Swiss Franc Pairs: CHF edges higher ahead of central bank bonanza

- The Swiss Franc is gaining as traders position themselves ahead of major central bank meetings this week.

- Swiss Franc is gaining despite a relaxed market mood and predictable data.

- The Federal Reserve, European Central Bank and Bank of England are all scheduled to make announcements after their meetings this week.

The Swiss Franc (CHF) trades higher against most counterparts on Tuesday as individual factors come into play in each pairing.The US Dollar is down amidst an improvement in risk appetite, with the S&P 500 – a favored barometer of risk – up over 0.4% and long-duration Treasury yields mainly down. The Pound Sterling edges lower after data shows UK wage inflation slowing in October.

US Consumer Price Index (CPI) data shows little change in November and comes out exactly in line with estimates, according to data released on Tuesday. This is likely to have little impact on the expected outcome of the Federal Reserve (Fed) policy announcement on Wednesday.

Daily digest market movers: Swiss Franc gains against weakening Dollar

- The Swiss Franc rises versus the US Dollar (USD) after US CPI data for November, released by the US Bureau of Labor Statistics, shows inflation in line with economists’ expectations.

- Headline CPI rises by 3.1% YoY, slightly below the previous 3.2% result but as estimated. MoM, CPI rises at the 0.1% forecast from 0.0% in October.

- The Consumer Price Index Ex Food and Energy, or core inflation reading, rises 4.0% YoY as expected and the same as previously. MoM core inflation rises 0.3% as forecast, from 0.2% previously.

- The data is likely to make little material change to expectations regarding the outcome of the US Federal Reserve (Fed) policy meeting on Wednesday, December 13, at 19:00 GMT. Current expectations are for the Fed to leave rates unchanged.

Swiss Franc technical analysis: USD/CHF pulls back to 0.618 Fibonacci level

USD/CHF – the number of Swiss Francs that one US Dollar can buy – pulls back after a string of positive days during December’s recovery.

The pair is probably in a short-term uptrend, and the pullback is likely just a correction on the back of profit-taking ahead of the Fed meeting on Wednesday rather than the start of a reversal.

The correction found support at the 0.618 Fibonacci retracement of the recovery from the December 4 lows, finding demand and bouncing back again.

US Dollar vs Swiss Franc: 4-hour Chart

More gains are likely in the short-term. The 0.8825 target, which offers soft resistance, is likely to be met once bulls take over again. If surpassed, prices could rise to the confluence of major moving averages residing at 0.8900, where tougher resistance is expected.

The pair completed a Measured Move price pattern at the December 4 lows and has since bounced. Measured moves are three wave patterns that look like zig-zags, with the first and third waves roughly of equal length. The third wave – C – likely ended at the December 4 lows.

A break below the 0.8667 December lows would negate the recovery and see bears back in charge, with likely losses to the 0.8552 July low.

Daily digest market movers: Swiss Franc gains against Euro as Eurozone economic outlook remains flat

- The Swiss Franc strengthens against the Euro on Tuesday.

- Data out on Tuesday was generally favorable, showing a rise in ZEW survey data, with the Eurozone ZEW Economic Sentiment index rising to 23 in December from 13.8 previously, when a fall to 12 had been forecast.

- German ZEW data was overall positive, with both the Current Situation and Economic Sentiment gauges rising.

- Euro traders are now waiting for the European Central Bank (ECB) meeting on Thursday for clarity on the future trajectory of interest rates.

- Recent lower-than-expected Eurozone inflation data suggests a risk the European Central Bank will cut interest rates, with negative implications for the Single Currency.

- The next main event for the Euro is the European Central Bank policy meeting on Thursday, December 14.

- Lower interest rates, or their expectation, tend to weaken a currency as they reduce capital inflows.

