European Central Bank on course for June easing

Summary

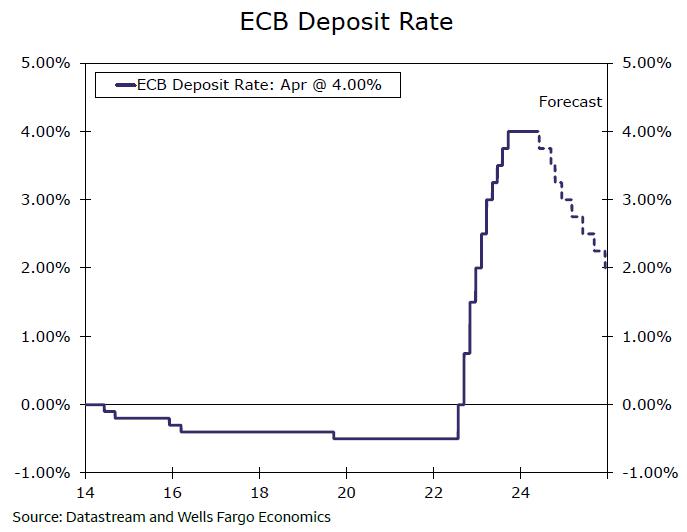

The European Central Bank held monetary policy steady at today's announcement, though we view the accompanying statement as laying the groundwork for a probable ECB rate cut in June. The ECB cited an easing in underlying inflation and moderating wage growth. In addition, the ECB's announcement and ECB President Lagarde suggested that so long as updated forecasts confirmed the improving inflation outlook, monetary policy easing would be appropriate at the June 6 meeting.

That said, we believe the ECB will pursue a measured pace of rate cuts during the second half of this year. That reflects some lingering inflation concerns, particularly as it relates to services inflation, and the likelihood of gradual Eurozone economic recovery as this year progresses. We forecast an initial 25 bps ECB policy rate cut in June, but then expect the central bank to forgo monetary policy easing in July. Instead, we expect the ECB to deliver 25 bps rate cuts in September, October and December for a cumulative 100 bps of easing this year. That is a slower pace of rate cuts than our previous forecast, though still more than the cumulative 76 bps of rate cuts currently priced in by market participants for the remainder of this year.

Download The Full International Commentary

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.