Euro takes out barriers above 1.15 on EU summit outcome

Major trading ranges that have been holding for more than a year have got broken with USD weakness continuing across the board. The trigger seems to have been the compromise struck by the EU leaders on the EU recovery plan. Consensus on the recovery plan albeit after lengthy and intense discussions would convince the markets of solidarity amongst the EU member states. The final split agreed was EUR 390bn in grants and EUR 360bn in loans. Euro broke through the 1.1450 resistance zone and took out barriers above 1.15. EUR/USD traded its highest level since Jan 2019. AUD/USD too broke through the 0.7050 resistance and traded its highest level since April 2019.

The positive sentiment and the move lower in the USD have been accompanied by lower US yields and higher gold prices as well, which is a bit unusual of a typical risk on move. The ultra dovish forward guidance of the Fed and optimism around the size and composition of the second stimulus package to be announced in the US could explain that bit of correlation aberration. Gold is at its highest levels since Sept 2011.

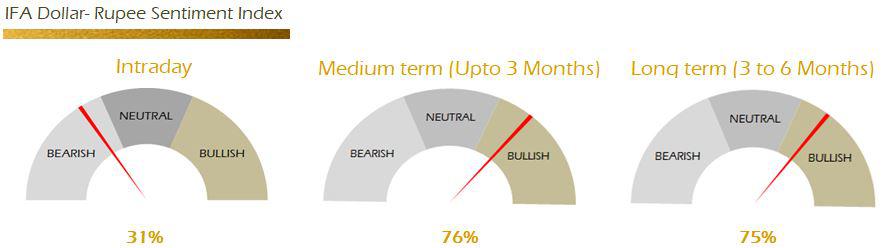

Equities too continue to rally globally on the back of upbeat risk sentiment. Nifty is up ~50% up from recent lows and about 10% away from all time highs. Nifty is likely to see resistance around 11250. USD/INR looks set to test the crucial 74.50 support today. In the backdrop of global USD weakness the RBI may allow the pair to drift lower. It may not be as aggressive in mopping up inflows. Likely range for today 74.35-74.75 with down side bias.

Strategy: Exporters were advised to cover at lower levels only cover through option strategy. Importers are advised to hold maintaining a stop loss of 75.00 or cover through risk reversal option strategy. The 3M range for USDINR is 73.60 - 76.50 and the 6M range is 73.00 – 77.00.

Download The Full Daily Currency Insight

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.