Durable Goods Orders pick up in February after unusually weak start to year

Summary

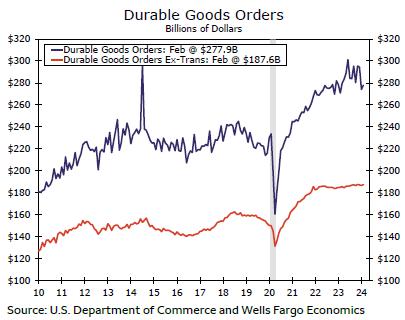

The February durable goods report showed a partial reversal of January's weakness, though we'd say it's still consistent with a stalling manufacturing sector. We expect we're a few months away from a gradual pickup in activity.

Orders pick up, but sustained recovery still likely few months away

Orders for new durable goods rose 1.4% in February. That wasn't enough to reverse the January weakness, which was revised lower to show a drop of 6.9% during the month. But that weak start to the year continues to be driven by a plunge in aircraft orders, and elsewhere, the data were more favorable last month (chart). Specifically, orders excluding transportation still rose 0.5% in February, more than reversing the 0.3% drop in January.

Underlying orders activity, however, continues to demonstrate a volatile pattern. That is, the major manufacturers that saw orders drop in January saw a pickup last month including machinery (+1.9%), primary metals (+1.4%) and fabricated metals (+0.8%). Computers & electronic products (-1.4%) and electrical equipment & appliances (-1.5%) saw orders fall, though these components have been notable bright spots recently. Computers & electronic products, for instance, rose for six straight months through January (chart), and as we elaborate on in a recent note, these areas of production are ripe for activity amid the recent boom in private manufacturing construction. Core capital goods orders (excluding defense and aircraft) rose 0.7% last month after two consecutive monthly declines, indicating some improvement in demand, but the current rate environment continues to hold a lid on broad activity. We don't anticipate a large rebound in capex demand until the Fed begins to ease policy in the second half of the year.

Download The Full Economic Indicator

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.