USDINR 77.97 ▼ 0.13%.

EUR/USD 1.0525 ▲ 0.26%.

GBP/USD 1.2247 ▲ 0.19%.

India 10-Year Bond Yield 7.495 ▼ 0.68%.

US 10-Year Bond Yield 3.231 ▼ 0.24%.

ADXY 102.94 ▲ 0.19%.

Brent Oil 112.96 ▼ 0.14%.

Gold 1,847.95 ▲ 0.40%.

NIFTY 50 15,310.25 ▲ 0.40%.

Global developments

PBoC kept the one-year loan prime rate unchanged at 3.7%. It has halted policy easing amid tightening by other major global central banks as the Chinese economy is gradually recovering from COVID related restrictions.

Overall risk sentiment is still that of caution. NATO secretary general said that the war in Ukraine could be a long one.

Russia has further slashed natural-gas supply to Europe in retaliation to West' support of Ukraine. European natural-gas prices were up about 50% on Friday from where they were in the beginning of the week.

Eurozone inflation rose to a record high of 8.1% in May, in line with preliminary estimates, primarily driven by higher fuel and food prices.

Focus this week will be on Fed Chair Powell's testimony before the US House Financial Services Committee on Wednesday and Senate Banking Committee on Thursday.

Price action across assets

Rout in cryptocurrencies got worse with Bitcoin plunging below the USD 20000 mark. There are fears that the move lower could trigger margin calls and create systemic risks. US yields were steady on Friday with 10y around the 3.23% mark. Today is a US holiday. After Thursday's short covering bounce, Majors weakened again on Friday against the US Dollar. Sterling is down to 1.22 from highs around 1.24 and Euro is down to 1.05 from highs around 1.06. Commodity currencies were the worst performers. Equity market sell off took a breather on Friday with S&P 500 ending 0.2% higher. Last week was the worst week for US equities since March'2020 with S&P500 dropping 5.8%. Crude prices were down 6% on Friday on concerns over global growth. Brent is trading around USD 112 per barrel mark.

U.S. reviews China tariffs, possible pause on federal gas tax to curb inflation.

Domestic developments

USD/INR

The Rupee continues to trade extremely narrow ranges. RBI Fixings see heavy bid due to NDF fixing related buying (as a result of RBI intervention in NDF).

1y forward yield rose 10bps to 3.38% while 3m ATMF implied vols cooled off to 5.35% on Friday.

Asian currencies are trading weak against the Dollar.

Bonds and rates

Yield on the benchmark 10y dropped 5bps to end at 7.55% after a smooth Gsec auction on Friday. 5y OIS too ended 13bps lower at 7.21%. We may see the rally continue today on lower crude prices.

Equities

The Nifty had ended 0.4% lower on Friday at 15293. IT stocks have been underperforming. Asian equities are trading with cuts of 0.5-1%

Strategy

Exporters are advised to cover on upticks towards 78.50. Importers are suggested to cover through options. The 3M range for USDINR is 77.20-79.20 and the 6M range is 76.75–80.00.

Macron loses absolute majority in parliament in 'democratic shock'.

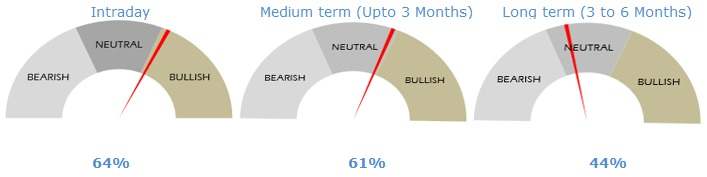

FX outlook of the day

USD/INR (Spot: 77.97)

The Indian rupee continues to trade extremely narrow ranges. RBI Fixings see heavy bid due to NDF fixing related buying (as a result of RBI intervention in NDF). Overall risk sentiment is still that of caution. Asian currencies are trading weak against the Dollar. US yields were steady on Friday with 10y around the 3.23% mark. Today is a US holiday. After Thursday's short covering bounce, Majors weakened again on Friday against the US Dollar. Yield on the benchmark 10y dropped 5bps to end at 7.55% after a smooth Gsec auction on Friday. We may see the rally continue today on lower crude prices in the domestic market. Focus this week will be on Fed Chair Powell's testimony before the US House Financial Services Committee on Wednesday and Senate Banking Committee on Thursday. The pair is expected to trade within the range of 77.90-78.20 with a downside bias.

EUR/USD (Spot: 1.0518)

EURUSD begins the new trading week at 1.0500 levels. On Friday, US Industrial Production for May dropped to 0.2% MoM, below 0.4% market forecast and 1.4% prior. The details suggested steady Capacity Utilization and a contraction in the manufacturing output. While the US data were soft, the Federal Reserve’s bi-annual Monetary Policy mentioned the GDP appears to be on track to rise moderately in the second quarter. Coming to French election, Macron's centrist alliance Ensemble! came first in Sunday's second round of legislative elections, securing 245 out of a total of 577, according to final results released by the French interior ministry -- more than any other political party. However, it still fell short of the 289 seat threshold for an absolute majority in the National Assembly, France's lower house. For the week ahead, today’s testimony by ECB President Christine Lagarde and Wednesday’s Testimony from Fed Chairman Jerome Powell are the key events. The pair is expected to trade in the range of 1.0450 to 1.0560.

GBP/USD (Spot: 1.2229)

The pair is oscillating in a narrow range of 1.2200-1.2233 in the early Asian session after a minor rebound from Friday's low of 1.2173. UK's inflation data can be a catalyst for the pair, as higher expectations of CPI data will spurt the recession fears and will weigh on cable. Market consensus for the UK inflation is at 9.1%, a little higher than the prior print of 9%. The maintenance of an inflation figure equal to or above 9% is eventually a wake-up call for a recession situation. This will force the BOE to sound extremely hawkish in its July monetary policy meeting. The pair is expected to trade in the range of 1.2180 to 1.2290.

USD/JPY (Spot: 134.80)

After Friday's meeting, BOJ is feeling left out as the central bank continued its accommodative stance in its monetary policy to spurt the aggregate demand. BOJ is sticking to its ultra-loose monetary policy while all other central banks have elevated their interest rates vigorously. Inflationary pressures are advancing in Japan’s economy now as the inflation rate has reached above 2%. The market consensus for Japan’s CPI is 2.9% against the prior print of 2.5%. While, the CPI excluding, food and energy may half to 0.4% from the former figure of 0.8%. A reduction in inflation excluding food and energy dictates that price pressures in Japan are significantly contributed by higher food and energy prices. Therefore, the Japanese economy is still deprived of all-around inflation pressures and a spurt in aggregate demand. The pair is expected to trade in the range of 134.40 to 135.30

RBI will ensure a soft landing for economy, assures governor Shaktikanta Das.

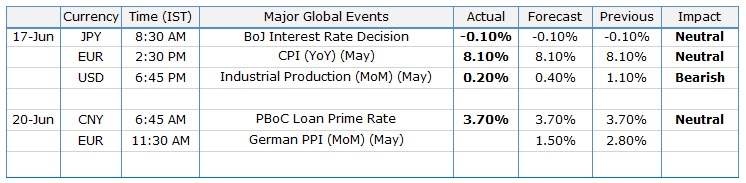

Economic calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now