USDINR 78.03 ▼ 0.05%.

EUR/USD 1.0444 ▲ 0.01%.

GBP/USD 1.2160 ▼ 0.15%.

India 10-Year Bond Yield 7.561 ▼ 0.41%.

US 10-Year Bond Yield 3.337 ▼ 1.71%.

ADXY 102.90 ▼ 0.36%.

Brent Oil 119.27 ▲ 0.64%.

Gold 1,834.30 ▲ 0.81%.

NIFTY 50 15,843.75 ▲ 0.97%.

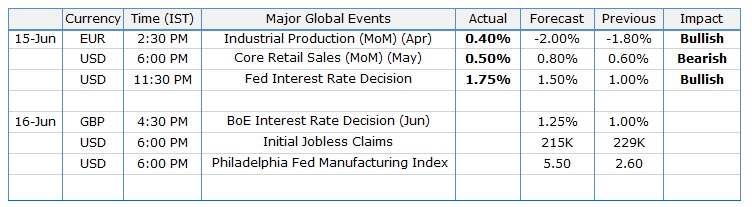

Global developments

US Fed hiked rates by 75bps to 1.50-1.75%, in line with expectations. Dot plot indicated that Fed members saw the Federal funds rate at 3.4% by end of 2022 and ,3.8% by end of 2023. This was lower than market expectations by 20-25bps. Also Fed chair Powell in his speech said that 75bps hikes were not the norm and that the pace of tightening would depend on the course of inflation. However the policy statement did say that the Fed was committed to bringing inflation back to 2%. It seemed the Fed did not want to rattle the markets and price in a preset course of tightening. As we had highlighted, the bar for the Fed to sound more hawkish than what the market was already expecting was extremely high.

US retail sales fell 0.3% in May against expectations of a 0.1% increase. Poor retail sales print indicates consumption is likely taking a hit on account of elevated inflation.

The ECB in an out of policy announcement said it would create new tools to address fragmentation risks. Fragmentation risk refers to risks from disproportionate tightening of financial conditions in Eurozone member countries as ECB withdraws accommodation. Countries such as Italy and Greece have higher debt levels and therefore would be more severely affected as ECB tightens policy. Spreads between Italian and German 10y bonds compressed about 30bps post this announcement. This move is a positive for stability of Eurozone and therefore positive for Euro as well.

BoE rate decision is due today. Despite slowing growth, BoE is expected to hike rates by 25bps as inflation continues to run extremely high.

Price action across assets

The risk sentiment recovered on a less hawkish Fed. US short term yields had dropped about 20bps as the policy was less hawkish than expected. 2y yield had dipped below 3.2% from 3.45% but has retraced back to 3.3%. The Dollar had weakened across the board on account of short covering in majors. 1.0360 continued to act as a firm support on the Euro. The Euro rose to 1.0450 as weak shorts got unwound. The Pound too was not able to break 1.20 convincingly and saw a strong short covering bounce to 1.22. The Dollar however has made a bit of a comeback overnight. Equities cheered the less hawkish policy with S&P500 gaining 1.5% and Nasdaq ending 2.5% higher. Crude prices have softened as EIA data indicated a larger than expected build up in inventories. Brent is trading around USD 119 per barrel.

India's exports rise 20.55% to $38.94 bn in May; trade deficit at record $24.29 bn.

Domestic developments

USD/INR

The Rupee continued to remain extremely range bound, mostly trading in 78-78.10 range throughout the session yesterday. RBIs presence onshore as well as offshore is deterring speculators from going long USD/INR.

3m ATMF implied vols ended 6bps lower at 5.75% while 1y forward yield ended 3bps higher at 3.35%.

Bonds and rates

Yield on the 10y benchmark ended 1bps higher at 7.59%. 5y OIS ended 3bps lower at 7.24%. We may see a rally in bonds today on lower crude prices and lower US treasury yields.

Equities

Domestic equities were soft ahead of the Fed policy with Nifty losing 0.25% to end at 15692. Metals and IT stocks were the laggards in trade while auto stocks outperformed.

Strategy

Exporters are advised to cover on upticks towards 78.50. Importers are suggested to cover through options. The 3M range for USDINR is 77.20-79.20 and the 6M range is 76.75–80.00.

