GDPNow Third-Quarter forecast jumps to 2.5 percent, recession off?

The Atlanta Fed GDP model surged higher, but it was not due to the tame CPI report. Let's take a look.

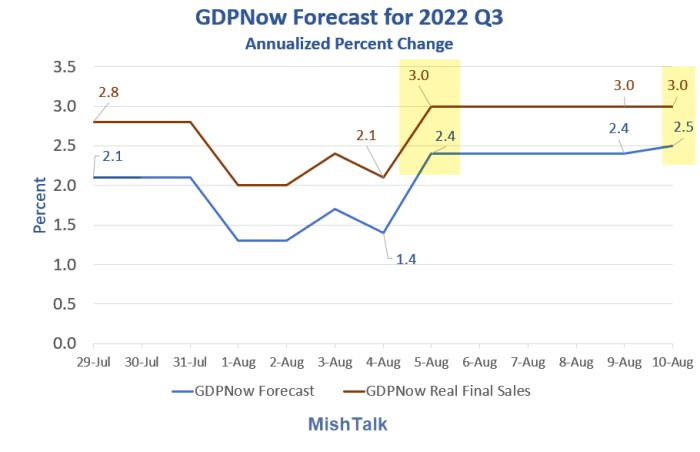

GDPNow data from Atlanta Fed, chart by Mish

Please consider the August 10 GDPNow Forecast.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2022 is 2.5 percent on August 10, up from 1.4 percent on August 4. After recent releases from the US Bureau of Labor Statistics and the US Census Bureau, the nowcast of third-quarter real personal consumption expenditures growth, third-quarter real gross private domestic investment growth, and third-quarter real government spending growth increased from 1.8 percent to 2.7 percent, -0.3 percent to 0.2 percent, and 1.4 percent to 1.7 percent, respectively, while the nowcast of the contribution of the change in real net exports to third-quarter real GDP growth decreased from 0.35 percentage points to 0.30 percentage points.

Watch Real Final Sales

The number to watch is Real Final Sales, not the baseline GDPNow estimate. The difference between the numbers is inventory adjustment that nest to zero over time.

RFS is the bottom-line estimate for the economy.

Much of GDP changes very little throughout the quarter (military spending, Medicare, Social Security, food stamps, etc.)

It's cyclicals (durable goods and housing) that tend to drive expansions and recessions.

Why the Jump

The last GDPNow forecast was on August 4.

The jump was not due to today's CPI report but rather the blowout jobs report on August 5.

I'm Calling BS on the Second Straight Amazing Jobs Report, Understanding Why

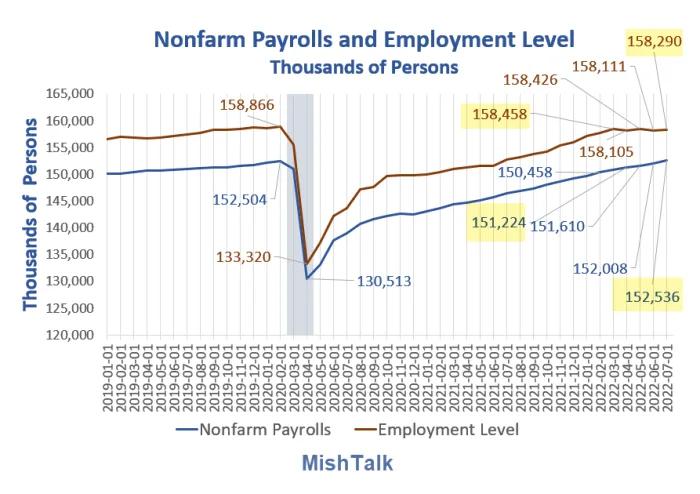

Nonfarm Payrolls vs Employment Level. Chart by Mish. One set of numbers is wrong.

On August 5, I commented I'm Calling BS on the Second Straight Amazing Jobs Report, Understanding Why

Synopsis Since March

- Employment -168,000

- Jobs +1,680,000

The household numbers are admittedly noisy, but a five month divergence now stands out.

In expanding economies, discrepancies tend to resolve higher. At turns, discrepancies tend to resolver lower.

I suspect labor turnover and retirements have seriously distorted payrolls and at least some of this strength will be taken away.

Regardless, I'm calling BS. At least one set of numbers is seriously wrong.

Models Don't Think

Models don't think. Humans can, perhaps incorrectly.

The baseline job numbers do not match 200,000 layoffs at Amazon, consumer sentiment, rising jobless claims (albeit from record low levels), warnings from retailers including Walmart and Target, layoffs at Walmart, and two warnings from Micron on demand for computer chips.

I smell huge revisions to the job numbers. If so, this forecast jump will be short lived.

There are three retail sales reports coming and a myriad of housing reports. Those will hold the key to the third quarter, not the July jobs report.

Cyclical Discussion

- July 12, 2022: Cyclical Components of GDP, the Most Important Chart in Macro

- July 14, 2022: A Big Housing Bust is the Key to Understanding This Recession

Housing will be another big bust this quarter. And durable goods rate to follow housing. Manufacturing rates to be negative.

Hopes for the quarter rest solely on consumer spending and falling inflation. But don't count on strong retail sales.

Add it all up and you have a third quarter of negative GDP.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.