Monthly Executive Briefing: Short-Term Headwind, Long-Term Tailwind

Key points

- Short-term headwinds strengthen as COVID infections stay high

- The beginning of the vaccine roll-out provides brighter prospects for the future

- We see pent-up demand in the household sector where savings rates are still elevated

- Downside risk factors have come down following the UK-EU Brexit deal and lower risk of new US-China trade war with the election of Biden

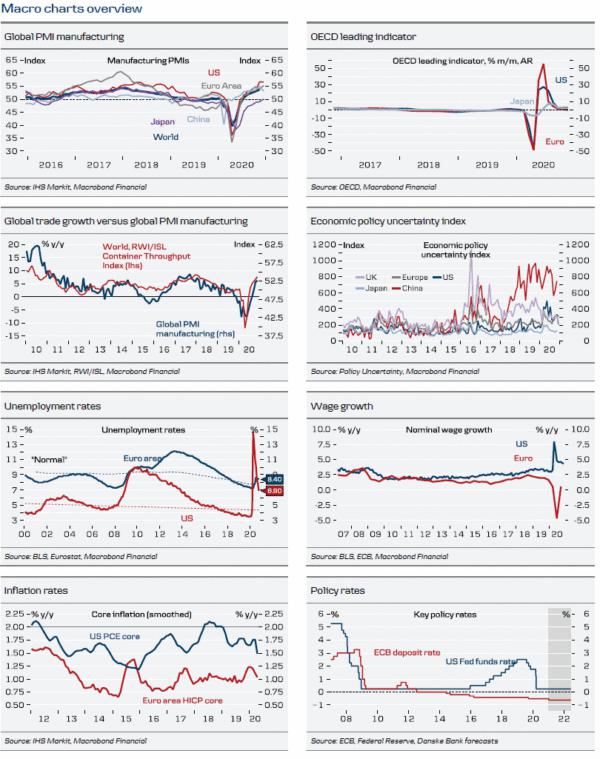

COVID-19 developments continue to be the main driver of the global economy. New restrictions following the surge in infections in Q4 have dealt a blow to the service sector in the US and Europe, but the manufacturing sector has continued to recover rather briskly, partly due to a strong rebound in China. A positive development in vaccines has also lifted medium- to long-term expectations for growth and underpinned equity markets, which generally look 6-12 months ahead

The short-term picture on COVID-19 is still dire and we expect restrictions to be with us for most of Q1. An increase in social gatherings in December over Christmas and New Year has pushed the R rate above one again, but as social gatherings typically decline significantly in January, this should help to push R back below one. A new obstacle to controlling the virus spread has shown up, though, in the form of a more contagious variant of the virus which appears to have originated in the UK. On the positive side, the vaccination process has started and the most vulnerable groups are expected to have been vaccinated by the end of Q1 or early Q2. This should help reduce mortality and hospitalisation significantly. In addition, warmer weather will help to reduce contagion. We thus expect the removal of the majority of restrictions by Easter in early April, with immunity being adequately achieved by the time colder weather comes back in the autumn.

With savings rates quite high in both the US and Europe, we expect pent-up demand in household spending to come through in H2 – especially in services. We also look for business investments to recover further. Chinese activity is expected to move down a gear in 2021 and be less of a booster to global growth but it will also be less needed for the global economy. On the stimulus front, the US Congress agreed on a fiscal package of around USD1trn in support to the US economy in H1. In December, the ECB recalibrated and extended its stimulus measures to provide economic support for longer.

The number of risk factors have also come down over the past months. The UK and EU finally agreed on a last-minute Brexit deal and the election of Joe Biden as US president has removed the risk of a new US-China trade war. Hence, once the vaccine has been rolled out, the sky should be getting brighter for the global economy.

In late December, the EU and China reached a deal on the Comprehensive Agreement on Investment, which has been negotiated since 2014. It opens the way to more investments in new sectors in China and raises protection of technology and intellectual property rights. This will bring more opportunities for European companies.

We continue to be positive on equities over the coming year, despite some valuation measures pointing to expensive markets. The positive outlook for the global economy, central bank rates near zero or negative for the foreseeable future and a decline in global risk factors all point to a benign environment for risk assets. It is actually the kind of environment that could feed asset price bubbles. While inflation is expected to increase, it is unlikely to lead to a removal of monetary accommodation this year. Only China has signalled an exit this year but it is also further on in the cycle and has a stronger focus on financial risks due to high debt levels

Reprinted from ActionForex,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.