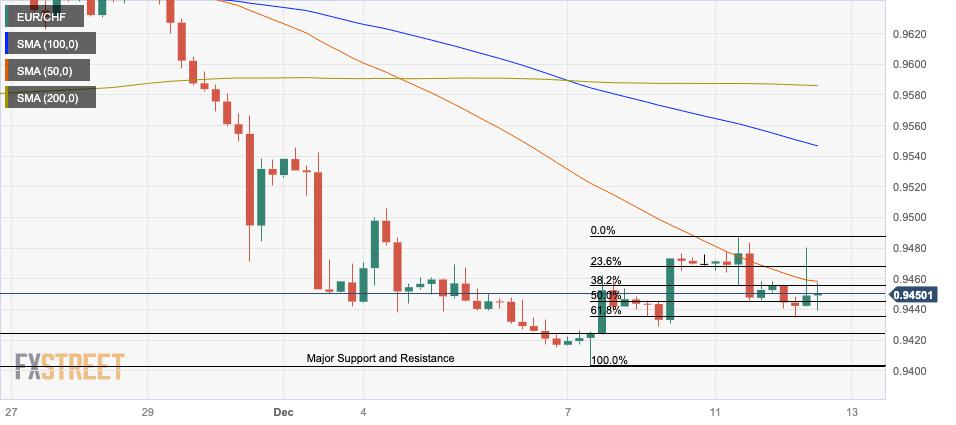

Swiss Franc technical analysis: EUR/CHF flips lower after run-up

EUR/CHF – the number of Swiss Francs that one Euro can buy – trades lower on Tuesday, although the lack of downside momentum suggests the current backslide is probably just a correction of the December rebound rather than a reversal.

The pair has shown weakness over the last 24 hours and corrected back down to the 0.618 Fibonacci retracement level of the rally, which began at the December 7 low. The current weakness could just be reflective of positioning ahead of the ECB rate meeting on Thursday, with another bullish move possibly following.

Euro vs Swiss Franc: 4-hour Chart

The pair has probably reversed trend in the short-term, suggesting bulls may still have the upper hand temporarily. A break above the 0.9487 December 11 high would reconfirm the short-term uptrend and lead to potential gains to around 0.9540, where a confluence of resistance levels sits.

The medium and long-term trend, however, are still bearish, suggesting caution is required as a risk of recapitulation remains.

A break below the 0.9403 low would reconfirm the bearish bias and see prices fall into uncharted territory, with major whole numbers then expected to provide support at 0.9300, 0.9200, and so on.

Daily digest market movers: Sterling falls against Swiss Franc after UK wage data moderates

- The Swiss Franc weakens against the Pound Sterling (GBP) on Monday as upbeat market sentiment supports riskier currencies like the Pound Sterling over safe-havens such as the Swiss Franc.

- UK employment data, released by the Office of National Statistics (ONS) on Tuesday, came out more or less as economists had expected, except that it revealed a slowdown in wage inflation.

- The Unemployment Rate stood unchanged at 4.2% in October, with 50K new positions filled during the month, slightly down from the 54K in September.

- The Claimant Count Rate, measuring the percentage of the working age population claiming benefits, stayed unchanged at 4%, and rose 16K in October, versus the 20.3K forecast and higher than the 8.9K of September.

- Average Earnings Excluding Bonuses slowed slightly to 7.3% from 7.8% in the previous month, and was lower than the 7.4% forecast.

- Average Earnings Including Bonuses slowed slightly to 7.4% from 8.0% in the previous month, and was lower than the 7.7% forecast.

- The slowdown in wage inflation is likely to lower bets for interest rates remaining high.

- Pound Sterling traders await the Bank of England (BoE) meeting on Thursday for insight on the future course of interest rates in the UK.

- Higher interest rates, or their expectation, are generally positive for a currency as they attract greater inflows of foreign capital. The opposite is true of lower interest rates.

Swiss Franc technical analysis: GBP/CHF returns to the bottom of its autumn range

GBP/CHF – the number of Swiss Francs that one Pound Sterling can buy – is trading within a range on both a short and long-term timeframe. The medium-term trend, meanwhile, could be classified as marginally bullish.

On the 4-hour chart used to analyze the short-term trend, the pair has reversed back down after bouncing higher. It is now back at the late 1.09 lows of the range-corridor.

Pound Sterling vs Swiss Franc: 4-hour Chart

The MACD has recently crossed below its signal line whilst above the zero line. This is a bearish signal and could signify more losses to come, although it lacks reliability because it occurred close to the zero-line.

If today’s 1.0979 lows hold, the pair could recover and start rising back up within the range. A decisive break cleanly below the lows, however, could indicate a breakdown from the entire month-long range. Such a breakdown would be expected to rapidly fall toward a minimum target at 1.0889, the 161.8% extension of the height of the range extrapolated lower.

From a bullish perspective, a recovery and break above the 1.1040 level would provide bullish confirmatory evidence a new leg higher was underway, toward a target at 1.1155 and the range high.

Swiss Franc FAQs

What key factors drive the Swiss Franc?

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

Why is the Swiss Franc considered a safe-haven currency?

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

How do decisions of the Swiss National Bank impact the Swiss Franc?

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

How does economic data influence the value of the Swiss Franc?

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

How does the Eurozone monetary policy affect the Swiss Franc?

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.