BoE raises interest rates to their highest level in 13 years in a bid to tackle soaring inflation

USDINR: 76.25 ▲ 0.12%.

GBPUSD: 1.2458 ▼ 1.29%.

EURUSD: 1.0583 ▼ 0.36%.

India 10-Year Bond Yield: 7.403 ▲ 0.34%.

US 10-Year Bond Yield: 2.954 ▲ 1.34%.

Sensex: 55,702 ▲ 0.06%.

Nifty: 16,683 ▲ 0.03%.

Key highlights

China's services sector activity contracted at the second-steepest rate on record in April 2022, according to a survey released. The country’s latest COVID-19 outbreaks, and the ensuing preventative measures, also led to sharper reductions in new business and employment. The Caixin services PMI was 36.2, down from March’s 42 figure.

Activity in India's dominant services sector grew at its fastest pace in five months in April on strong demand, prompting firms to add jobs for the first time since November, but sky-rocketing inflation remained a major concern. The India Services PMI rose to 57.9 in April from 53.6 in March, its highest since November and surpassing the 54.0 estimates in a Reuters poll.

The Bank of England raised interest rates to their highest level in 13 years in a bid to tackle soaring inflation. In a widely expected move, policymakers at the BoE voted for a fourth consecutive rate hike since December at a time when millions of U.K. households are grappling with skyrocketing living costs. The Bank’s MPC approved a 25-bps increase by a majority of 6-3, taking the base interest rate up to 1%.

USDINR movement

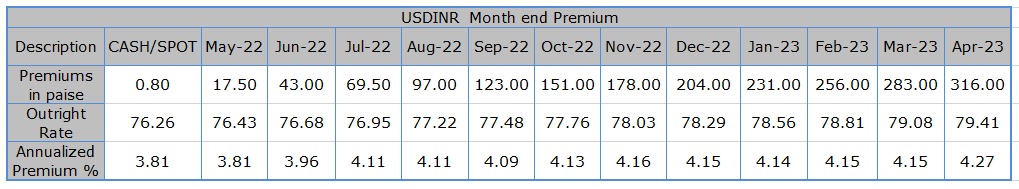

The USDINR pair opened at 76.16 levels. The pair traded in the range of 75.99-76.2875 and closed the day at 76.25. The USDINR pair opened weak amid broad dollar weakening globally. However, the pair gained momentum later in the day on the back of higher bond yields. Surging crude prices also dented the sentiment for the rupee and made the rupee give up the initial gains.

Global currency updates

The GBPUSD pair weakened further below the 1.2400 mark and touched its lowest level since July 2020 in reaction to the Bank of England's dovish outlook. As was widely anticipated, the UK central bank lifted its key interest rate for the fourth time in the current tightening cycle to curb inflation. The vote distribution indicated that three MPC members were in favor of raising interest rates by 50 bps.

ECB Chief Economist Philip Lane said that the exact timing of rate hikes is not the most important issue, reported Reuters. The ECB will move rates, not just once, but over time in a sequence, he noted. His remarks come after he earlier said that the euro area is unlikely to revert to the persistent below-target inflation trend that was so entrenched before the pandemic. The EURUSD pair broke the 1.06 level and traded at the level of 1.0552.

Bond market

Treasury yields recovered some of their losses from the previous session that were sparked by Fed Chair Jerome Powell signaling that the central bank would not take more aggressive hikes at upcoming meetings. The yield on the benchmark 10-year Treasury note traded at 2.962%. The yields of the 10-year benchmark continue to surge as the bond market continued to digest the higher rates and elevated crude prices. The 10-year benchmark closed the day 2 bps higher at 7.40%.

Equity market

Indian equity benchmarks Sensex and Nifty 50 finished a session barely in the green, even as the Fed's move to hike the key interest rate by an expected 50 bps soothed the nerves of global investors. Gains in IT, metal, and auto stocks were offset by losses in consumer durables, pharma, realty, and select financial stocks. Broader markets were mixed, with the Nifty midcap 100 edging up 0.10% while the Nifty smallcap 100 declined 0.75%. The Sensex gained 0.06% to settle at 55,702 while the Nifty added a mere 0.03% to close at 16,683.

Evening sunshine

Focus to be on the BoE Gov Bailey Speech due later today.

European stocks rose after strong gains elsewhere as the Federal Reserve downplayed concerns over aggressive interest rate hikes to tackle soaring inflation. U.S. stock index futures slipped, a day after the Federal Reserve’s less aggressive tone sparked a rally on Wall Street, with investors awaiting jobs data this week for more clues on the path of interest rates. The market would watch out for BoE Gov Bailey's Speech due later today.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.