As expected, the Bank of Canada (BOC) maintained its overnight rate at 5.00% and kept its quantitative tightening program in April.

Turned out, there was a “clear consensus” among BOC members to hold their policies steady for the month.

Sorry April rate cut bettors.

Link to BOC’s April 2024 Policy Decision press release

While the Bank noted that “inflation is still too high and risks remain,” they also recognized that “CPI and core inflation have eased further in recent months.”

BOC also upped its global growth forecasts and mentioned population growth and a recovery in household and government spending as reasons why its domestic economy may pick up.

The accompanying quarterly monetary policy report has the deets:

- The global economy may now expand by 2.8% in 2024 (from 2.5%); 3.0% in 2025 (from 2.7%), and may see a 3.1% uptick in 2026

- On an annual basis, Canada’s real GDP could see a 2.1% growth in 2024 (from 1.6%); a 2.2% expansion in 2025 (from 2.7%), and a 1.9% growth in 2026.

- Quarterly real GDP may clock in at 2.8% in Q1 2024 (from 0.5%) and see a 1.5% increase in Q2.

- Inflation is also expected to decelerate at a faster rate, with CPI printing at 2.8% y/y (from 3.2%) in Q1 and growing by 2.9% in Q2.

- Annual inflation could see a 2.2% uptick in 2024 (from 2.4%) while 2025’s CPI is still seen at 2.1%.

Link to BOC’s Quarterly Monetary Policy Report

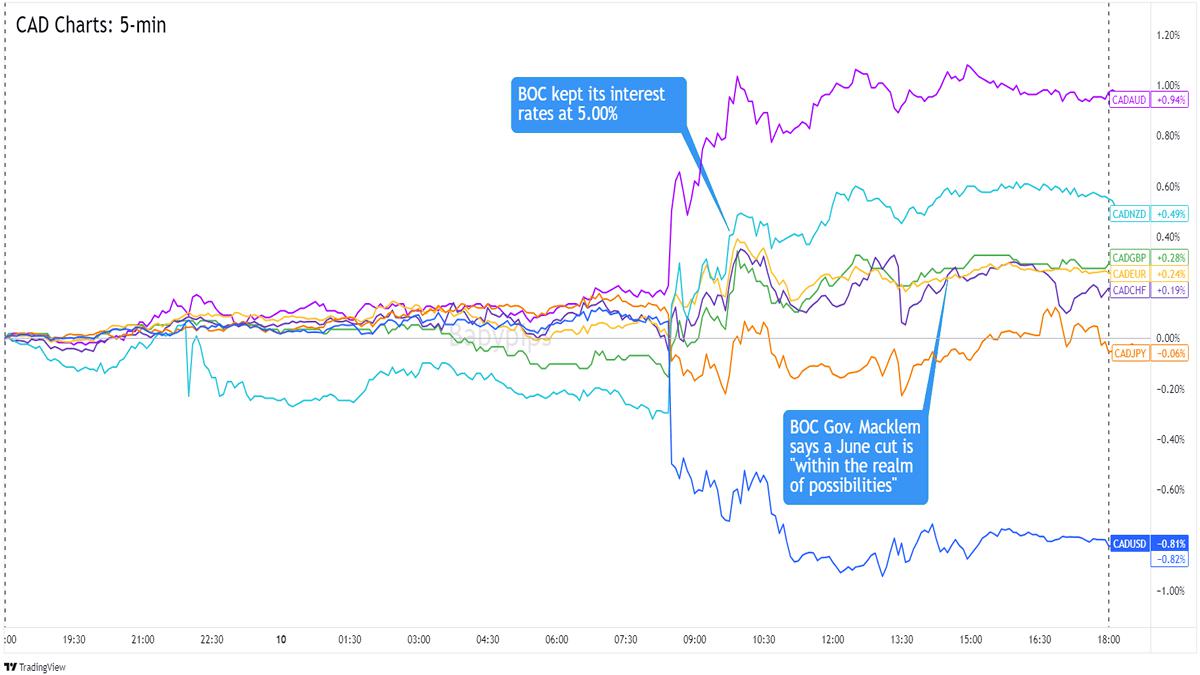

Market Reactions

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies 5-min Forex Chart by TradingView

With rosy prospects like that, it’s no wonder traders side-eyed Macklem’s remarks that a June interest rate cut “is in the realm of possibilities.” Macklem detailed that:

“We’ve been pretty clear we like what we’ve been seeing since January. Inflation and core inflation have come down. Things are moving in the right direction. We’re encouraged by that progress. We need to see that progress continue. If things evolve broadly in line with the outlook we published today then we will be more confident we are on the right path and it will be more appropriate to cut our interest rates.”

Link to Macklem’s prepared opening statement

Unfortunately, not a lot of traders were convinced that Canada’s inflation situation would slow down enough to warrant a June rate cut especially with gas prices rising.

This is probably why CAD mostly shrugged off Macklem’s remarks. After ranging in the earlier trading sessions, the Loonie traded higher against its major counterparts.

It only weakened against the U.S. dollar and that was because the U.S. also just dropped a hotter-than-expected inflation reading in March.

CAD is currently seeing the most gains against fellow commodity-related currencies like AUD and NZD but it’s also trading higher against counterparts like GBP, EUR, and CHF.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

No comment on record. Start new comment.