The Fed’s QT: Are yesterday’s sellers today’s buyers?

Since June 2022, the US Federal Reserve (Fed) has scaled back its balance sheet, by limiting the reinvestment of maturing debt in its securities portfolio. The scale of the effects of this quantitative tightening (QT2) will depend in particular on the nature of buyers of newly issued securities.

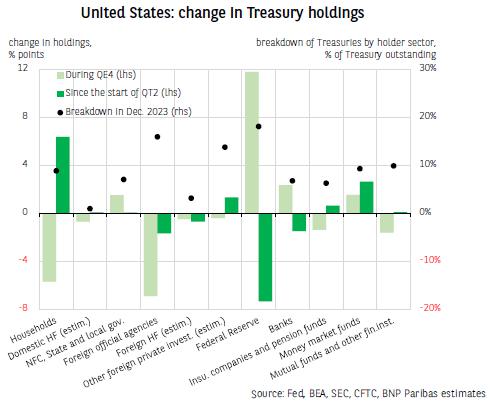

According to the Fed’s financial accounts it is mainly households1 and money market funds which have increased their holdings2 of Treasuries since the beginning of QT2. The weightings of other sectors are little changed, with the exception of banks (which expanded their portfolios during QE4 between Q3 2019 and Q1 2022) and non-residents, whose weightings have been reduced. According to BEA data, for the latter this reduction has come solely from the official sector (central banks, governments, sovereign wealth funds, etc.), with foreign private investors (insurers, pension funds, banks, hedge funds) having increased their exposure. Two complementary data series, one from the Securities and Exchange Commission (SEC) on overall exposure to Treasuries (holdings, borrowings and derivative positions) of the biggest hedge funds active in the USA, and the other from the Commodity Futures Trading Commission (CFTC) on leveraged funds’ positions in Treasury derivative markets (futures and options markets), help refine this analysis3. As the vast majority of hedge funds are domiciled abroad (mainly in the Cayman Islands), more than three-quarters of the Treasuries they hold are domiciled there too. It would seem, however, that since the beginning of QT2, the weight of non-resident hedge funds amongst the Treasury’s creditors has fallen, unlike the weightings of other foreign private investors.

Download The Full Eco Flash

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.