Weekly Outlook: US Growth in Q4 revised lower to 6.9%, slower growth to come

US Growth in Q4 revised lower to 6.9%, slower growth to come

Key Highlights

- The centre's fiscal deficit jumps to 82.7% of the FY22 target in April 2021-February 2022.

- The British economy expanded 1.3% on quarter in the final quarter of 2021, higher than the 1.0% growth in the previous period.

- German annual inflation rose more than expected in March. CPI Inflation, rose 7.3% on the year after 5.1% in February.

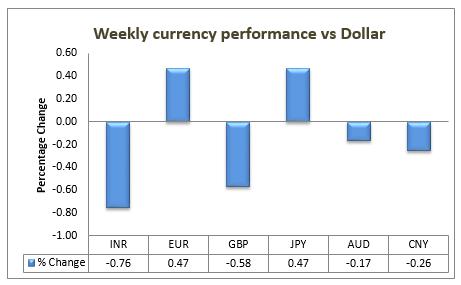

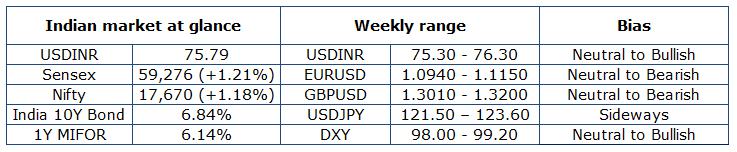

USD/INR Weekly performance & Outlook

- The USDINR pair started the week with an upside bias at 76.37 levels. The pair remained volatile during the week and eventually closed the week at 75.79 levels.

- The USDINR pair rose after Fed Chair Powell stated that inflation is much too high and to reign it in, the central bank may raise interest rates by a bigger quantum if required. Prices of Brent crude oil also remained elevated and were above $110 a barrel during the month due to existing tension between Russia and Ukraine. However, Crude oil prices fell after Shanghai, China's financial hub, imposed a lockdown to curb a surge in COVID-19 cases, which led to renewed fears of demand destruction. The peace talk between Russia and Ukraine calmed the Risk aversion, leading to a weakening of the dollar index. The Asian and domestic equity markets too looked optimistic as the market continued to rally.

- The Market would watch out for the RBI MPC meeting for the economic outlook and forward guidance. Inflation is picking up in India, but the country's central bank is likely to maintain its loose policy even as its global peers raise rates, potentially forcing it to play catch-up aggressively later. RBI watchers expect the bank to stand pat on 8th April, even though inflation has broken above the 6% upper end of the bank's target band for two months. Markets expect the RBI to raise its retail-inflation projection for the fiscal year in the upcoming MPC meet. The interest rate divergence, inflation and commodity prices are expected to drive the market. The USDINR pair is expected to trade with a neutral to bullish bias. The pair is expected to trade within the range of 75.30-76.30 in the week ahead.

ECB President Christine Lagarde rules out stagflation

EUR/USD:

- The euro enjoyed a short relief rally built on constructive peace talks between Ukraine and Russia which initially sent the price of oil lower. However, the shared currency couldn’t hold on to the gains as it slipped, weighed by the ongoing Russia Ukraine war which still sees no end in sight. Despite peace talks, there has been no real progress as of yet. ECB President Lagarde stated that the Food and energy prices in the Eurozone should stop rising, which should help the Eurozone avoid a combination of stagnant growth and high inflation feared by economists. As for Eurozone inflation, however, the analysts expect inflation across the euro area would continue to surge in the short term, mostly due to a substantial surge in energy prices. The EURUSD pair is expected to trade with a neutral to bearish bias in the week ahead.

BoE's Andrew Bailey warns energy shock is larger than in the 1970s

GBP/USD:

- The British pound recovered some ground vs. the dollar as the market mood turned sour, courtesy of reports of the Kremlin saying that although Ukraine’s effort to fulfill some of Russia’s demands, peace talks have not reached a breakthrough. Furthermore, lower US Treasury yields are a tailwind for the Pound sterling, which reached a daily high of around 1.3185 but retreated towards the mid 1.3110-50 area. The pound did not react much to the UK Q4 GDP data that has beaten the market expectations, climbing to 1.3% against 1%, and a previous 1%. The pair is expected to trade with a neutral to bearish bias in the week ahead

Biden announces largest-ever Strategic Petroleum Reserve release

Dollar Index:

The US Dollar Index, finished March positively, with a monthly gain of 1.72%, its highest since November of 2021. The market mood on March’s last trading day was dismal. Failure to find a meaningful resolution to the Russia-Ukraine conflict keeps investors on their toes, boosting the dollar’s prospects. Money market futures expectations that the Federal Reserve would hike 50-bps in May and June meetings loom, keeping the US dollar tilted upwards. The CME FedWatch Tool has priced in a 69.9% chance of a 50 bps rate hike in the May meeting, while June odds lie at 64%.

