Safe haven assets gained ground near the end of the U.S. session as traders worried about Iran possibly making retaliatory strikes against Israel.

Meanwhile, bitcoin (BTC/USD) broke out of a technical consolidation and saw an intraday uptrend ahead of a potential “halving” of block mining rewards in mid-May.

Here’s what you missed from yesterday’s trading:

Headlines:

- China’s markets out on bank holiday

- Australia building approvals for February: -1.9% m/m (+3.0% forecast, -2.5% previous)

- Switzerland CPI for March: 0.0% m/m (0.4% m/m forecast; 0.6% m/m previous)

- HCOB Eurozone Services PMI for March: 51.5 vs. 50.2 previous; “For the first time in nine months, sales received by services companies grew during March”; ” input cost inflation across the service sector dipped to an eight-month low”

- HCOB Germany Services PMI for March: 50.1 vs. 48.3; “rates of input and output price inflation slow”; “pace of job creation moderated from February’s eight-month high”

- Challenger: U.S.-based employers announced 90,309 job cuts in March, the highest monthly total since January 2023. It’s up 7% from January and 0.7% from the same month last year

- U.S. Weekly Initial Jobless Claims rose to 221K (214K forecast; 212K previous); continuing claims fell from 1.81M to 1.79M

- U.S. goods and services trade deficit for February increased to -$68.9B vs. -$67.6B previous

- Canada Trade Balance for February 2024: C$1.4B (C$500M forecast; C$608M previous)

- Philadelphia Fed President Patrick Harker said on Thursday that inflation remains too high

- Minneapolis Fed President Neel Kashkari said that if inflation progress stalls, rate cuts may not be needed

- Australia’s goods trade surplus narrowed from 10.06B AUD to 7.28B AUD as exports fell (-2.2% m/m) while imports rose (4.8% m/m) in February

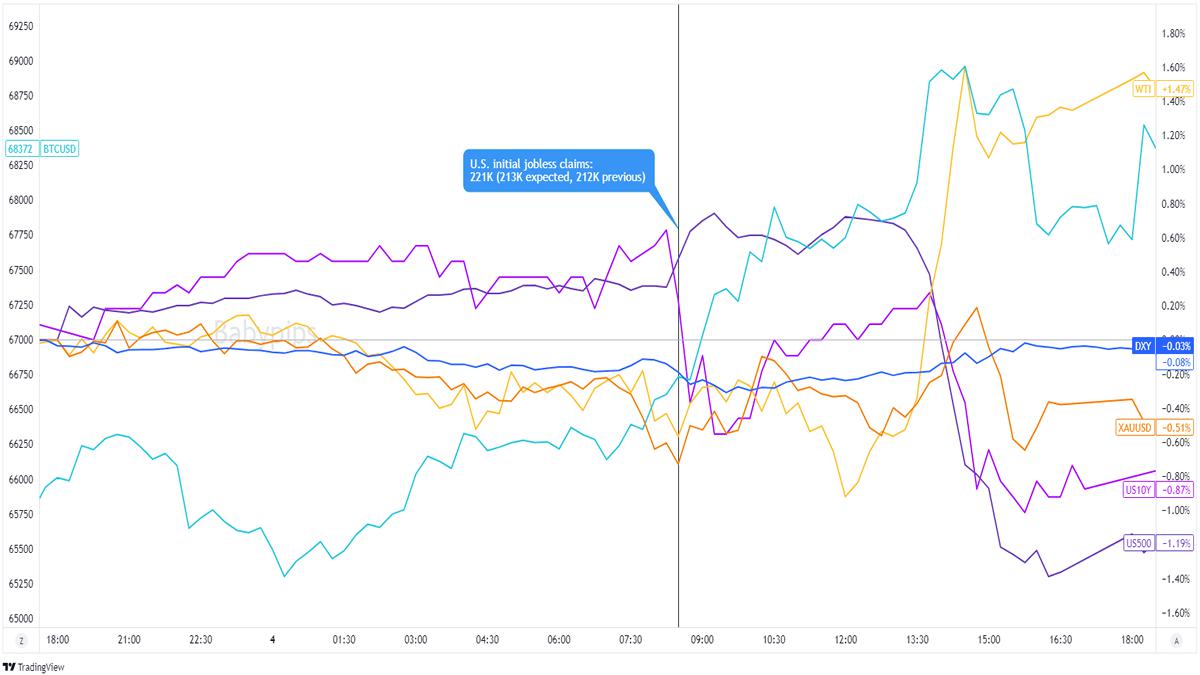

Broad Market Price Action:

USD-vs-Majors-Recap-2024-04-03 Chart by TradingView

The absence of China, Taiwan, and Hong Kong’s markets contributed to subdued trading conditions during the Asian session. Risk-related currencies like AUD and NZD missed the memo, however, as they leaned on a slightly risk-friendly environment following Powell’s confirmation that the Fed is on track to cut its interest rates at least three times this year.

