The “hot” CPI print yesterday needs to be taken with a grain of salt

Outlook

The “hot” CPI print yesterday needs to be taken with a grain of salt. With only a speck of sarcasm, Reuters notes that the month/month rise was 0.359%, then rounded up to 0.4%, when 0.3% had been forecast. “The rounded print would have been in line with expectations had the number come in less than one basis point lower.”

In addition, we will be getting PPI tomorrow and PCE/core PCE on April 26. For Feb, core PCE had been up 0.3% m/m and 2.8% y/y. This is actually the data to look at, not CPI, for the simple reason it’s what the Fed prefers.

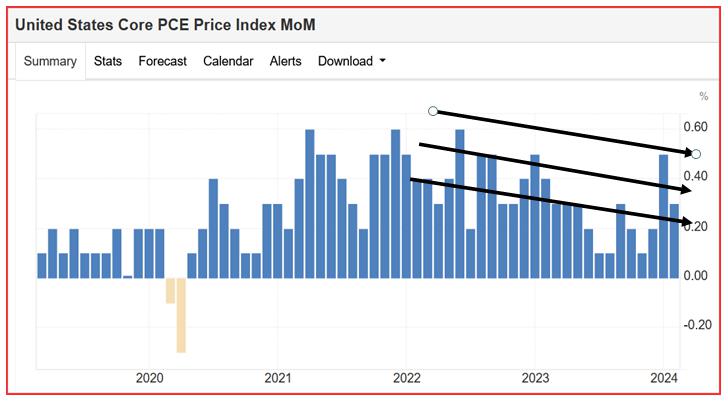

Still, the numbers are horrendous and as the charts above show, the rises look like a lot more than Mr. Powell’s bumpy road. The market responded to the CPI exactly as predicted—a knee-jerk rise in yields and the dollar on the assumption the Fed will hold off cutting in June. This deduction seems fully warranted on the CPI numbers, especially core and supercore, but there is a rebuttal, sort of. See the Trading Economics chart with our inserted arrows. For what it’s worth, Trading Economics expects the next core PCE to come in at 0.1% (vs. 0.3% recently).

Is it legit to draw trendlines on economic data? As a rule, it’s risky, because circumstances can so often deliver fits and starts. But these arrows may very well represent the reason Mr. Powell has been saying that one month of any data does not materially change the overall outlook, even if bumpy.

Even if we do not get a nicer PCE, it does seem as though the Fed funds futures bettors went overboard again. The CME FedWatch tool shows the probability of a May cut at zero. For June, it’s 16.4%. For July, 31.1%. For Sept, 45.6%. For Nov, 42.5%. It’s not until Dec that the probability of no rate change at all is a mere 13.2%. This is illogical, of course. Other measures of rate cut expectations, like swaps, show different numbers but the same gloom-and-doom—the Fed is going to have to change its tune.

Bloomberg writes that “For the Fed, the first rate cut is now only fully-priced for November.” Remember this comes two days after the presidential election, and is therefore simply not a realistic expectation. Shunning politics or not, there is no way the Fed waits until after the election.

Today we get PPI but probably more importantly, speeches from Feds, including Boston Pres Collins, New York Pres Williams, Richmond Fed Pres Barkin and Atlanta Fed Pres Bostic. It’s doubtful these will be useful. We will also get a slew of inflation data to plow through. So far we kind of like the idea that Manhattan rental prices have in fact fallen. Offset: the new 30-year fixed rate mortgage is 7.34%.

Forecast

CPI yesterday validated the worst fears of those who expected a resurgence of inflation and adjusted their Fed rate cut expectations accordingly. As we wrote yesterday, yield differentials don’t always rule the roost but usually assert dominance when conditions are tense.

We didn’t expect the data to be so bad and so put off the end of dollar softness for a week or so, not over in one day. It looks like the reversal to the upside for the dollar has at least a couple of weeks to go.

Do we get another round of dollar softness if PCE looks better? Yeah, probably, but that’s down the road. You can’t trade today on data not due for another two-plus weeks. We continue to think the Fed really, really does want to cut for all the reasons we have outlined. Now we have to parse Fed speeches to see if the spine stiffens to return to the expectations in the Dec FOMC, at least some of the way—not three cuts, but at least one.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.