USA depression likely and watch for currency intervention

It has been easy, but we need to be on our toes now.

1. Stocks and currencies can have an accelerated crash!

2. All my currency forecasts made in December have now occurred, and the further potential targets look real too.

It has been very easy to this point.

Now, that the world suddenly has the same ideas we highlighted 6-12 months ago, it is time to get back on our toes. We are approaching levels where individual central banks and governments, as well as some form of joint statement, suggesting currencies need to stabilise is approaching.

This will create volatility. It may not turn the tide. I have made plenty of money for investment banks selling against various central banks. They provide liquidity to sell more in most circumstances. Initially though, expect volatility. Potentially against us.

If you missed my forecasts from last year. EUR .97, AUD .65, GBP 1.05. This year highlighting .88, 58, 1.00 to .95 respectively.

3. The mainstream financial media commentary, economists and strategists from the investment bank and hedge fund industries are still deplorably behind the economic and market curves. They are still talking the same 'buy the dip' rubbish they have repeated every week this year, and they never apologise. Just tell you to buy more now?

There seems little real economic or market reading ability left after the full takeover by bureaucrats in these sectors, against the street corner market savvy genius of previous decades in markets. The most conservative, steadily bullish only, are promoted. Which absolutely determines that they can only misunderstand consistently, what is really going on in the real world.

Clients of these organisations deserve better than 'buy the dip' parrots.

4. The US economy, as forecast mid-last year, is in a technical and headed into a very real Recession. There is enormous evidence now to suggest the USA is on track for an inescapable Depression.

A significant contributing factor to this outcome. will be the reluctance of the Fed or Government or economists generally, the great swathe of mediocrity, let's face it, the Wall Street economists and academia haven't got much right at all in the past two decades, not recognising the reality of the economic slow down, have taken zero action to head it off post-Covid.

Instead, the government is spending big, and the Fed is aggressively hiking interest rates.

This will undoubtedly be, the biggest economic catastrophe of the century!

Dwarfing the GFC and Covid mere moments.

5. Stocks have another 10%, 20%, 30% to fall over another 1-4 years of bearish activity. A six year heavy stock market period, as the world economy entrenches into a go-slow disappointment period over the next 3 years, is a very real possibility.

Buying now, risks waiting many years just to get back to break-even.

