The Greenback was off to a solid start this month and quarter, thanks to an upbeat ISM manufacturing PMI report.

Consequently this led market players to tone down Fed easing bets for the year, spurring a selloff among risk assets, except for crude oil.

Headlines:

- S&P Global U.S. final manufacturing PMI for March downgraded from 52.5 to 52.9 (52.5 forecast)

- U.S. ISM manufacturing PMI for March: 50.3 (48.5 forecast, 47.8 previous)

- U.S. ISM manufacturing PMI prices component for March: 55.8 (53.3 forecast, 52.5 previous)

- BOC Business Outlook Survey for Q1 2024 highlighted improved business sentiment and sales growth expectations

- U.K. BRC price shop index for March: 1.3% y/y (2.2% forecast, 2.5% previous)

- Australia’s MI inflation gauge for March: +0.1% m/m (-0.1% previous)

- Australia’s ANZ job advertisements for March: -1.0% m/m (-2.1% previous)

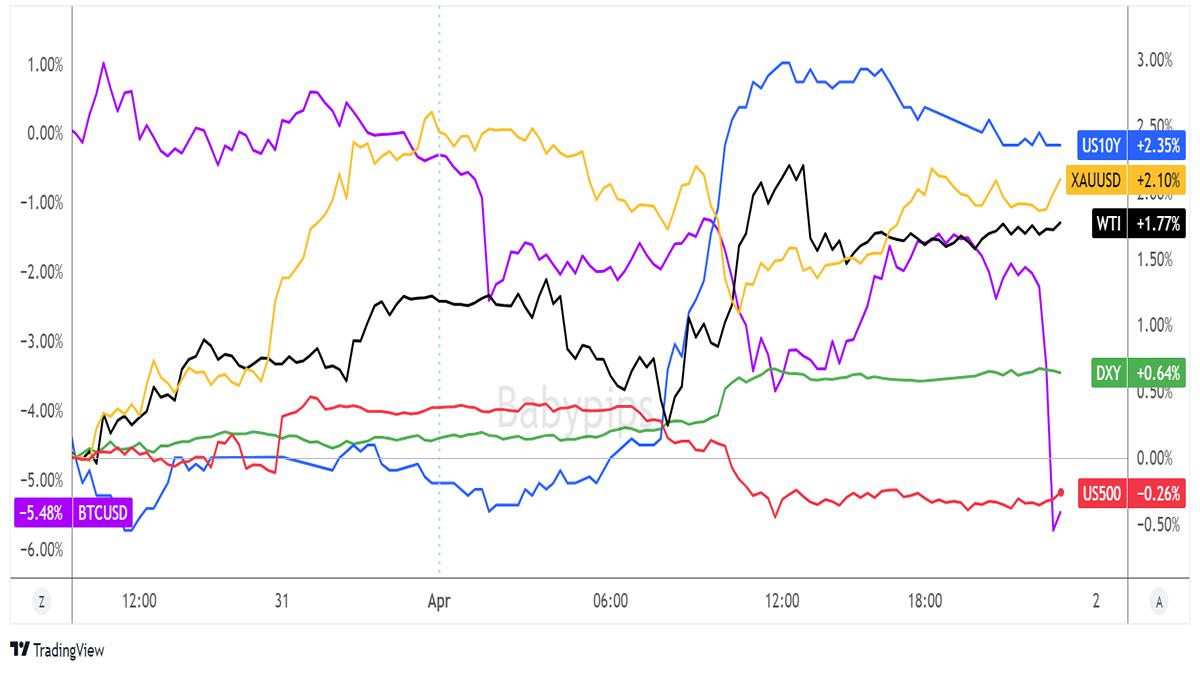

Broad Market Price Action:

A return to industry expansion for the U.S. ISM manufacturing PMI turned out to be a huge ego boost for the Greenback, as it rallied across the board during the release and lifted Treasury yields along with it.

In particular, the 10-year yield popped 12.1 basis points higher, chalking up its largest jump since February, while the two-year yield rose 8.9 basis points for the day.

Meanwhile, risk assets retreated in response to the report, which dampened easing expectations for the FOMC later this year. The Dow fell 0.60% while the S&P 500 index logged a 0.20% loss for the session. BTC/USD was also on the decline, falling back below the $70K mark and recording more than 5% in losses so far.

