USD Gets Support On New Year’s Eve

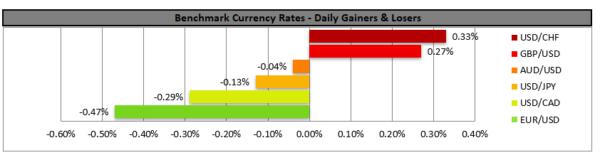

The USD tended to regain some ground on New Year’s Eve and US stocks were at record highs, yet during today’s Asian session the USD opened with a negative gap against a number of its counterparts. Expectations for a rebound in global trade in conjunction with low U.S. interest rates by the Fed, a very high U.S. budget and trade deficit could drive other currencies higher given the boost of prices in commodities and set the greenback on a downward course that seems to have accelerated somewhat. Should the risk on mood of the market continue we could see the USD slipping further as it may continue to experience safe haven outflows. EUR/USD dropped on Thursday aiming for the 1.2215 (S1) support line, yet during today’s Asian session the pair reversed course. We tend to maintain a bias for a sideways motion given also that he RSI reading below our 4-hour chart is at the reading of 50, implying a rather indecisive market, yet the bulls may be just around the corner should the risk on mood of the market continue. If EUR/USD finds fresh buying orders along its path, we could see it breaking the 1.2285 (R1) line and aim for the 1.2340 (R2) level. If a selling interest is displayed, we could see EUR/USD, the 1.2215 (S1) line and start aiming for the 1.2155 (S2) level.

Gold is on the rise due to the weak greenback

Gold’s prices started the new year with a jump, by rising to a new high since the start of November and breaking above the key $1,900 level during today’s Asian session, as a weakening USD and a surge in COVID-19 infections and the possibility of stricter coronavirus lockdown measure boosted the precious metal. Some sense of return to normality, especially after the rollout of vaccines is expected to be in the second half of the year, which may imply that uncertainty is to remain at high levels and monetary policy continue to be loose, which may polish the shiny metal further. The next two fundamental events which we note are Georgia’s runoff elections on Tuesday and the release of the Fed’s meeting minutes on Wednesday.

XAU/USD steepened its ascent during todays’ Asian session, aiming for the 1930 (R1) resistance line. We tend to maintain a bullish outlook for the precious metal as the upward movement incepted since the end of November seems to find new dynamics, after a pause mid-December. On the flip side though we would highlight the fact that the RSI indicator below our 4-hour chart has reached the reading of 70, which confirms the bull’s dominance, yet at the same time may be implying that gold’s long position is getting rather overcrowded and some traders may be tempted to book some profits. Should the bulls maintain the momentum, we could see the precious metal breaking the 1930 (R1) line and aim for the 1965 (R2) level. Should the bears be in charge, gold’s prices could break the 1907 (S1) line and aim for the 1877 (S2) level.

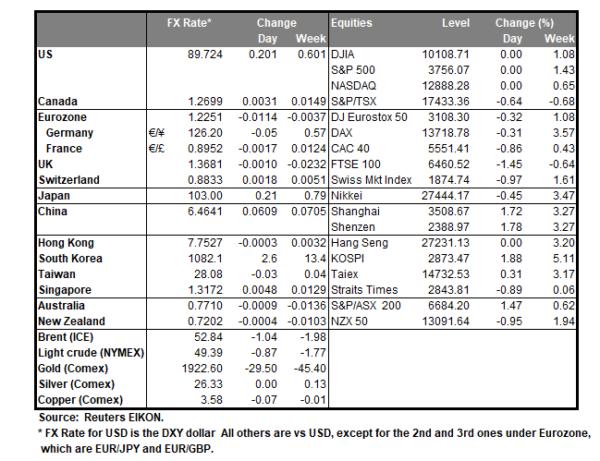

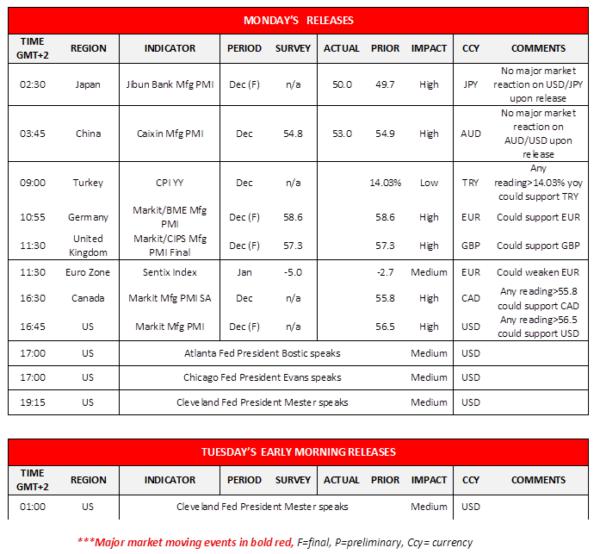

Other economic highlights today and early Tuesday:

Today during the European session, we note Turkey’s CPI rates for December, December’s final manufacturing Markit PMIs for Germany, the UK, the US and Canada as well as Eurozone’s forward looking Sentix index for January. As for speakers please note that Atlanta Fed President Bostic, Chicago Fed President Evans and Cleveland Fed President Mester are scheduled to speak.

As for the rest of the week

On Tuesday, we note the US ISM manufacturing PMI for December. On Wednesday, we get France’s and Germany’s preliminary CPI rates for December, Eurozone’s and UK’s final Services and Composite PMI’s for December and the US factory orders for November. On Thursday, we get from Australia the building approvals and trade balance for November, Germany’s industrial orders for November, Eurozone’s preliminary CPI Rates for November, the US weekly initial jobless claims figure, Canada’s trade balance for November and the US ISM services PMI for December On Friday, we note Germany’s industrial output for November, UK’s Halifax house prices for December, the US Employment report for December and Canada’s employment data for the same month.

EUR/USD H4 Chart

Support: 1.2215 (S1), 1.2155 (S2), 1.2100 (S3)

Resistance: 1.2215 (R1), 1.2285 (R2), 1.2340 (R3)

XAU/USD H4 Chart

Support: 1907 (S1), 1877 (S2), 1850 (S3))

Resistance: 1930 (R1), 1965 (R2), 1992 (R3)

Reprinted from ActionForex,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.