The focus this week will be US CPI – Fed cares deeply about its credibility

Outlook

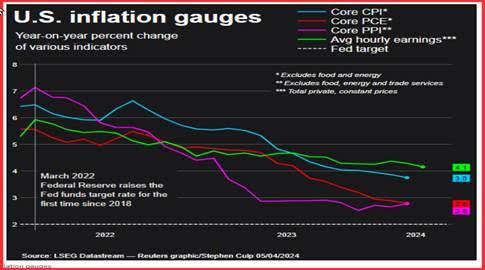

The focus this week will be US CPI on Wednesday, forecast up 0.4% m/m and 3.1% y/y (from 3.2%). 2% prior. Core is expected to decelerate to 0.3% m/m and 3.7% y/y. We also get the Fed minutes. Late in the week will be some big bank earnings (Citi, JP Morgan, Wells Fargo). Off in the sidelines are worriers about the looming commercial real estate market failure.

In a data-filled week, note the ECB meets Thursday. (The BoC also meets.) It’s a bit vague but chief Lagarde seems to have been plowing the ground for a June cut, even if that looks a bit premature. If the debate in the US that the Fed would/could/should not do the deed in June, it’s becoming a set-up for a dust-up.

We are stuck with endless talk about US inflation. The top question that has been raising its head above the water for some months now is whether the hot US economy is too hot for the promised rate cuts. Quite apart from macroeconomics, we see two reasons for the Fed to stick to its narrative for as long as possible.

First, the Fed cares deeply about its credibility/reputation. This had to be a part of the affirmation at the last policy meeting. We don’t know what rise in inflation would be necessary to unseat the Fed from its position, but it would have to be pretty big and universally accepted. This idea thrusts us down into the weeds of which inflation number (CPI vs. PCE), which timeframe, annualized or year/year, etc. Given the lack of consensus on those measurement issues, any rise in inflation would have to be defined carefully and thoroughly. We therefore believe the Fed will hold the line until it’s forced off.

Powell expressed it perfectly: "The recent data do not ... materially change the overall picture, which continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down toward 2% on a sometimes bumpy path."

A rush to judgment that June won’t warrant a hike is just that—a rush. Everybody and Larry Summers thinks the economy is too hot for a June cut. Summers even thinks the current conditions are “easy,” which is true in the grand scheme of things. But he comes close to calling some current conditions a set of bubbles, and that’s bothersome.

Secondly, the political stuff. The Fed is supposed to be independent of politics and indifferent to them. But surely it will have registered that Trump would include the Fed in dismantling, downsizing and stupefying the federal Establishment if he gets elected in November. The Fed must want to show itself to be competent and indispensable. In the grand scheme of electoral politics, it’s a tiny bit of establishmentarianism that might affect a handful of voters.

In the world of finance, demonstrating usefulness to the big corporate donors would need to be a counterweight to the Trump promises of deregulation and tax cuts, which are nectar to the bees. Those big corporates need a stable and reliable banking system. The system would fall apart without the Fed—wouldn’t it? There’s the FDIC, the Fed Wire, emergency lending, repo and reverse repos, and the whole idea of a “lender of last resort.” We no longer have an actual person named JP Morgan to pull the irons out of the fire.

Exaggeration? Oh, yes, because various laws and legislated regulations form the basis of the Federal Reserve system, weird, as it may be (it’s partly private and partly public—very messy). The executive cannot wave a wand and make it disappear. Trump is talking nonsense. We searched for the last time Trump or associates spoke of dismantling the Fed and it was years ago. See our “somewhat silly” tidbit below. The point remains that just talking about dismantling or downsizing the Fed is a dollar danger.

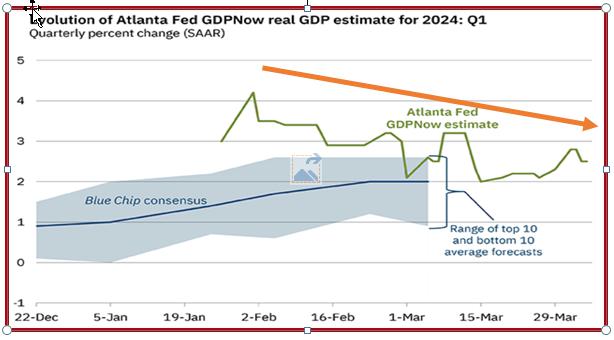

Tidbit: The Atlanta Fed GDPNow last week had Q1 growth at 2.5%, from 2.8% on April 1.

The next update is Wednesday, April 10. We can easily argue that growth is slowing down and that means almost by definition that inflation is slowing down, too. The proof is in the pudding, aka the CPI data trends.

About the Yen: We keep seeing harsh noises from the Japanese government about traders selling the yen to too low a level. PM Kishida threatens to act against "excessive yen moves” and BoJ Gov Ueda got more realistic with a suggestion about another rate hike. We call this “all hat and no cattle,” the cattle being the other G7 countries willing to join in actual intervention. But jawboning does work extremely well, at least sometimes, and this is one of them. Since March 20, jawboning has kept the dollar/yen in a range of 150.80 to 151.97, avoiding (so far) the 152 level that might set off another run.