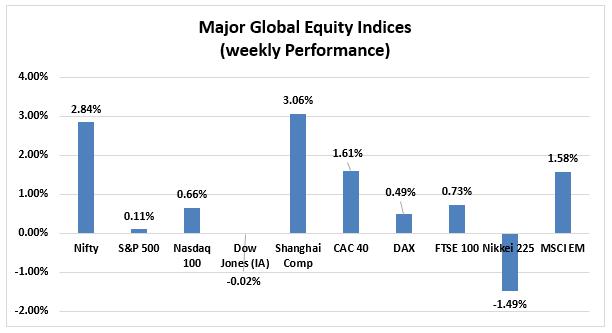

Domestic and Global Equities:

Domestic Equities:

- The Indian equity index Nifty 50 showed an upward trend this week as it rose from 17,222 to 17670. As per the weekly trajectory, the energy and commodity indices have been in the red zone along with FMCG and pharma taking a bit of a downside hit. The banking and financial service sectors have been slowly showing upward trends while the IT sector has remained volatile in between the week. The FII outflow in the month has been substantial, however, the domestic investors have kept the balance up keeping the market stable and slowly keeping an upside trend. The volatility is expected to remain for some time due to global and domestic cues that are currently driving the market.

Global Equities:

- The war situation has disrupted the short and mid-term inflation expectations with soaring energy and food prices impacting the overall global economy. The energy importer’s decisions on how they will respond to rising demands with keeping growth at a steady rate will be something to observe for the markets. Investors, however, were still fretting over whether the inflationary pressures would force central banks into aggressive rate hikes, potentially triggering recessions. Global stocks fell as investors sold risky assets due to concerns about a possible recession and further escalation of the Russian-Ukrainian war.

Domestic and Global Bonds:

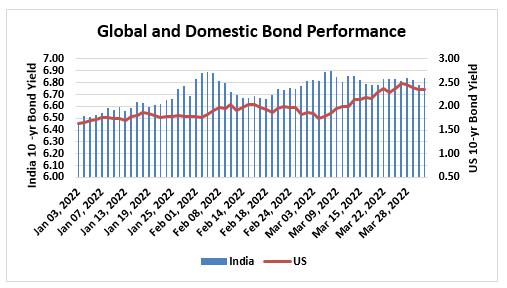

Domestic Bonds:

- Commodity prices have remained volatile over the week with crude prices taking a downward movement keeping the G-Sec volatile. The 10-year G-Sec moved within the wide range of 6.78-6.84 due to global and domestic cues. The recent news of Russia accepting payments in Euro from European partners also accepting the fact the ruble payment system will be implemented in tranches has kept the crude prices humble for the week. The news about the outbreak of the new Covid waves in China and the following lockdown in some major cities also impacted the demand for oil. The G-Sec went as high as 6.84% as the bond market eyes on the RBI monetary policy meetings on the 8th of April. The borrowing calendar for H1 is announced. The centre would borrow Rs 8.5 lakh crs by issuing 32000-33000crs of bonds every week. The gross borrowing for the year is budgeted at 14.3 lakh crs. The GST collections in March 2022 hit an all-time high of Rs 1,42,095 crore, driven by the economic recovery.

Global Bonds:

- The US 2-year and 10-year yield curve differences have been observed to be narrowing down giving a possible recession signal. The bond market phenomenon means the rate of the 2-year note is now higher than the 10-year note yield. The 2-year to 10-year spread was last in negative territory in 2019, before pandemic lockdowns sent the global economy into a steep recession in early 2020. The trajectory of the world’s biggest bond market in the coming months will depend heavily on whether yields have risen far enough to draw in domestic buyers and foreign investors, given that rates are on the rise worldwide. It will also hinge on whether data signal that the steepest inflation since the 1980s is becoming ingrained in the economy.

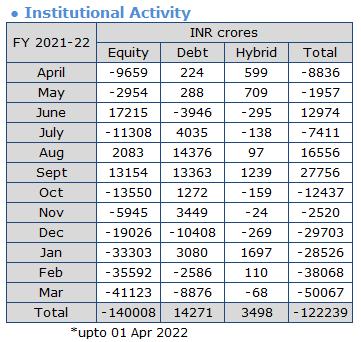

Monthly FPI Net Investments:

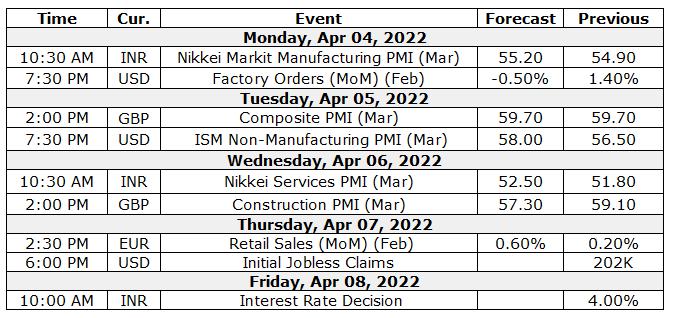

Macro-economic Calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.