Technical analysis: EUR/CHF remains optimistic although advances hit a snag

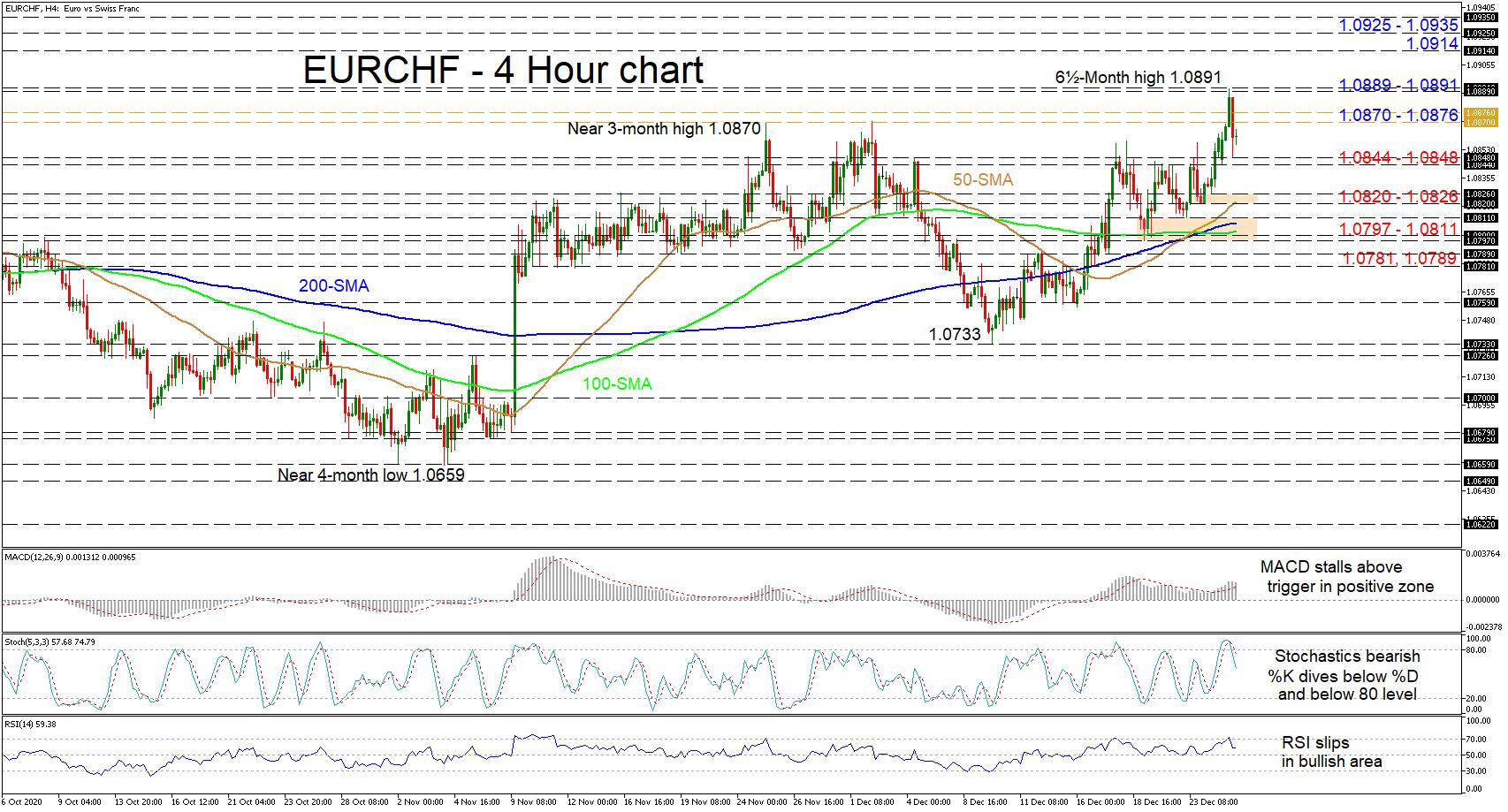

EUR/CHF is retreating from a fresh 6½-month peak of 1.0891, although continuing to retain a somewhat bullish tone. The pair appears to have logged a false break above the 1.0870-1.0876 resistance ceiling, soaring to a new high marginally above the 1.0889 barrier from June 8. The flattening 100-period simple moving average (SMA) is sponsoring the neutral-to-bullish demeanour in the price, while the rising 50- and 200-period SMAs are backing further positive price action.

However, the short-term oscillators are currently reflecting that positive momentum is fading. The MACD, some distance above zero, is weakening above its red trigger line, while the RSI is falling in bullish territory. Moreover, the stochastic oscillator is bearish, promoting a deeper pullback in the pair.

To the upside, early hindrance may originate from the 1.0870-1.0876 zone before the bulls head towards the 1.0889-1.0891 resistance roof. Decisively overcoming this boundary, the price may aim for the 1.0914 high from June 5. Should further gains unfold, the pair may then challenge the 1.0925-1.0935 resistance section from December 2019.

Alternatively, if the price recedes, initial support may arise from the 1.0844-1.0848 area. Diving beneath this may send the pair towards another support region of 1.0820-1.0826 that also encompasses the 50-period SMA. If selling interest persists and manages to sink past the critical section of 1.0797-1.0811, which contains the 100- and 200-period SMAs, the bears may even correct the price towards the respective 1.0789 and 1.0781 lows.

Summarizing, EUR/CHF maintains a short-term positive tone above its SMAs and the 1.0797 level. Nonetheless, a retracement below 1.0844-1.0848 or a rally above 1.0889-1.0891 may signal the next direction.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.