Gold: $2,147 support in a vulnerable position

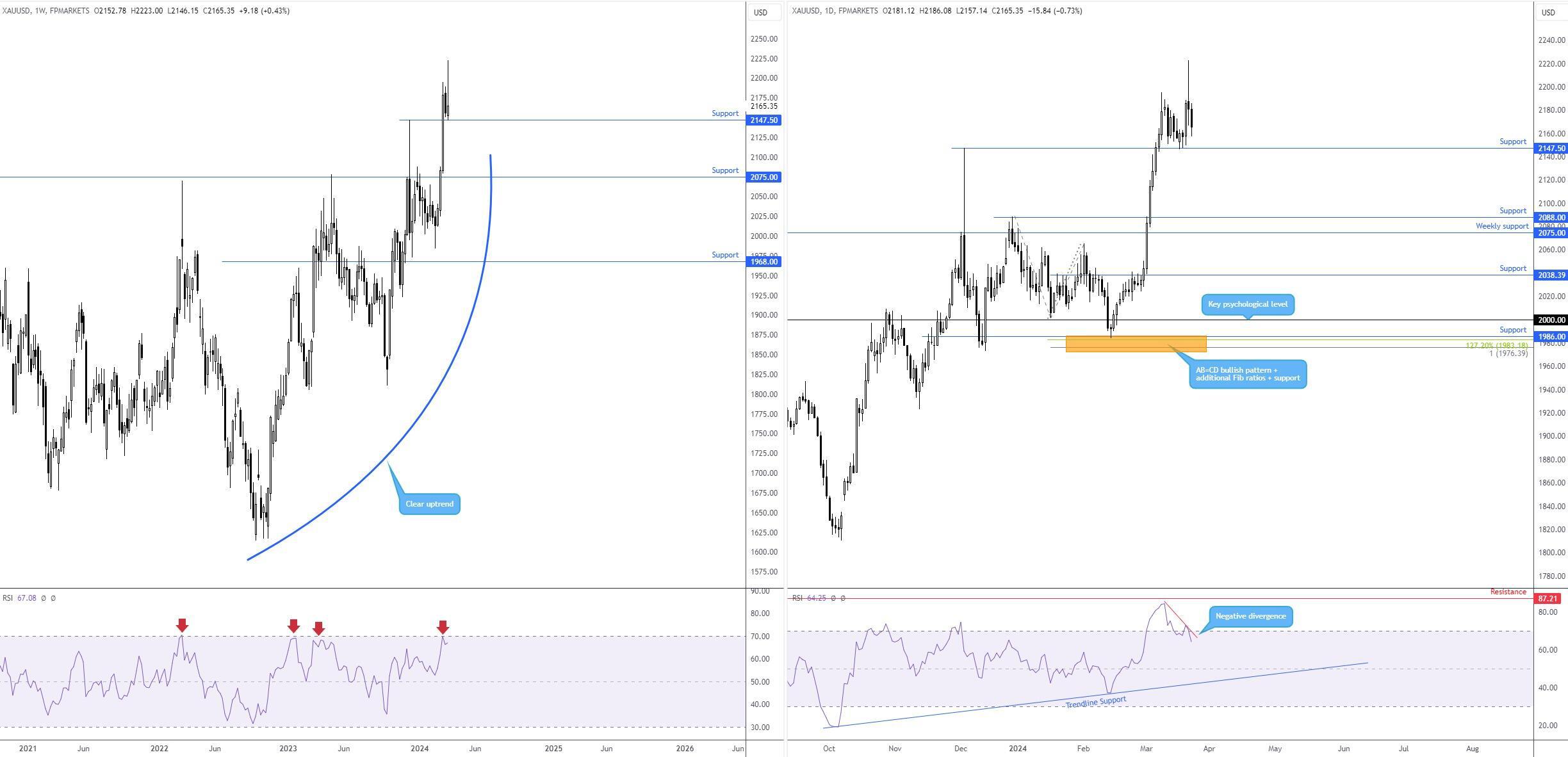

Following another all-time high for the yellow metal last week at $2,223, the tail end of the week witnessed a moderate correction. There’s no denying that the yellow metal is exhibiting an uptrend and has been since pencilling in a bottom around the $1,614 area in late 2022. Knowing we have a clear uptrend in the longer term and are essentially void of any immediate resistance, some traders/investors could view the recent correction as a dip-buying opportunity, particularly if we revisit support at $2,147, visible on both the weekly and daily charts.

Slowing momentum

Despite the broader bullish signs, momentum to the upside may be in the process of fading. Take note of the Relative Strength Index (RSI) on the weekly and daily charts. Since early 2022, each time the weekly chart’s RSI entered space near overbought territory, a correction in the price of gold materialised (the smallest correction was in early January 2023, dropping nearly -8.0%). On top of this, we’re also seeing early signs of negative divergence on the daily chart’s RSI ahead of indicator resistance at 87.21, a level extended from as far back as August 2020. Therefore, does this, as well as the support at $2,147 already welcoming bids last week (and may potentially be weakened), place a bold question mark on the current support?

$2,147 support in view

So, with the above analysis on the table, dip-buyers from $2,147 are likely to exercise caution should the price challenge the level this week (technicians will possibly drill down to lower-timeframe price action and attempt to seek bullish setups off the level for additional confirmation, for example). A daily close under the barrier, however, could unearth a bearish scenario in the direction of support between a weekly level at $2,075 and daily support coming in from $2,088.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.