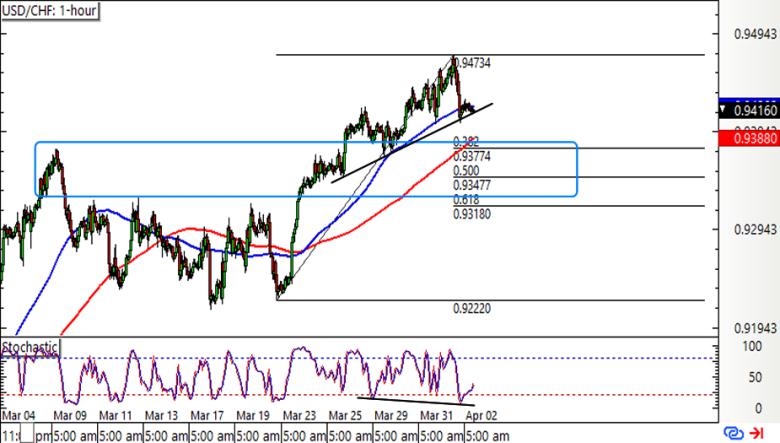

I’m looking at this long dollar setup ahead of an expected upbeat NFP report later today.

Think USD/CHF could bounce off any of these levels?

Before moving on, ICYMI, today’s Daily Asia-London Session Watchlist looked at EUR/USD’s pullback area ahead of NFP release. Be sure to check that out to see if there is still a potential play!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

- Australian and New Zealand banks closed for holidays

- Taiwan train crash resulted to dozens of fatalities, several injuries

- Japan secured more Pfizer vaccines to immunize elderly population

- U.S. bond yields continue to advance on Biden stimulus, vaccine rollout

Upcoming Potential Catalysts on the Economic Calendar:

- German, French, U.K. and Canadian banks closed for holidays

- U.S. non-farm payrolls report at 1:30 pm GMT

- FOMC member Bostic’s speech at 4:00 pm GMT

What to Watch: USD/CHF

Uncle Sam’s employment report will be the main event in the New York trading session, and the low liquidity environment could mean more volatile action!

Can the actual figures beat expectations and spur a dollar rally?

Analysts are expecting to see an even stronger increase in hiring at 652K in March versus the earlier 379K gain, which might be enough to bring the unemployment rate down from 6.2% to 6.0%.Leading jobs indicators are giving mixed signals, as the ADP figure came short of consensus while the Challenger job cuts report printed a sharp 86.2% drop in layoffs.

Technical indicators, however, are suggesting that support levels are likely to hold.

For one, the 100 SMA is safely above the 200 SMA, which happens to coincide with the 38.2% Fib to add to its strength as a floor. Stochastic is not just on the move up to show a pickup in buying pressure but has also formed a bullish divergence.

A downbeat NFP reading might take USD/CHF to the lower support levels marked by the 50% and 61.8% Fibs, but dollar bulls might simply take these as opportunities to buy at cheaper prices. After all, it looks like the scrilla is in for a strong finish as U.S. bond yields are climbing steadily.

Hot

No comment on record. Start new comment.