On Monday’s New York session, the U.S. ISM manufacturing PMI surprised to the upside, as it climbed from 47.8 to 50.3 for the month of March.

This surpassed the consensus at 48.5, reflecting a return to industry growth for the first time since 2022.

Components of the report revealed that the pickup was driven mostly by a sharp rebound in demand and production, as well as an increase in input costs that lifted the prices component up from 52.5 to 55.8.

Meanwhile, the jobs sub-index improved from 45.9 in February to 47.4 in March, indicating a slower pace of contraction.

Read the official U.S. ISM Manufacturing PMI report for March here

USD Price Action Following the ISM PMI release

Overlay of USD vs. Major Currencies Chart by TradingView

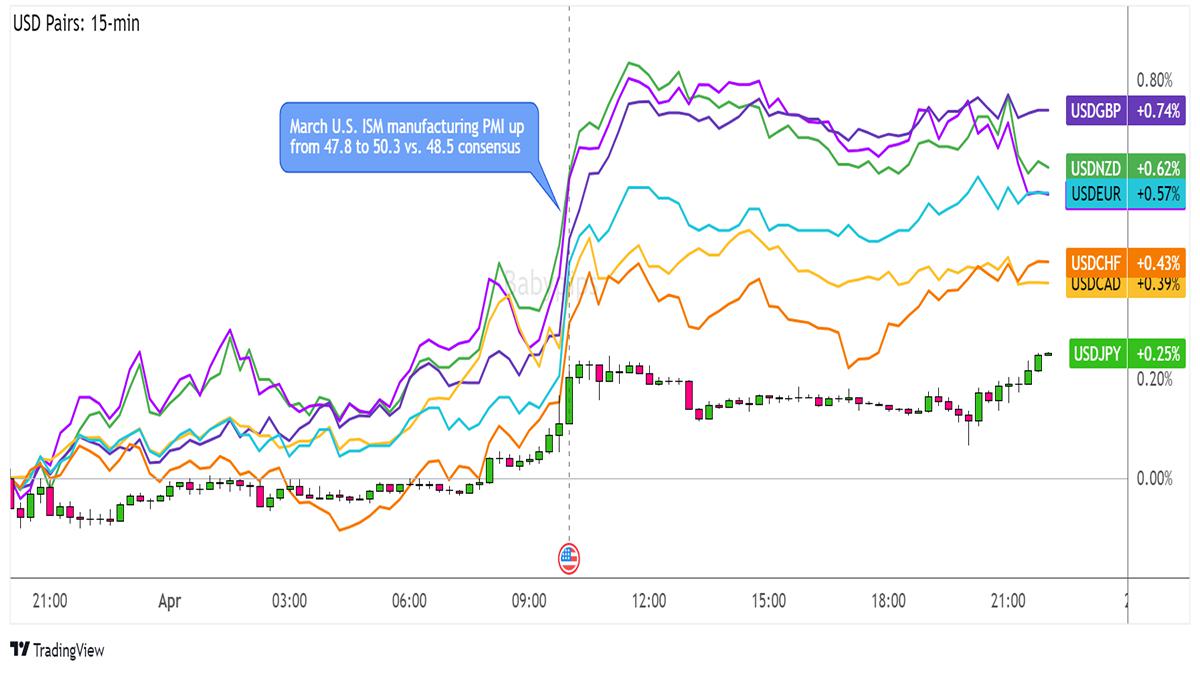

The Greenback popped sharply higher during the release of the March ISM manufacturing PMI, chalking gains across the board.

From there, we saw slight dips against the Swiss franc and Japanese yen and some consolidation versus the European currencies and the comdolls.

Soon after, the dollar dipped against the Aussie and Kiwi during the early Asian session right around the release of the ANZ job advertisements report and RBA meeting minutes.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

No comment on record. Start new comment.