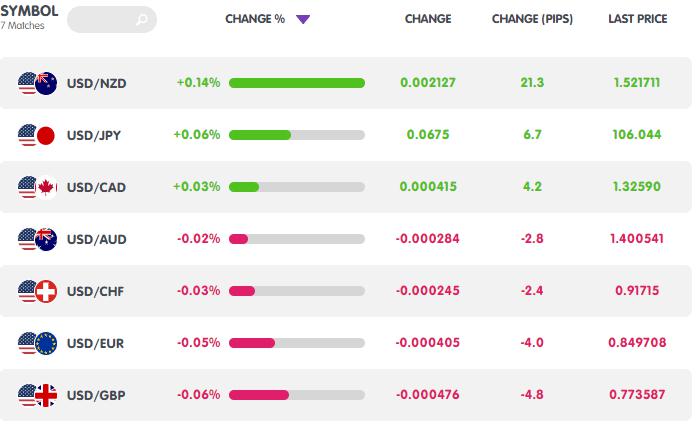

A lack of major catalysts kept the major currencies confined in tight ranges during the Asian session.

Central bankers will be under the spotlight in the next few hours as officials from the BOE, SNB, and BOC make speeches while the ECB publishes its latest minutes.

I’m looking at EUR/NZD for potential trade opportunities. Before I show you the setup, though, you might want to look at the top headlines during the Asian session:

- FOMC minutes: officials fear lack of stimulus will stifle the US economic recovery

- Fed could boost bond buys, but won’t for now, policymakers say

- Fed’s Williams says moderate inflation overshoot acts as ‘guard rail’

- ECB’s Lagarde pledges no premature removal of monetary aid

- Kiwi falls as central bank reinforces negative rate expectations

- RBNZ hints at its Funding for Lending Programme having few conditions and not necessarily needing to be implemented with a negative OCR

- U.K. house sales activity predicted to be lower in 12 months – surveyors

- No hints of new stimulus from BOJ’s Kuroda

- NZ: ANZ’s business outlook continues solid improvement across the board

- Japan posts $19.8B current account surplus in August

- Asian shares at one-month highs on renewed U.S. stimulus hopes

Upcoming Potential Catalysts on the Economic Calendar:

- Switzerland’s unemployment rate at 5:45 am GMT

- Germany’s trade balance at 6:00 am GMT

- BOE Governor Bailey to participate in a panel discussion at 7:25 am GMT

- BOE’s FPC meeting minutes at 8:30 am GMT

- SNB Governor Jordan to make a speech at 9:30 am GMT

- ECB’s meeting minutes at 11:30 am GMT

- BOC Governor Macklem to give a speech at 12:30 pm GMT

- U.S. initial jobless claims at 12:30 pm GMT

What to Watch: EUR/NZD

Earlier today, traders priced in the Reserve Bank of New Zealand (RBNZ) considering negative interest rates more seriously than markets had expected. Details point to the RBNZ using its funding scheme to achieve the effects of a negative interest rate instead but the headline stuck and had already weighed on the New Zealand dollar.

Euro bears can take advantage of the current bearish momentum and a low key 1-hour bearish divergence and then just take profits at the first signs of a support level or bullish pressure.

If today’s ECB meeting minutes or other central bank events lead to more demand for the euro than the Kiwi, however, then you might want to consider jumping on a short-term bullish momentum and target today’s highs near 1.7950 instead.

Whichever bias you’re trading, keep in mind that EUR/NZD tends to move by 109 pips on Thursdays so adjust your entry and stop loss levels to make sure you don’t get stopped out on a volatility spike.

Hot

-THE END-