FX thoughts for the week

Between hikes and financial stability

Four G10 central banks (Fed, SNB, Norges, BOE) meet this week amid elevated market stress. I see upside risks in NOK (vs SEK) and downside ones for the pound.

The SNB should continue to support the franc despite local banking sector issues, but the dollar’s Fed tailwind may be starting to ease.

Big picture

Do central banks face a conflict between their inflation mandate and financial stability?

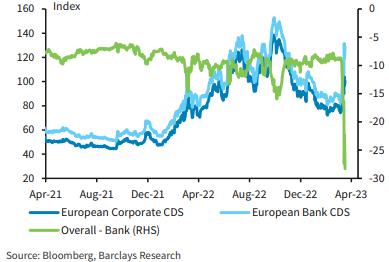

The markets are still grappling with this question and confidence in the financial sector has not fully recovered (as shown in Figure 1). For now, central banks are responding with a conditional no.

They believe that if the banking stress is mainly a liquidity crisis, it can be resolved through lender-of-last resort operations without affecting policy tightening. This is evident in the BoE's response to the LDI-driven bond market turmoil and the ECB's recent 50bp hike. However, questions regarding the business models of banks involved in the recent turmoil remain, beyond liquidity issues.

This week, I anticipate that four more G10 central banks will provide their answers. The Fed and the SNB are likely to be more pressured to respond due to the banking stress in their jurisdictions. I predict that the Fed will increase policy rates by 25bp and the SNB by 50bp. If the SNB's mission is to support CHF valuations as an inflation-fighting instrument, the potential for 6% terminal rates in the US could be significantly reduced. As a result, I anticipate an unchanged median terminal dot in the FOMC, which could limit the potential for sustained dollar upside.

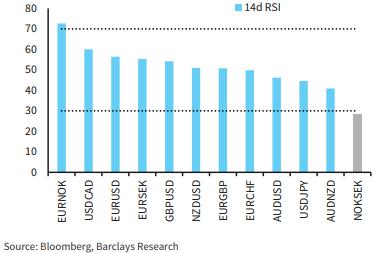

Norges and the BoE have been among the least likely to hike rates so far, resulting in significant currency damage. NOK's underperformance is particularly noticeable amidst already high imported inflation, which increases the chances of a Riksbank-style hawkish pivot (such as a 25bp hike and upgraded rate path). This, along with stretched technical (as shown in Figure 2), creates an opportunity for a significant NOK recovery (versus SEK due to broader risk market fragility and Sweden's high interest rate sensitivity). Meanwhile, the BoE has been hesitant to raise rates and I expect them to remain on hold.

With the hawkish window almost closed at the current policy rate, there is potential for the pound to face downside risks again this week.

Recent developments provide some breathing room for EM central banks, with the Fed likely to be in the fine-tuning phase of the monetary policy cycle. The BCB is expected to keep rates unchanged amid sticky core inflation, but the market anticipates a less hawkish statement. A full cut in June is fully priced in, with the possibility of it happening as early as May. Despite this, I anticipate the BRL to perform well in the near term, as the local political premium is likely priced and high carry remains supportive.

Figure 1. Financial sector worries persist

Figure 2. NOK is technically stretched

In focus

USD

Managing risks US

I have been closely following the rates markets, which continue to be volatile, with many investors still expecting rate cuts to happen later this year. Recent turmoil in the financial system has led to concerns about the Fed's terminal rate, which may end up being lower than previously feared. During this week's meeting, I will be looking for guidance from the Fed on how they plan to balance financial stability risks against the ongoing high inflation. According to a few economists’ friends, the FED is expected to hike rates by 25bp, with a terminal dot of 5.1%. I anticipate that Powell will emphasize data dependence and warn about the heightened uncertainty in interpreting the dot plot. As the Fed is in a fine-tuning phase and with the ECB potentially becoming more hawkish due to lower interest rates and a China-driven reopening, the upside for the USD appears to be limited.

EUR

Still scope for appreciation in 2023

I believe that the ECB's policy normalization efforts will continue to benefit the EUR, as demonstrated by their recent 50bp hike despite the financial turmoil that ensued.

There are also several supporting factors in place, such as the accelerating growth momentum, which is expected to be evident in Friday's flash PMIs, and the demand boost from China's reopening.