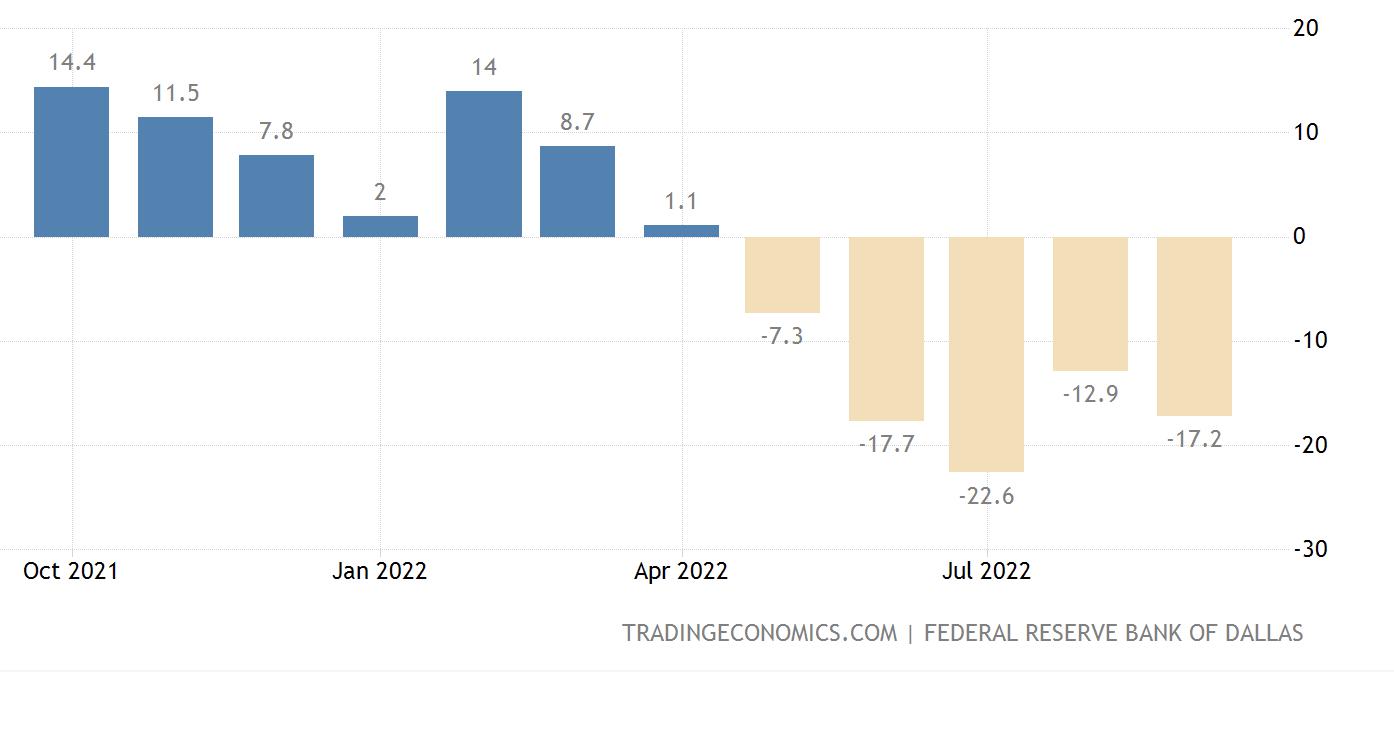

US Dallas Fed Manufacturing Index

An absolute crisis.

