Cyclical outlook: Known unknowns

In the US, the latest Survey of Professional Forecasters (SPF) of the Federal Reserve Bank of Philadelphia paints a rather upbeat picture of the economic outlook. A similar survey of the ECB points towards a gradual pickup in growth this year. In both cases, the level of disagreement is low. This provides reasons to be hopeful about the economic outlook. However, the alternative scenarios are predominantly negative for growth and inflation, and some have totally different implications for the evolution of bond yields. This would mean that as time goes by and the likelihood of the different alternative scenarios evolves, bond yield volatility could be high.

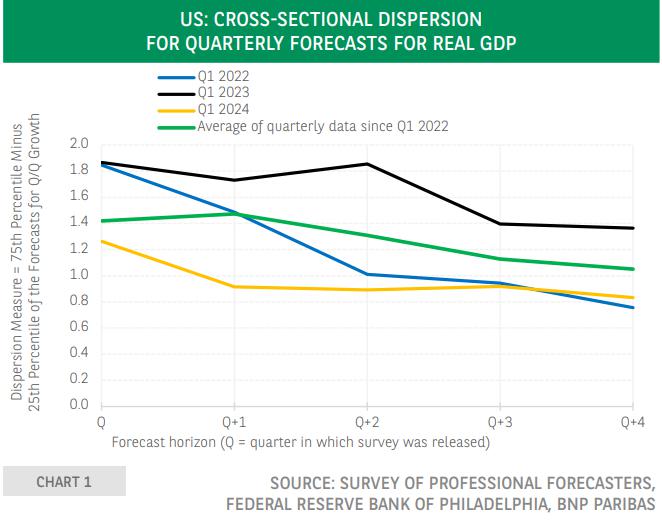

In the US, the latest Survey of Professional Forecasters (SPF) of the Federal Reserve Bank of Philadelphia paints a rather upbeat picture of the economic outlook. Admittedly, growth is expected to slow down in the second quarter of this year, but a healthy pace should be maintained in the following quarters. In the Eurozone, the ECB's Survey of Professional Forecasters points towards a gradual pickup in quarterly growth this year. Economists seem to be in broad agreement on these expected developments. Chart 1 shows, for the US, the dispersion of quarterly real GDP growth forecasts of the survey participants. Unsurprisingly, as the forecast horizon lengthens, the dispersion tends to decline. Forecasters may have strongly diverging opinions about near-term developments reflected in high disagreement between forecasters- whereas this is less likely in the medium run. Interestingly, for the latest SPF the dispersion across forecast horizons is lower than what was observed at the start of 2022 and 2023. For the latter, the high dispersion might have been due to disagreement about the consequences of rate hikes by the Federal Reserve. At the current juncture, the prospect of rate cuts may explain the limited dispersion of growth forecasts. It should be noted that this dispersion is also well below the average calculated using all surveys since the start of 2022. Turning to the Eurozone, table 1 shows the standard deviation of the survey participants’ forecasts for real GDP. Since the survey round of 2023 Q1, this measure of disagreement for the two quarters ahead forecast has dropped significantly. In the 2024 Q1 survey, it declined to 0.4, a number last seen in 2023 Q3. Since the second half of last year, the six quarters ahead forecast dispersion has also declined, dropping to a very low value of 0.2.

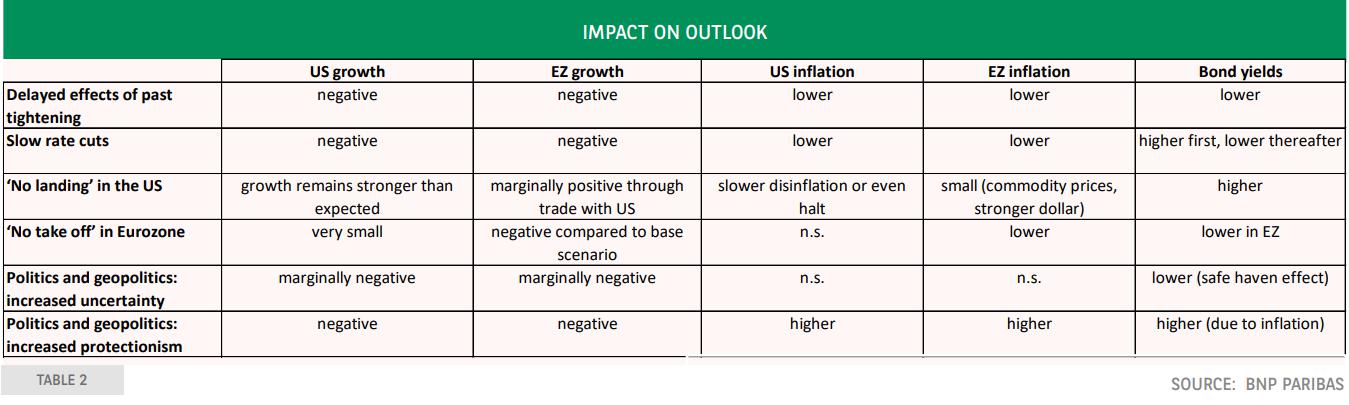

A low disagreement does not imply that forecasters do not feel uncertain. It simple means they assess things in a similar way. The user of economic forecasts should welcome low disagreement because the forecast provides a stronger signal . However, in financial markets, low disagreement increases the sensitivity of asset prices to unexpected developments and to a change in the most likely scenario. Consequently, it is important to also look at the sources of risk and uncertainty. Table 2 provides a non-exhaustive overview of key ‘known unknowns’ and their likely economic consequences.

Download the Full Eco Flash

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.