Crude Oil Futures: Further retracements look not favoured

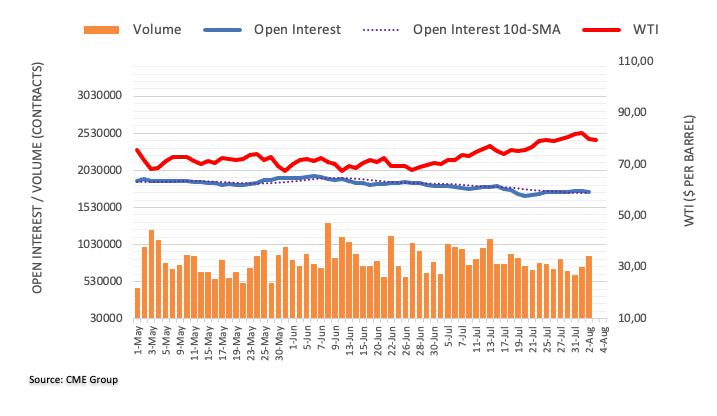

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions by around 15.5K contracts on Wednesday after two consecutive daily builds. On the other hand, volume went up for the second straight session, now by around 144.2K contracts.

WTI: The 200-day SMA holds the downside so far

Prices of WTI charted a substantial drop on Wednesday and returned to the sub-$80.00 region. The downtick of the commodity was accompanied by shrinking open interest, which removes strength from prospects for extra losses in the very near term. In the meantime, there is a decent contention around the 200-day SMA, today at $76.55 per barrel.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.