Greetings forex friends! It looks like the European Central Bank held interest rates as-is on April 11th, 2024:

- Marginal Lending Rate: 4.75%

- Deposit Facility Rate: 4.0%

- Main Refinancing Rate: 4.5%

Link to ECB’s April 2024 Policy Decision press release

This was a widely expected outcome and in their statement, they noted that if the upcoming update on inflation dynamics increased confidence in sustainably reaching their target, then it may be appropriate to reduce monetary policy restriction.

Basically, they remained data dependent overall on the future of rate cuts, but they did signal that June’s data would likely be enough to get the majority on board with reducing rates if the data warrants it.

Beyond June, members were mixed on when the next rate cut may come, with some looking for another one as soon July, while others leaned towards one cut per quarter.

Market Reactions

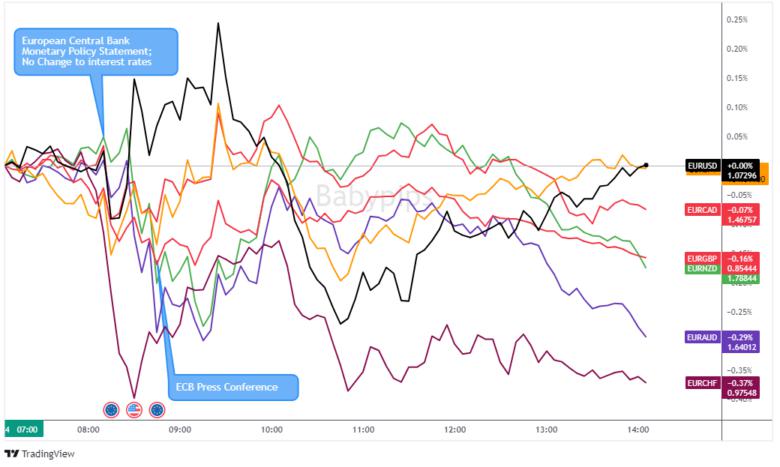

Euro vs. Major Currencies: 5-min

Overlay of EUR vs. Major Currencies 5-min Forex Chart by TradingView

The statement release sparked an initial selloff in the euro against the major currencies, sentiment that lasted right into the ECB press conference.

It was there that the euro found a temporary bottom and bounced for the next hour, likely on ECB President Lagarde tempering June cut expectations a bit by saying the rate cut path is not pre-determined and will be data dependent.

Lagarde also pushed back on narratives that the ECB may be influenced by the Fed and it’s rate path (now seeing lower odds of cuts after stronger-than-expected inflation data this week from the U.S.), saying that “we are data dependent – we are not Fed dependent.”

This divergent outlook may have been the spark for the broad move lower in the euro post press conference, specifically the swift drop in EUR/USD heading into the London close.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

No comment on record. Start new comment.