On Tuesday, Australia’s latest inflation report signaled the CPI growth rate held steady at 3.4% y/y in February, holding at that rate for three months now (but coming below the 3.5% y/y forecast).

Food prices are finally growing a little slower at 3.6% y/y vs. 4.4% y/y previous, giving consumer wallets a nice little break.

The closely watched core inflation number rate ticked lower to 3.9%. That’s down from January read of 4.1% y/y, but still above the Reserve Bank of Australia’s 2% – 3% target range, keeping the odds elevated that the RBA will continue to hold interest rates at 4.35% for now.

Read the official Monthly Consumer Price Index report from the Australian Bureau of Statistics here

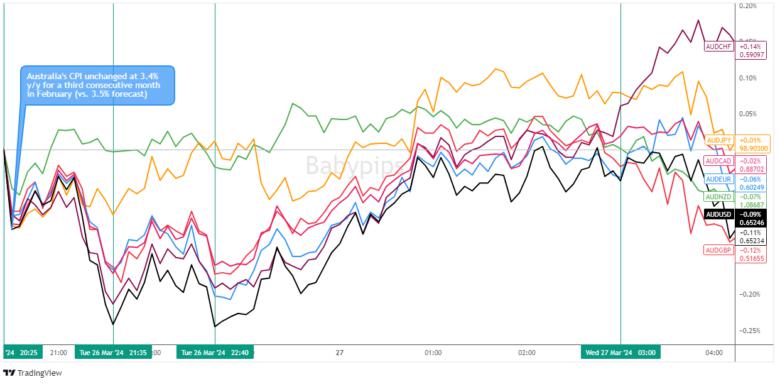

AUD Price Action Following the CPI update

Overlay of AUD vs. Major Currencies Chart by TradingView

After the data release, the Aussie instantly fell roughly -0.12% against the majors, bounced and then pushed lower to its intraday bottom, roughly -0.20% from the pre-event prices, within the span of one hour.

From there, we saw one more broad bounce and selling pressure back to the lows, preceding a turn in sentiment two hours after the data release. The bullish turn seems to roughly correlate with positive economic news from Australia’s largest trading partner: China (China’s industrial profits rise 10.2% in Jan-Feb).

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

Hot

-THE END-