblessness versus the 216K consensus and previous 222K print.

The ECB kept interest rates on hold at 4.50% as expected but dropped stronger hints about easing in June, as the official statement noted “it would be appropriate to reduce the current level of monetary policy restriction” if inflation continues to move closer to target.

Link to European Central Bank (ECB) April monetary policy decision here

FX Market Behavior: U.S. Dollar vs. Majors

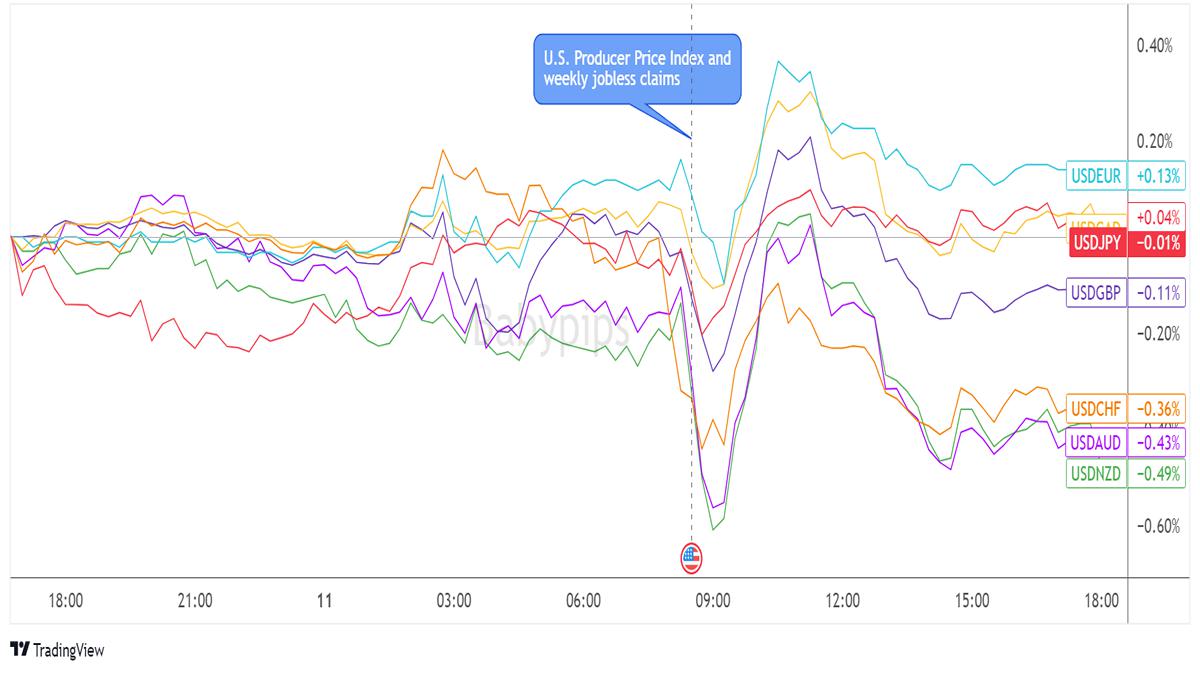

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar stayed mostly in consolidation against its peers, as traders held out for the release of the PPI figures.

The report spurred an overall bearish reaction for the Greenback, even though the core PPI hit the mark, as the headline reading came in below consensus. After all, this is a point in favor of the Fed starting its easing cycle sooner rather than later.

Still, the U.S. currency managed to pull up from its drop pretty quickly, even climbing back in the green against EUR and CAD, as the former was reeling from a relatively dovish ECB announcement while the latter trailed the decline in crude oil prices.

Upcoming Potential Catalysts on the Economic Calendar:

- Chinese trade balance due in the Asian session

- U.K. monthly GDP at 6:00 am GMT

- U.K. industrial production at 6:00 am GMT

- U.S. preliminary UoM consumer sentiment index at 2:00 pm GMT

- FOMC member Bostic’s speech at 6:30 pm GMT

- FOMC member Daly’s speech at 7:30 pm GMT

Friday could have one more bout of volatility across asset classes, as China will be printing its latest trade figures and likely influencing overall market sentiment.

Before the U.S. market closes, the preliminary UoM consumer sentiment figure could also spur directional flows for USD, as this is considered a leading indicator of spending activity.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

No comment on record. Start new comment.