AUD/USD outlook: Bearish bias below the base of thick daily cloud

AUD/USD

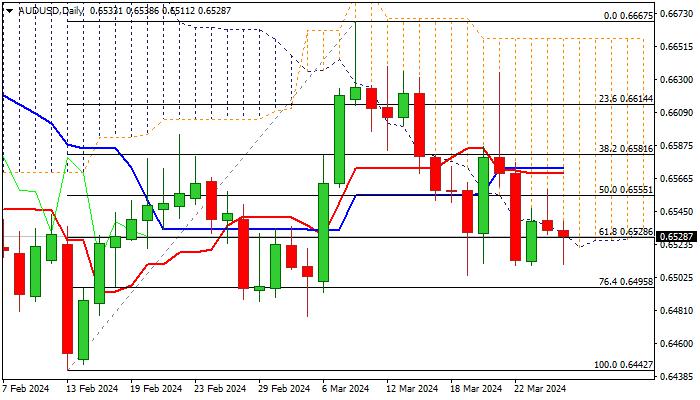

AUDUSD remains under pressure as the price action was capped by the base of thick daily cloud (currently at 0.6531) in past few sessions, while a batch on daily MA’s in bearish configuration, weighs heavily.

Bears pressure a higher base at 0.6500 zone (also Fibo 76.4% of 0.6442/0.6667 ascend) which recently contained a number of attacks and marks significant support, break of which would expose key short-term support at 0.6442 (Feb 13 low).

Technical studies are in full bearish setup on daily chart and favor further weakness however, fundamentals may again play a key role in determining near-term direction.

The dollar was boosted lately by doubts about the start and pace of rate cuts after disappointing US inflation data for the last month, though it seems that the Fed would start easing its monetary policy in June and deliver three cuts this year.

Markets await release of US weekly jobless claims and PCE inflation report, which is expected to give more details about inflation and Fed’s action.

Solid barriers at 0.6550/60 zone, provided by converged daily MA’s, mark significant resistance, with firm break above these levels to dent bears or to confirm negative structure if the price fails to break higher.

Res: 0.6555; 0.6570; 0.6606; 0.6634.

Sup: 0.6510; 0.6495; 0.6477; 0.6442.

Interested in AUD/USD technicals? Check out the key levels

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.