It’s a good thing in the sense that it shows respect for the institutions (MoF and BoE). It’s a bad thing in the sense that it’s government currency manipulation, plain and simple. Gov Ueda has the right idea. To the extent that the yield differential so disfavors the yen, narrowing it is a positive. The 10-year JGB is 0.7710% (as of Friday) vs. the US with 4.406%. Which does the rational investor prefer?

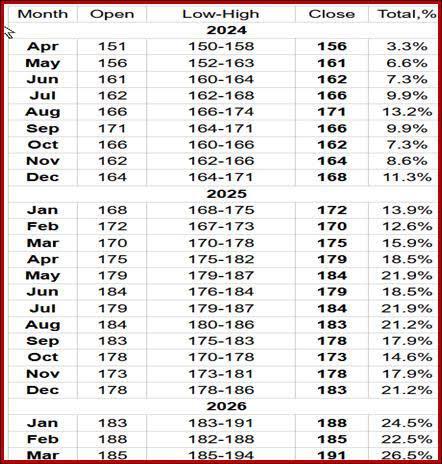

See the chart from the excellent site kshitij.com. This shows the 2-year notes vs. the dollar/yen. As in the case of the Bund and euro, the correlation is not bad. Most analysts would make the point that what favors the yen is not the Japanese yield rising, but rather the US one falling. That keeps getting postponed as hot US data keeps coming. You have to wonder whether Mr. Ueda is looking at a chart like this, quite apart from considerations of the domestic macro conditions. When you scan the internet for 2024 forecasts, you might as well spit in the sea. The usual suspects (big banks) show a range from ¥120 to ¥160.

As we wrote before, we favor the 160. This is due mostly to an interpretation of institutional conduct from decades of watching the MoF and BoJ. Those who would favor more rate hikes are like the single nail sticking up—they get the hammer. Consensus takes a long time to build and consensus is a top consideration in these institutions.

We found a site named “The Economy Forecast Agency” with dollar/yen forecasts out to 2029 at https://longforecast.com/usd-j... We have no idea where it gets the numbers. The site claims to use fancy models incorporating prices from all over the place, cyclicality, and so on. These forecasts differ significantly from those in the Japanese press (which tend to show the yen appreciating). See the table. It will set your socks on fire.

Japan really does have inflation now. The 2023 year brought the highest inflation in 41 years! In Feb, the annual inflation rate rose to 2.8% from 2.2% and never mind that most of the rise was due to base effects (like the end of energy cost subsidies).

Bottom line, we think G7 will decline (or has already declined) to join the BoJ in serious intervention. It can get away with a lot of jawboning, but in the end, the yield differentials rule the roost. PM Kishida goes to Washington later this week. We doubt he would even ask for US intervention help. And the US would hardly want to give it, anyway—a devaluing dollar is inherently inflationary.

Forecast: The response to the employment report was exaggerated but not wrong. We may get only one or two cuts this year instead of the three the Fed has called for. So far this week the CME futures are pointing to two but it’s a fast-flowing river. Many analysts expect the timing to get pushed out to July. A lot depends on whether the rise in yields is sustained. It shouldn’t be—we are still in an easing environment. For the moment we need to set aside new talk about the ending “neutral” rate, one of the economics professions worst sins against common sense. So, Period One: US yields high, dollar strong. Period Two: US yields fade, dollar tracks—even if the ECB cuts first.

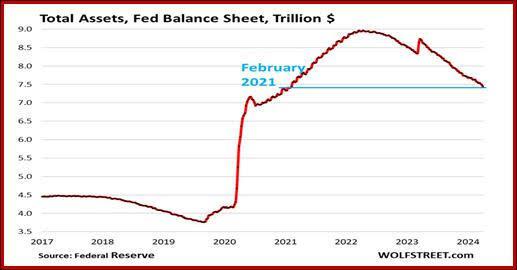

Somewhat Silly Tidbit about the Fed: Abolish the Fed? What if the Fed were disbanded and the entire stock of notes and bonds let loose upon the economy? As of last week, that was $3.9 trillion, and adding mortgage backeds, another $2.4 trillion.

Let’s not quibble about the exact amount and in what form—it’s a huge amount and literally indigestible. Let that fly out the door and we are back in the world of Irving Fisher/Milton Friedman—inflation is a function of money supply.

This is the water reservoir, the aqueducts, the plumbing, the engineering of the financial system. Water was the essential lifeblood of the Roman empire and credit overseen by the the Fed’s money management is the lifeblood of the US system of capitalism.

Even if the Fed is gutted, the commercial banks can band together to form a lender of last resort—they have already spent billions on clearing and other measures. They could come up with the capital, even if it would be a whole lot more than the $100 billion NATO is contemplating to Trump-proof NATO.

But that doesn’t mean the talk alone plus any real interference (like firing Powell and installing some unqualified airheads) would be massively disruptive to the financial system. The dollar would crash.

Other potential policy and institutional changes under Trump II are just as awful, from 100% tariffs on everything Chinese to default on the sovereign debt. Just saying.

Hip update: a splendid outcome on the bone front. But it turns out that anesthesia, antibiotics, anti-pain injections and heaven knows what else make you downright stupid. It turns out even Tylenol affects cognitive function—look it up; it’s scary. We confused Google and Amazon at one point and misspelled half of the words we were trying to type. You were definitely better off without a briefing!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.