Four reasons for current AUD weakness to continue

1. Global sentiment worsens

The AUD is a commodity based currency and when global sentiment drops, so does the demand for commodities like Iron Ore, copper, and coal. These are key Australian exports. Worsening global sentiment the less demand that is anticipated for Australia’s key exports.

2. China’s zero-COVID-19 policy

The majority of Australia’s Iron ore exports go to China. A growing, flourishing China means the AUD lifts too. China is struggling after its latest COVID lockdowns, maintains a COVID zero policy and this is a drag on the AUD. China is not expected to hit its GDP target for this year and there are wider questions about its shift to a ‘common prosperity’ stance in a rejection of some Western free market values.

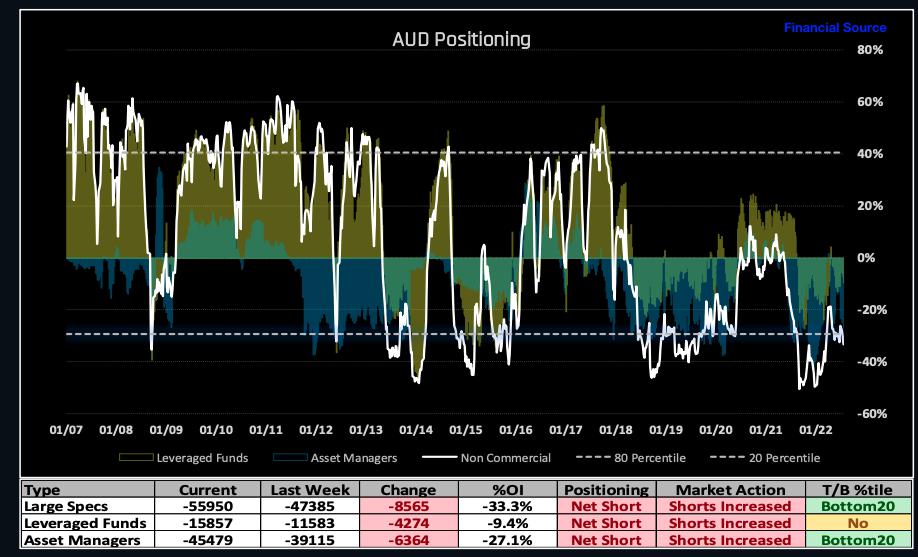

3. COT data show AUD short positioning build

Yes, the RBA are expected to hike rates, but leveraged funds increased their shorts again in the last CFTC report. So, leveraged funds and asset managers have now kept short positions on the AUD going for the last 15 weeks. Remember the RBA are now less hawkish shifting to a meeting by meeting basis.

4. Fed 75bps hike back on

July’s NFP jobs print was very strong and increased expectations of the Fed hiking by 75 bps in September. This strengthened the USD and brings down the AUDUSD pair as well as commodity prices. Another factor weighing on the AUD.

The takeaway?

If the RBNZ maintain a hawkish, hiking stance (diverging from the latest RBA decision) when they meet on August 17, then watch for AUDNZD falls. Key resistance level is marked. However, this outlook is not very likely as the RBNZ is likely to follow the RBA and turn more bearish.

Learn more about HYCM

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.