NZD/JPY: Expect buyers on the dips

The NZDJPY pair has broken higher through resistance at 82.50 as flagged here on the strong fundamental picture for the pair. That fundamental picture remains in place as there are continued reasons for NZD strength and JPY weakness.

The reason for NZD strength

The New Zealand dollar has significant reasons for strength:

-

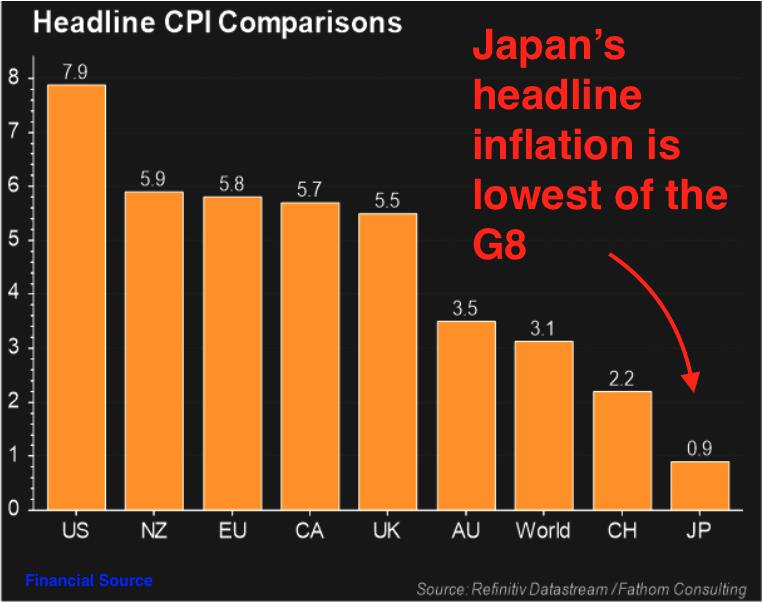

The headline inflation rate is just under 6% at 5.9%. This means the RBNZ is under pressure to hike rates to control very high inflation.

-

The RBNZ has projected the terminal interest rate to be above 3.3% by March 2025. See here for the report on the latest meeting.

-

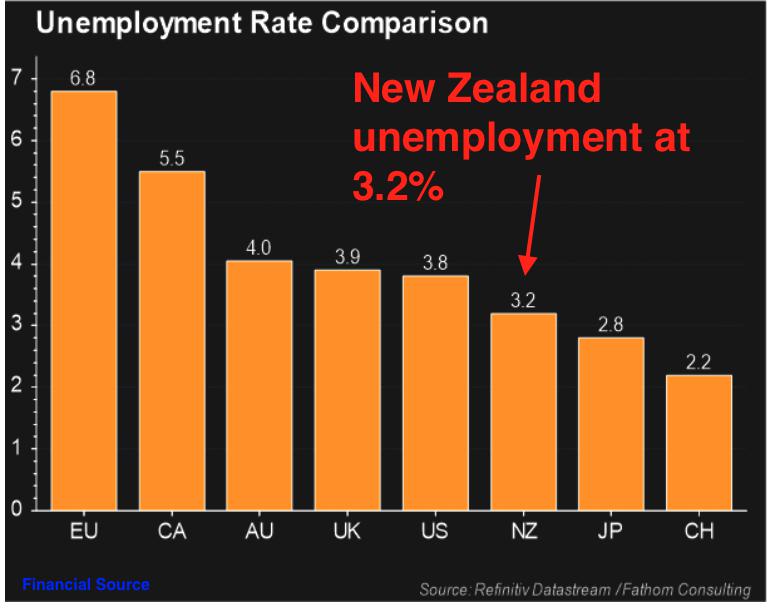

Unemployment is low at 3.2%.

-

New Zealand bond yields continue to surge higher.

-

Interest rate markets are pricing in nearly 8 interest rate hikes from the RBNZ this year for a total of nearly 200 bps. The current interest rate level is at 1.00%.

The reason for Japanese Yen weakness

The Japanese Yen has significant reasons for weakness:

-

High oil prices weaken the Yen as it is a net importer of energy.

-

The BoJ has pledged to keep the Japanese 10-year yields within the +0.25% -0.25% band.

-

Inflation is still relatively low in Japan with the headline at 0.9%. The lowest of the G8.

-

The BoJ was quite happy with a weak JPY and the powerful easing policy remains in place which all should keep the JPY structurally weak over the medium term.

The most obvious place for dip buyers to step in would be against the 82.50 level as that is both a daily high and a weekly trendline area. Furthermore, it means that stops can be fairly closely placed under 81.90 while allowing for another potential leg higher as outlined below.

Learn more about HYCM

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.