The Swiss National Bank (SNB) surprised market observers on Thursday by cutting its main interest rate by 25 basis points to 1.50%. This move signals the central bank’s confidence in its success in taming inflation.

Link to Swiss National Bank Monetary assessment of 21 March 2024 press release

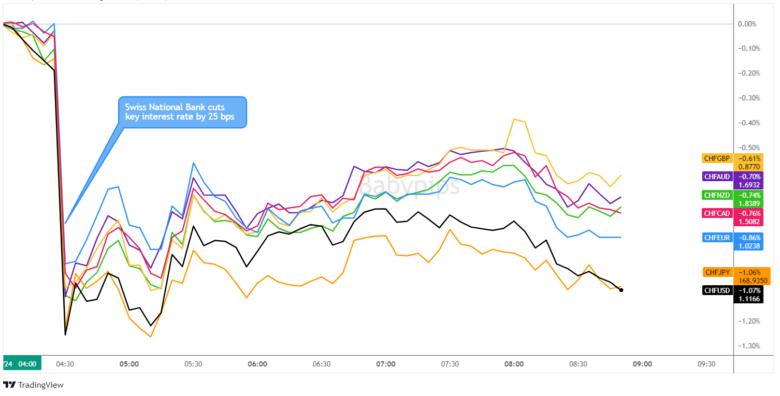

CHF Price Action Following the Rate Cut

Overlay of CHF vs. Major Currencies Chart by TradingView

A key driver of the decision was the SNB’s revised inflation forecast, which now calls for notably lower consumer-price gains relative to the December forecasts. The SNB predicts inflation will average annual inflation at 1.4% for 2024, 1.2% for 2025 and 1.1% for 2026.

The SNB sees Switzerland GDP to grow by 1% this year and unemployment to rise, but also sees “significant uncertainty” domestically and globally as the main risk is “weaker economic activity abroad.”

The SNB’s decisive step comes ahead of anticipated moves by other major central banks, underscoring its proactive approach. While elements like rising rents, wages, and a resilient economy could have prompted caution, falling inflation and the persistent strength of the franc (the franc has been a net outperformer among the majors since 2021) ultimately spurred the rate cut.

Jordan further emphasized the SNB’s ongoing commitment to monitoring inflation conditions and reacting if necessary, including managing the foreign exchange market. “We are willing to be active in the foreign exchange market as necessary,” he stated in the introductory remarks, indicating the central bank could intervene as needed to stabilize the Swiss franc.

Hot

No comment on record. Start new comment.