US Second Quarter GDP Preview: Are there any shocks left?

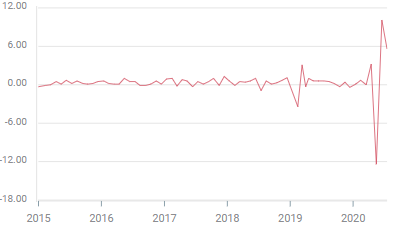

- Second quarter GDP forecast to contract 34.1% annualized.

- Atlanta Fed GDPNow estimate for Q2 is -34.3%.

- Retail sales and durable goods are higher in Q2, industrial production lower.

- The economy contracted 5% annualized in the first quarter.

- Dollar has factored in the GDP result and the likely Fed defensive lower rates.

In a year of superlatives the US economy seems destined to set one more as annualized second quarter GDP is expected to drop by the largest amount in a century of records.

The widest measure of economic activity is forecast to drop 34.1% in the second quarter with range of consensus estimates in the Reuters survey running from -22.6% to 40.0%. The Atlanta Fed GDPNow model predicted a 34.3% decrease on July 17 with one more update to its estimate on July 29 before the Bureau of Economic Analysis release on July 30.

Shutting down the US economy in March and April as a response to the Covid pandemic has precipitated the most severe contraction in US GDP since the Depression of the 1930s and even that worldwide debacle took far longer to reach the same depths of unemployment and economic decline.

Retail sales and durable goods

As unlikely as it may be considering the dire predictions for second quarter, the retail sales control group which provides the consumption component of GDP, gained an average of 1% a month in the last quarter. The 12.4% plunge in April was more than made good by the 10.1% rise in May and a 5.4% increase in June.

Retail Sales

FXStreet

FXStreet

The same is true for its subset of durable goods. After plummeting 17.2% in April, purchases came roaring back 15.8% in May and 7.3% in June, for a monthly average of 2.43%.

Business spending was not nearly as resilient as managers wait to see if the returning sales volumes are sustained. From a decline of 5.8% in April, investment rose 1.6% in May and 3.3% in June for a monthly decline of 0.9%.

Industrial production

The output of US factories mines and utilities collapsed 12.4% in April, by a considerable amount the largest monthly drop in history. Recovery has been limited to 6.8% in May and June.

Unemployment and payrolls

The unprecedented loss of 22.16 million jobs in March and April as the US economy was largely suspended by government order has been reduced by about a third in as 7.499 million workers were recalled in May and June. Unemployment insurance and other government relief programs have helped to keep consumption, which accounts for about 70% of US economic activity, from collapsing.

Non-farm payrolls

FXStreet

FXStreet

Nonetheless with initial jobless claims rising to 1.416 million in the latest week and having stalled at 1.3615 million the previous month, the improvement in the economy seems to have wilted.

Conclusion and the markets

To the equity markets second quarter GDP is old news. Prices have been buoyed by expectations for recovery in the third quarter and by the avalanche of liquidity the Federal Reserve and the government have larded on the economy.

There is the possibility that the expectation for a disastrous figure may be overstated. Economists missed the revival in jobs in May. Consensus estimates expected a loss of 8 million, in fact the economy rehired 2.699 million workers. A similar miss happened in June when companies employed 4.8 million instead of the 3 million forecast.

The issue is not that economists are natural pessimists, though economics is sometimes called the dismal science, but that there are no modeling parameters for analyzing these events. In such a situation projections and assumptions operate in a linear fashion, there is no term in the equation that can calculate the desire and willingness of individual and business to rebuild and restart their lives.

For the dollar a historic decline in GDP and further Fed actions are priced. In the last two weeks the euro has gained 3.3% versus the dollar, the yen has risen 2%. If the GDP figures are better than expected some profit taking might be in order.

.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.