Oil prices rise as investors react to some positive news on Covid easing restrictions

Key highlights

The European Central Bank's upcoming bond-buying program will curb rising borrowing costs for vulnerable eurozone countries while keeping up the pressure on their governments to repair their budgets, ECB President Christine Lagarde said. With the ECB nearing its first interest rate hike in over a decade, bond yields for Italy and other indebted countries have surged and the spread they pay over safe-haven Germany has widened.

China will roll out tools in its policy reserve in a timely way to cope with more economic challenges, as COVID-19 outbreaks and risks from the Ukraine crisis pose a threat to employment and price stability, a state planner official said. Activity in the world's second-largest economy is beginning to recover after widespread COVID-19 lockdowns in April and early May throttled growth, recent data has shown, but headwinds such as a property market downturn, weak consumer spending and the risk of more COVID outbreaks persist.

Liquidity continues to worsen in Tokyo’s fragile bond market amid echos of the Bank of Japan’s robust defense against speculators betting it would tweak yield curve control. Volumes in front-month Japanese government bond futures fell to the lowest this year in local trading, more than 60% below the 12-month average, according to data compiled by Bloomberg.

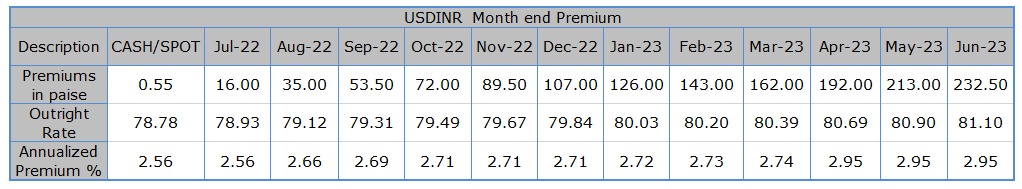

USD/INR movement

The USDINR pair made a gap-up opening at 78.52 and traded within the range of 78.52-78.84. The pair closed the day at 78.77 levels. The month-end expiry kept the pair volatile during the day. The domestic currency nosedived to a fresh low of 78.84 as against the previous day's close of 78.34. The FII outflows and global risk aversion kept the investors on their toes as the selling from the emerging market intensified. The oil importers were also seen at the dollar buying side on the back of month-end flows net-off. The elevated crude price further dented the sentiments for the Indian rupee.

Global currency updates

The EURUSD pair continued with its struggle to conquer the 1.0600 round-figure mark. However, the overall uncertainty about the deteriorating state of inflation and the increasing struggle of the euro area to deal with the crude and gas crisis kept the pair's gains capped. The GBPUSD pair extended its sideways price move and remained confined, below the 1.2300 round-figure mark. The pound lacked bullish conviction amid the UK-EU impasse over the Northern Ireland Protocol of the Brexit agreement. The reduced odds for more aggressive Fed rate hikes kept the USD bulls on the defensive and acted as a headwind for the USDJPY pair today.

Bond market

U.S. Treasury yields were higher as investors await a fresh batch of data for further clues on the health of the economy. The yield on the benchmark 10-year Treasury note was trading higher by 4 basis points at 3.24%. Market participants have become increasingly concerned about the prospect of a recession in recent weeks as the Federal Reserve tries to cool soaring inflation with aggressive interest rate hikes. The domestic bond market remained under pressure today on the back of higher crude oil prices. The India 10-year G-Sec benchmark closed 6 basis points higher at 7.466%.

Equity market

Indian benchmark indices, Sensex and Nifty 50, settled today's volatile session almost flat as the Street sentiment remains subdued on higher crude oil prices. Among sectors, auto, and metal indices rose 1-2%, while some selling was seen in the financial names. The Nifty Bank slipped, while the midcap index gained to close 0.29% higher at 26,791.

Evening sunshine

"Focus to be on the US CB Consumer Confidence data."

European stocks were fractionally higher amid mixed global sentiment. U.S. equity futures traded higher, while the dollar slipped lower against its currency market peers and oil prices jumped, as investors reacted to some positive news on Covid about easing of restrictions from China in hopes of finding a spark that could ignite global growth prospects in the second half of the year. Investors will be looking closely at more data later today, including June consumer confidence, to gauge the health of the economy.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.