However, crude oil steered away from the selloff, as geopolitical conflict and supply concerns lifted the commodity on reports that Israel bombed Iran’s consulate in Damascus.

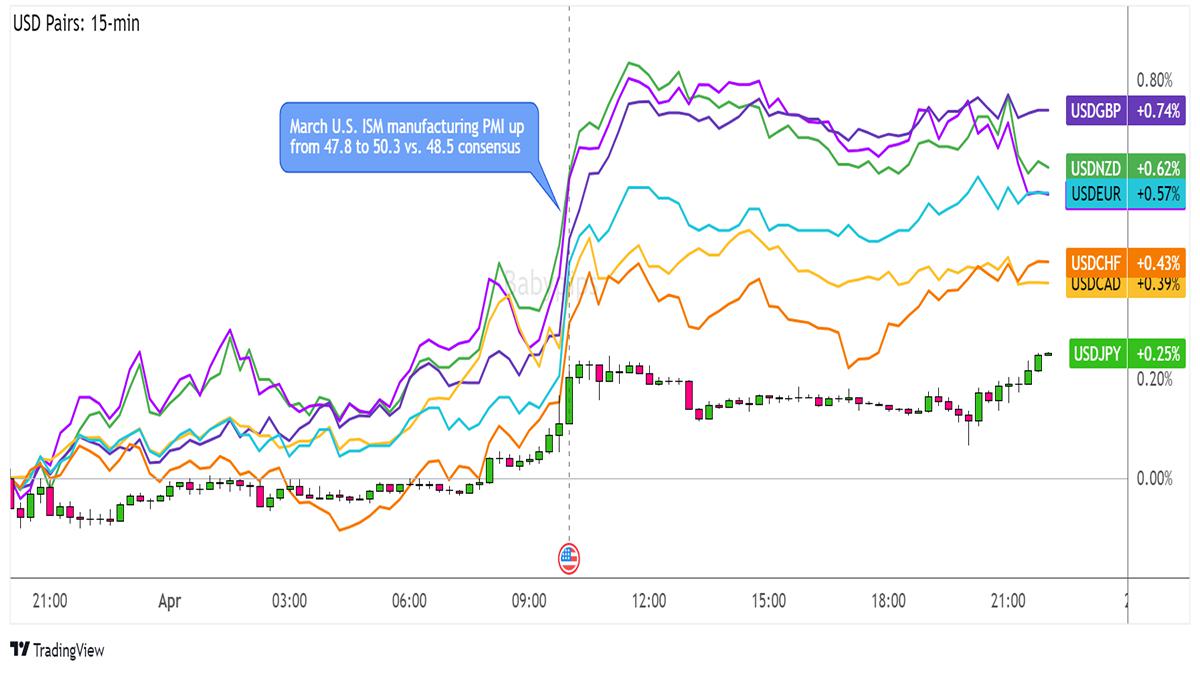

FX Market Behavior: Majors vs. U.S. Dollar

Overlay of USD vs. Major Currencies Chart by TradingView

After starting with a bit of consolidation, the U.S. dollar started treading higher leading up to the ISM manufacturing PMI release, then staged a steeper climb upon seeing stronger than expected results.

From there, the dollar managed to hold on to most of its gains against the euro and pound but dipped slightly against the franc. The early Asian session had a bullish turn for the Aussie and Kiwi, possibly as Australia’s MI inflation gauge and ANZ job advertisements report noted some improvements.

Upcoming Potential Catalysts on the Economic Calendar:

- German preliminary CPI (Tentative)

- Swiss retail sales at 6:30 am GMT

- U.S. JOLTS job openings at 2:00 pm GMT

- U.S. factory orders at 2:00 pm GMT

- New Zealand GDT auction (Tentative)

- FOMC members Mester, Williams and Daly to give speeches starting 4:00 pm GMT

The German preliminary CPI release might draw the most attention in the upcoming trading session, as this would serve as a prequel for the eurozone’s flash CPI readings due the next day. The U.S. JOLTS job openings report would also be of interest since leading U.S. jobs indicators could trigger USD positioning ahead of Friday’s NFP release.

Check out the rest of the top-tier catalysts to watch out for this week to gain insights on potential scenarios and gauge how market sentiment might fare!

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

No comment on record. Start new comment.