As I have mention on here; https://acy.com.au/en/market-n... that this could result in approximately 4% additional upside in EURUSD. Furthermore, a more gradual approach from the Fed due to banking sector issues directly related to their rapid policy tightening can further assist this process. This week, several GC members, including President Lagarde, will be appearing at the ECB's Watchers conference, which will be interesting to follow.

JPY

Market turmoil boosts safe-haven demand for JPY

Last week and beginning of this week, USDJPY reversed its course due to the risk-off move and decline in overseas yields, dropping to the 131s at one point. There is a possibility that the yen may face additional pressures for appreciation if market concerns continue to intensify.

In other news, I have revised my BoJ call and I’m now anticipating that YCC revisions will commence in June, rather than April as previously expected. Additionally, I’m expecting February's nationwide CPI (core) to rise by +3.1% y/y, slowing down from January's +4.2% y/y, due to the government's efforts to mitigate the increase in energy prices.

GBP

Sterling risks again to the downside into BoE meeting

My view on the MPC decision this week is that it could lead to downward pressure on sterling, which is consistent with recent trends.

While high and persistent inflation domestically remains a concern, the limited fiscal easing that has been introduced is expected to contribute to demand. On the other hand, the recent fixed-income repricing has lowered the BoE's terminal rate expectations to only 4.25%, which could be viewed as positive. However, it is important to note that dovish central banks can leverage this shift to further reinforce their dovish stance without incurring additional costs. Overall, I believe that risks to my forecast of EURGBP at 0.87 in the medium term are more likely to be skewed to the upside. In terms of notable data releases this week, CPI will be released on Wednesday, flash PMIs and retail sales on Friday, and MPC member Mann is also expected to speak after the meeting.

Commodity

FX CAD underperforms on US-specific risks

My expectation for the Bank of Canada has shifted in line with the Federal Reserve's expectations, and this has caused the Canadian dollar to weaken against the USD amidst the latest market volatility.

CAD has also lagged other commodity currencies due to its sensitivity to US-specific risks, such as those related to US financial stability and growth. This week, it will be important to keep an eye on February's CPI, January's retail sales, and the deliberations summary from the latest BoC meeting.

The Reserve Bank of Australia's dovish tone on pausing rate hikes, along with lacklustre recent data releases, has put an end to AUD's outperformance. Meanwhile, the New Zealand dollar continues to benefit from a more hawkish central bank. However, the solid Australian employment report and a large Q4 GDP miss in New Zealand limit the potential for further AUDNZD downside in the near term. This week, I will be paying attention to RBA Assistant Governor Kent's speech on Monday and the minutes from the March meeting on Tuesday.

Scandies and CHF

Upside risks for NOK/SEK into this week’s Norges meeting

Last week's large miss to the upside in CPIF-ex energy has helped validate the Riksbank's recent hawkish pivot, which in turn reduces the likelihood of further SEK weakness despite Sweden's high sensitivity to interest rates. This week, we'll be closely monitoring speeches by Riksbank's Deputy Governor Breman and Governor Thadeen on Tuesday and Wednesday respectively.

While Norwegian data has been mixed lately, the significant underperformance of NOK increases the chances of a hawkish pivot by Norges Bank this week. I’m anticipating a 25bp hike and an upgraded rate path, which could lead to a significant recovery in NOK, especially against SEK given the stretched technical.

On Thursday, I expect the SNB to increase interest rates by 50bp, allowing CHF resilience to continue amidst ongoing policy normalization and the resumption of safe haven inflows. Despite Swiss-specific banking sector stress, the franc's fortunes are unlikely to change given available backstops like ample fiscal space and FX reserves, coupled with ever-present FX intervention. As the EUR recovers, we expect CHF strength to be more visible compared to the USD.

Non-Japan Asia

FX risk premia likely to remain elevated

This week, I expect North-Asia FX to be closely linked to the performance of the US dollar. However, CNY could be an exception due to President Xi's visit to Russia, which has boosted sentiment onshore and supported CNY assets briefly. The abrupt suspension of widely used bond price feeds in China has revived concern about sudden regulatory shifts, but the regulator acted quickly by delivering a 25bp RRR cut to smooth market volatility. Thus, I expect front-end yields to stay low in the near term.