China's holdings of U.S. Treasuries skid to 12-year low; Japan also cuts holdings.

FX Outlook of the day

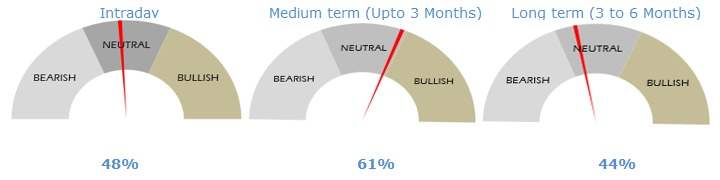

USD/INR (Spot: 78.03)

The Indian rupee continued to remain extremely range bound, mostly trading in 78-78.10 range throughout the session yesterday. The RBIs presence onshore as well as offshore is deterring speculators from going long USD/INR. US Federal Reserve hiked rates by 75bps to 1.50-1.75%, which was in line with the market expectations. Dot plot indicated that Fed members saw the Federal funds rate at 3.4% by end of 2022 and ,3.8% by end of 2023. This was lower than market expectations by 20-25bps. Also Fed chair Powell in his speech said that 75bps hikes were not the norm and that the pace of tightening would depend on the course of inflation. However the policy statement did say that the Fed was committed to bringing inflation back to 2%. The risk sentiment recovered on a less hawkish Fed. US short term yields had dropped about 20bps as the policy was less hawkish than expected. The Dollar had weakened across the board on account of short covering in majors. However, the Dollar has made a bit of a comeback overnight. We may see a rally in the domestic bond market today on lower crude prices and lower US treasury yields.

EUR/USD (Spot: 1.0443)

The pair rallied towards 1.05 level on announcement of ad hoc ECB Governing Council meeting to exchange views on the current market situation. During the meeting, members decided to apply flexibility in reinvesting redemptions coming due in the PEPP portfolio. In addition, they decided to mandate the relevant euro system committees together with the ECB services to accelerate the completion of the design of a new anti-fragmentation system. Post FOMC rate hike of 75 bps, EUR initially dipped to 1.0370 levels, however later recovered 80 pips post FOMC conference. Investors are focusing on the minutes from the Eurogroup meeting, the major agendas are expected to be gauging new oil suppliers after banning Russian oil imports. The pair is expected to trade in the range of 1.0380 to 1.0500.

GBP/USD (Spot: 1.2126)

Cable has recovered 150 pips from the intraday lows of 1.2000 in a short squeeze that has come about during the Federal Reserve's chairman's comments in the press conference that has followed rate hike of 75bps. The hike of 75 bps was in line with expectations and as a consequence, there had been a slow reaction in financial markets. During press conference, chairman Jerome Powell pushed back against the market's aggressive expectations of a series of big interest rate hikes. Powell said either 50bps or 75bps are most likely at the next meeting but that he does not expect 75bps moves to be common. Investors focus have shifted to BOE, wherein BOE's willingness to combat inflation with steeper rate hikes isn't particularly strong as the central bank's hands are tied by a weakening economy. The pair is expected to trade in the range of 1.2050 to 1.2200.

USD/JPY (Spot: 134.32)

Yen strengthened throughout the day yesterday from the highs of 1.3520, there had been position rebalancing prior to FOMC. Post FOMC press conference, US dollar and bond yields got hammered after Fed Chair Powell does not expect 75bp rake hikes to be common. The pace of rate hikes will depend on incoming data. He sees that inflation developments warranted a bigger hike at the June meeting. Based on the dot plot, 50bps rate hikes are expected at every meeting for the rest of the year. On data front, US retail sales report showed spending turned negative for the first time this year. Retail sales dropped 0.3% in May, which was a big surprise, with core spending growth slowing to 0.1%. Americans are dipping into their savings to cope with rising prices, according to the recent drop in the personal savings rate, which fell to its lowest level since 2008. BOJ meeting tomorrow will be a catalyst for yen. The pair is expected to trade in the range of 134.10 to 135.20.

ECB pledges new crisis tool to help indebted southern states.

Economic calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now