The ‘Santa rally’ to drive the commodity currencies higher

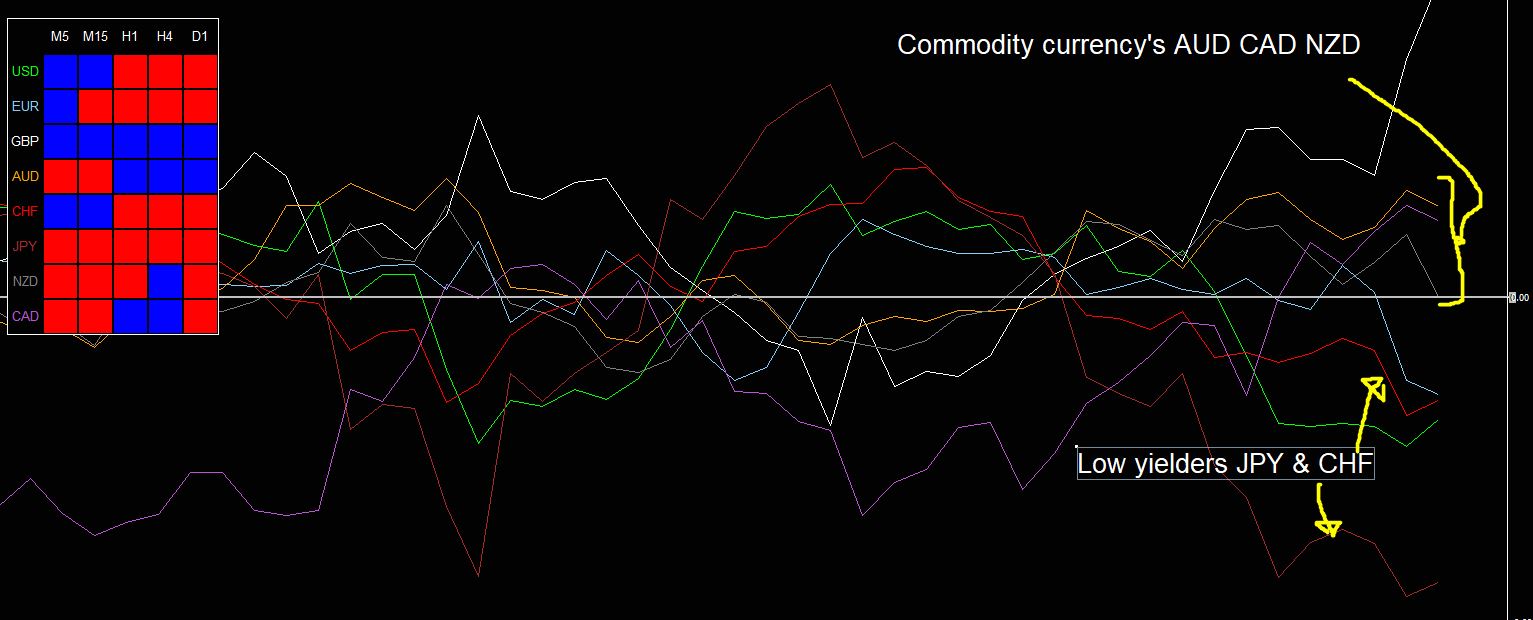

The SP 500 has rallied over 4% in the past three days driven by expectations of a strong healthy economy into 2022. Oil prices have surged over 10% in the same period. This is a clear-cut case of ‘Risk-On’. Risk on means investors and traders are happy to take on more risk with their cash in the hope of a better return. The global financial markets are all intertwined with positive and negative correlations constantly shifting. However, one correlation that seems to hold is the correlation of risk sentiment and the forex market. ‘Risk on’ will often see the low-yielding currencies, like the JPY, CHF and the Euro come under pressure. Why? Well simply put, these currencies can be borrowed cheaply and then exchanged by selling in the currency markets in exchange for the higher-yielding assets. If a currency is borrowed and subsequently sold, it will trade lower. And that is exactly what happen at the moment. The strength meter below, shows a clear move our of the JPY, CHF and the Euro, with the high beta, higher-yielding, commodity currencies pushing higher.

Forex day trading is all about having an edge. A trend follower's edge is to buy the strong currency and sell the weak, and this chart shows exactly where the edge is. Picking the correct pair to trade and fine-tuning entries with a defined set of rules is what separates the winners from the losers. So if stocks kick off in 2022 in a positive mood, we could see the commodity currencies trade significantly higher than the low yielders. So play lose attention to where the risk money is going. Examples of risk on currency trades could be buying AUDJPY. buying CADCHF, buying AUDCHF and selling EURNZD. Time your entries with rules and always use the stop loss would be my advice.

Have a wonderful Christmas and a happy new year to all my followers. Let’ make 2022 a year a positive year to remember.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.