Gold Price Forecast: XAU/USD sinks on ubder hawkish Fed statement, but much was priced in

- Gold is feeling the pressure on a much more hawkish Fed, but much was priced in already.

- US dollar has rallied 30 points in the DXY on an uber hawkish Fed but is stalling.

- Fed's dot plot is far more hawkish with 3 rate hikes in 2022 and 2023. The taper has been doubled.

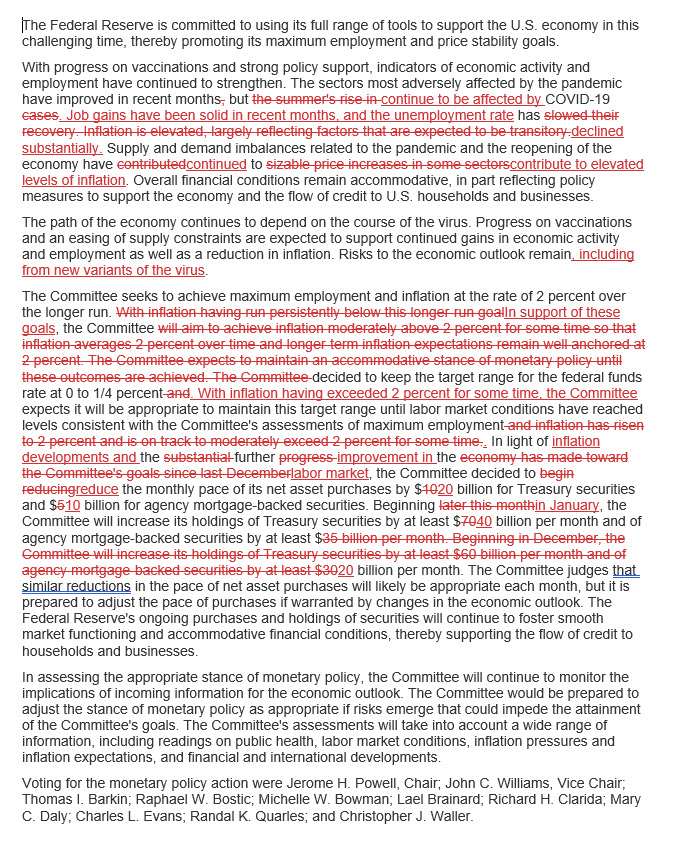

Gold, XAU/USD has extended the day's losses on an uber hawkish Federal Reserve statement and announcements of a doubling of its tapering of QE and a seismic shift in the dot plot. The median forecast is now showing three hikes in 2022 and 2023.

The Federal Reserve statement acknowledges that job gains have been solid and it has dropped the transitory language with respect to upside inflation pressures.

Fed futures printing in a 100% chance of a Fed hike as soon as May and 50% for a March rise, with 90% for April.

Key takeaways from the Fed statement

- FOMC monthly taper pace $30 billion vs $15 billion prior.

- ''In assessing monetary policy, will continue to monitor incoming information for the economic outlook.''

- ''Prepared to adjust stance of monetary policy as appropriate if risks emerge that impede its goals.''

- ''Job gains have been solid in recent months, and the Unemployment Rate has declined substantially.''

See also: Summary of Economic Projections

Watch live: Fed's Powell coming up, top of hour

Federal Reserve Chairman Jerome Powell holds a news conference after Federal Open Market Committee concluded its two-day meeting.

This shift to three rate hikes in 2022 will very much support the notion of the Fed moving into tightening mode. Therefore, there will be plenty of interest as to how the Fed now refers to inflation - after Powell said its description as transitory should be 'retired. This will be the key theme during the presser and the price of gold will be determined by it.

''Certainly, while the above suggests a hawkish tone from the Fed, the market is already pricing an aggressive tapering and the first hike in May 2022,'' analysts at TD Securities argued.

''This leaves a balance of risks tilted towards the upside for the near-term precious metals outlook, particularly as our macro strategists expect enough slowing in inflation and growth to delay rate the start of the hiking cycle.''

Gold technical analysis

However, from a technical perspective, while the price is being supported, the wick is going to be a target for the bears for the sessions ahead. A break of $1,750 will open the risk of a far deeper move to the downside and $1,700 could come under pressure over the coming weeks.

This will depend on the US dollar's trajectory. The initial move was a strong bid but it has since settled as follows:

Reprinted from FXStreet_id,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.