I anticipate that USD/INR will fall as it catches up with EMFX gains and on financial year-end USD inflows. Although the INR underperformed last week, Q4 BoP data should confirm easing external pressure, evidenced by narrowing trade deficits. Fixed-income markets will likely track global rates moves in the near term. Sticky Feb core CPI (6.4%) did not have much effect with headline inflation in line with expectations.

I believe ASEAN FX gains could slow ahead of the upcoming FOMC, amid elevated two-way volatility. SGD/NEER could grind higher within the band following markets’ risk reduction last week, and February CPI (Thu) should provide direction for residual policy adjustment expectations. IDR is unlikely to benefit much from USD weakness, especially if foreign bond outflows gather pace. Meanwhile, BI confirmed the end of hikes and reiterated the need to strengthen exports receipt management via FX deposits. The PHP is likely to underperform after recent resilience, and the widening trade deficit on slower exports and higher capital imports highlights the large financing gap. The MYR remains challenged by BNM’s large USD-forward sales book constraining intervention. The THB could consolidate following last week’s outperformance, and moderate equity outflows and a large goods trade deficit could offset.

LATAM

BCB on hold; MXN in pain; Andeans following global

BRL: The BCB is widely expected to stay put on Wednesday amid sticky core inflation, but expectations are for a less hawkish statement. Political pressure for cuts remains high, with a full cut in June now fully priced by the market, and May certainly on the table. Meanwhile, the fiscal reform is expected to be presented in the next week, and economists expect a moderate proposal to ultimately prevail. I expect the BRL to outperform in the near term, as the local political premium in terms of the fiscal and the BCB is likely priced and high carry remains supportive.

MXN: I have observed that the MXN has been underperforming due to increased US recession fears and crowded positioning. However, with cleaner positioning, I expect the FX to trade more in line with its peers. Any positive headlines for risk should benefit the MXN, as carry would come back into play with the US economic data remaining strong. On rates, the Fed is in the fine-tuning phase of the policy cycle, which should ultimately take some pressure off Banxico. As mentioned early a few friends economists and I expect two more 25bp hikes for the cycle, with core inflation moderating to 8.15 in H1 Mar (Thu). Although duration should benefit in this environment, I must note that local rates are likely to remain volatile in the near term.

Moving on to Andean rates, I have observed that they have broadly followed core rates lower, as financial stability concerns limit room for further Fed hikes and give LATAM central banks breathing room.

Banrep is still expected to deliver another hike, with the market pricing another 40bp for the cycle. I expect rates to rally, with the end of the cycle seeming more likely (whether this is the last hike, or there is room for one smaller hike). Moreover, the initial proposal for pension reform was released in a more moderate version and is expected to be more watered down in Congress, like the tax reform process.

Thus, I expect further support for rates as locals warm up to local bonds with this uncertainty on its way to being resolved. Meanwhile, terminal rates in Chile look quite low after the recent move. I think the cuts priced in April are unlikely to materialize and expect 3m rates to correct this pricing, while 2y rates are unlikely to decouple from US rates for now.

In terms of FX, I have observed that the COP and CLP were among the worst performers in the EM sell-off, as carry took a hit. That said, I still think the CLP will benefit from exposure to China over time. Meanwhile, the COP remains sensitive to broad risk and oil, and I expect these to remain the main drivers in the near term.

EEMEA

CBT on hold, South Africa core inflation up again

In Turkey, I expect CBT (Thu) to keep rates on hold at 8.5%. In our view, rates and the TRY exchange rate will remain stable until elections. After elections, TRY overvaluation will have to be addressed, but the pace of FX adjustment will depend on the elections’ outcome, see Türkiye Elections: Change or continuity?

In South Africa, the EFF (one of opposition parties) called for the national shut-down on Monday. 1 Given that Tuesday is a national holiday in South Africa, we do not expect an EFF shutdown to have a large economic impact, but it may further dent economic sentiment. We expect ZAR to continue to trade with larger premium until credible electricity reform is rolled out. Core inflation (Wed) should continue to increase. Consequently, we now expect SARB to hike policy rates by 25bp at its upcoming meeting next week.

In Russia, the CBT kept rates on hold, broadcasting a hawkish message in line with expectations.

In Israel, PM Netanyahu rejected the president’s proposal to mediate in the controversial judicial reform conflict. 2 As a result, we do not expect markets to fade already significant risk premium embedded in the ILS.

In CEE, local currencies will likely follow global trends this week.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.