Volatility got a bit more interesting when several FOMC members made speeches during the U.S. session. Neel Kashkari (a non-voting member), in particular, grabbed headlines when he implied that the Fed may not “need to do those rate cuts at all” this year if inflation continues to move sideways.

Traders were digesting Thursday’s U.S. jobs-related reports when word got around that Iran may retaliate against Israel following an airstrike that killed senior Iranian commanders in Damascus earlier this week.

U.S. crude oil prices jumped above $87.00 while spot gold spiked to new record highs at $2,305 before pulling back. U.S. stocks and 10-year bond yields also took hits and saw minimal pullbacks over the prospect of increased military tensions in the Middle East.

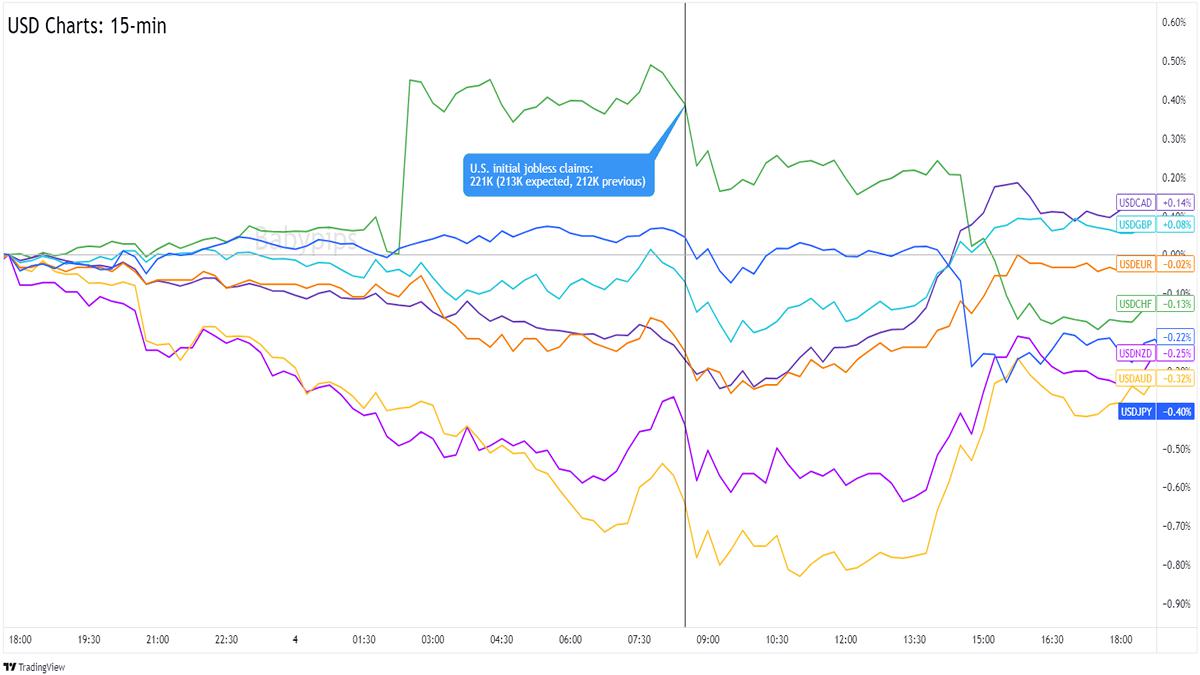

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar saw more selling for most of the Asian and European trading sessions as traders continued to price in the Fed possibly pushing forward with three interest rate cuts this year.

It even saw fresh bearish pressure after the Challenger report noted that U.S.-based companies’ job cut plans have hit highs not seen since January 2023 while the initial jobless claims data also edged higher than the previous reading AND markets’ estimates.

The Greenback turned higher near the end of the U.S. trading session when the markets started worrying about Iran making retaliatory strikes against Israel. USD lost a few pips against fellow safe havens like JPY and CHF but also saw strong upswings against its “riskier” counterparts.

Upcoming Potential Catalysts on the Economic Calendar:

- Germany’s factory orders at 6:00 am GMT

- Germany’s import prices at 6:00 am GMT

- Switzerland’s foreign currency reserves at 7:00 am GMT

- Swiss SECO consumer climate report at 8:00 am GMT

- U.K.’s construction PMI at 8:30 am GMT

- Euro Area’s retail sales at 9:00 am GMT

- Canada’s labor market data at 12:30 pm GMT

- U.S. NFP reports at 12:30 pm GMT

- Canada’s IVEY PMI at 2:00 pm GMT

Factory activity in Germany may get some attention during the European session following a weaker-than-expected manufacturing PMI from the country earlier this week.

Then, it’s all about jobs during the U.S. session with both Canada and the U.S. dropping their March numbers. Keep an eye out for updates that may change the Fed or the Bank of Canada’s (BOC) monetary policy biases!

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

No comment on record. Start new comment.