The top factor for FX is still the US recovery budget of $1.9 trillion

Outlook

We get the December trade balance today, but payrolls is the usual trigger for FX action. Note that Canada also reports jobs data today.

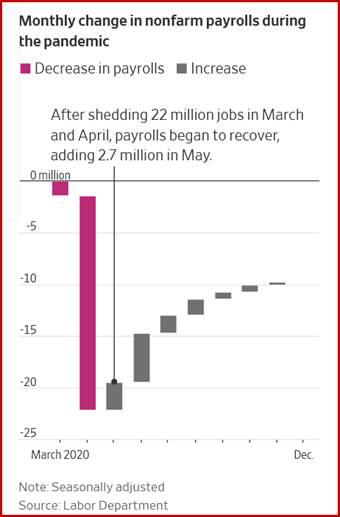

January payrolls today is expected to show a gain of 50,000 jobs, repairing the drop in December and pointing the way to the pace of recovery. Jobs lost number 22 million, of which a little more than half or 12.3 million have been recovered.

Putting so much weight on this one data point is not rational; for one thing, it’s seasonally adjusted according to past experience but we are in a unique one-time set of conditions now and nobody knows if seasonal adjustments are appropriate. For another, in such a vast economy, it’s bad data in the first place and always needs revision, and even then is not reliable because the gray economy of unreported jobs is also very, very big. For all we know, unreported jobs could number as much as 50,000, or the same as the reported jobs.

Then there are the special one-time situations where jobs remain lost and will remain lost for many more months solely because of the pandemic, like restaurants and bars as well as travel and tourism, not to mention schools. The press remains full of stories about how some of these businesses will never come back. Well, we won’t know until herd immunity arrives but the new must expect a surge in job recoveries.

The payrolls chart from the WSJ shows job growth decelerating. If the January payrolls is weak, as expected, one could draw the inference that bending this curve can continue to the downside. In other words, a pessimistic outlook for the economy leading to a sell-off in equities and other financial market consequences. Since what we want to deduce from payrolls is actually consumer spending, maybe it gets offset by the $1400 checks and other recovery measures, or perhaps someone will devise a hypothetical chart showing job growth once herd immunity reaches a threshold of 30%, then 50%, then 70%.

There is also a possibility of payrolls coming in much higher than the 50,000 now forecast, despite a seasonal bent to fewer in the Jan month.

Bottom line: payrolls is one of the least forecastable of all the indicators and doesn’t deserve its place at the top of the market movers. Volatility is always extra-high on payrolls day and often delivers gaps and fat corrections in the first few hours. To make matters worse, payrolls is reported on a Friday, the very day some traders prefer to close out position lest the weekend bring a market-moving surprise. The act of closing or paring positions can look like a counter-trend correction or reversal and mislead as to sentiment. These are all entirely valid reasons why conservative traders just stay out of the market on payrolls day and think “trading the news” is just reckless.

We don’t always have a good explanation for FX market developments. Case in point: yesterday the first FT report on the BoE had it that the policy committee planned to study negative rates—not implement, but get ready just in case. After a dip, sterling rallied. This was the “correct” response in terms of the actual content of the BoE message, but runs contrary to how the market often acts—sell first, ask questions later. We have another one today, perhaps—German factory orders down by almost double the forecast. But the euro didn’t move an inch on the release, likely because in context, Germany has already recovered from the spring shock and besides, is steady on the global competitiveness comparison.

For today and going into next week, the top factor for FX is still the US recovery budget of $1.9 trillion. It’s by far the biggest number in the world economy today and dwarfs whatever payrolls may be. What happens if the payrolls number is a big gain, like 100,000? The dollar goes up on economic optimism despite those guys trying to pare longs. The other Really Big Number is the coming herd immunity in the UK, which seems to offset the Brexit problems like UK financial institutions still out in the cold and having to eat Stilton instead of Roquefort.

Finally, consider the charts. Chart readers keep seeing tops and bottoms—as in gold--based on various lines and indicators. But we are in a changing world; we have even seen a big bank forecast the rise in emerging markets about to stumble because their equity indices are already at the level forecast long ago, so no more is possible. Really? As Larry Williams says, it’s okay to buy at highs and sell higher. We never really do know when a high or low is in; we know only when it’s broken for good, i.e., afterwards. Right now nobody understands why the dollar is defying recent conventional wisdom—sell it when risk-on returns. Well, we have risk on, or a drop in risk aversion, and still the dollar gains. The only profitable way to respond is to go with the flow.

Politics: The House voted to strip conspiracy theorist and racist/anti-Semite Rep. Greene of her committee seat, which removes her from any real influence. It’s an empty victory because the Republicans standing with her are implicitly agreeing that her white supremacist orientation and threats of violence against the speaker and other members is okay. Only 11 Republicans voted her off the committee while 199 think she is okay. Party loyalty won and decency lost.

Separately, a company that makes voting machines (Dominion) is suing Trump lawyer Giuliani and co-counsel Powell for $1.3 billion for defamation; he had falsely claimed the machines could be rigged and had been rigged, even after being warned off in December. Yesterday another voting machine maker jumped on board with a $2.7 billion lawsuit against everybody at the Fox network except one guy, also accusing Giuliani, lawyer Powell and three TV hosts of intentionally lying about Smartmatic in an effort to mislead the public. This is going to be fun.

Meanwhile, Trump declined to be questioned in person at the Senate impeachment trial that starts next week, probably passing up the chance to get back in the spotlight because lying to Congress is a crime. Critics are now bemoaning that they are missing the chance to ask him “Do you admit that you lost the election to Biden?”

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.