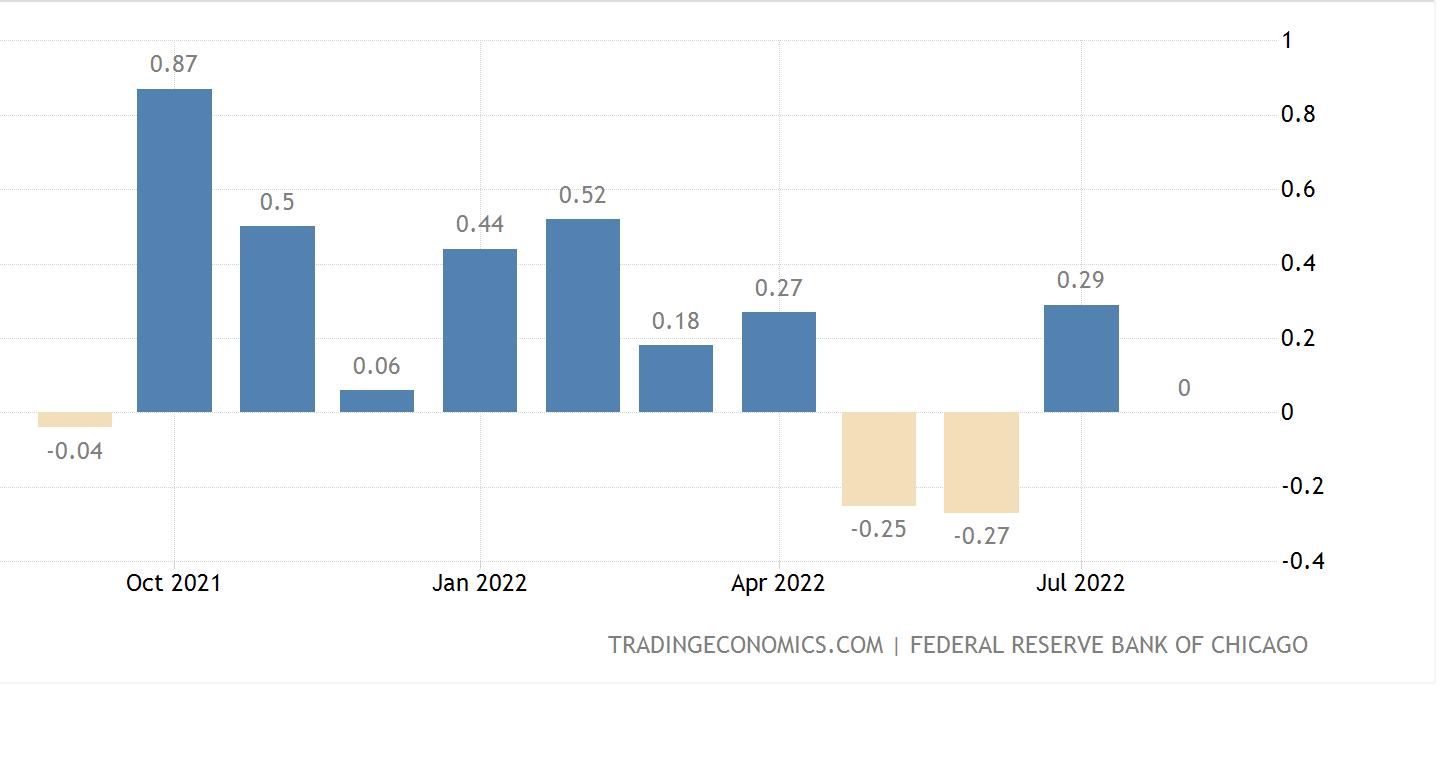

Chicago Fed National Activity Index

ZERO.

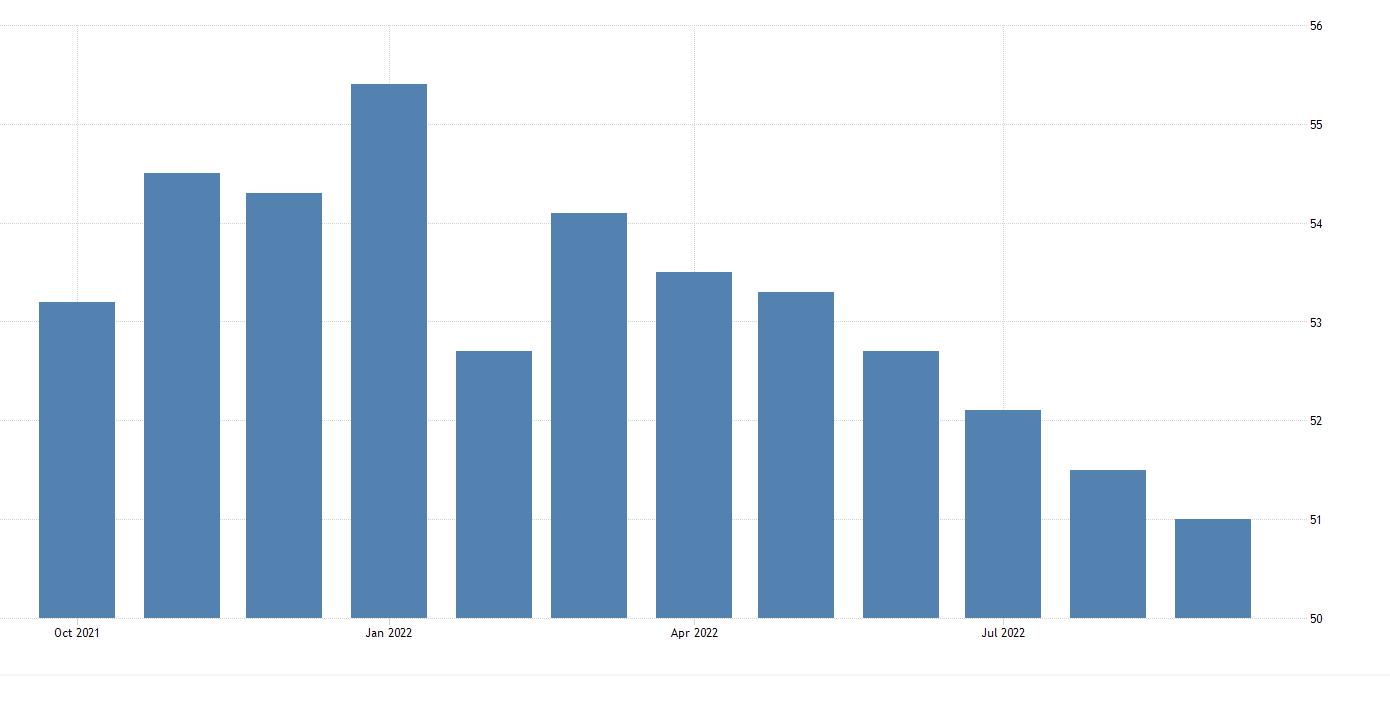

US Treasury Bonds Yield

As forecast, at new highs and accelerating.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.