US Initial Jobless Claims Preview: Improvement stalls and worry returns

- Initial claims predicted to be unchanged at 1.3 million.

- Continuing claims expected to drop to 17.067 million from 17.338 million.

- Improvement in initial claims has stalled at more than 1 million a week.

- Dollar fades on US economic concerns, European stimulus.

The three month receding trend in unemployment claims has stalled in July as businesses continue to lay off workers in large numbers despite improvement in many areas of the US economy.

Initial jobless claims are expected to be 1.3 million in the July 17 week, unchanged from the prior week and little different than 1.31 million in the first seven days of the month. Continuing claims are forecast to edge lower to 17.067 million in the July 10 week from 17.338 million.

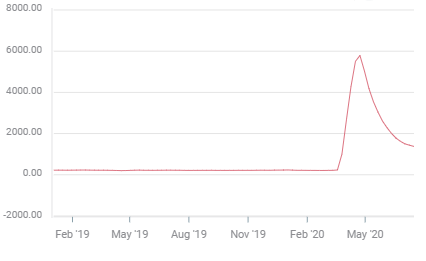

Non-farm payrolls and unemployment claims

Though the pace of rehiring in May and June has been much faster than originally anticipated, of the nearly 21 million workers fired in April 7.5 million, 36%, have returned to their jobs, the unemployment rate last month was still 11.1%, higher than the 10% peak of the financial crisis recession.

More concerning the decline in unemployment claims which has taken the four-week moving average down almost 50% from 2.609 million in the May 22 week to 1.435 million on July 3, improved to just 1.375 million the following week and is expected to be unchanged on July 17.

Initial jobless claims, 4 week moving average

FXStreet

FXStreet

Consumption and consumer confidence

Consumption has rebounded sharply with retail sales rising 25.7% in May and June more than the 22.9% they lost in March and April. These sales reflect both deferred purchases and returning normal expenditures. But the ability of consumers to sustain spending depends on the continued improvement in employment.

Consumer confidence indexes reflect the uncertainty in the job market and the impact on the economy of the rising number of Covid positive tests that have prompted some states to partially roll back or delay their reopening plans.

For July the preliminary Michigan consumer sentiment index unexpectedly dropped to 73.2 from 78.1 in June, missing the 79 prediction by a wide margin. The Conference Board consumer confidence index for July is expected to slip to 96.3 from 98.1 in June when it is reported on July 28.

Conclusion, markets and the dollar

Equity markets have largely ignored the rising Covid incidence in Southern and Western states with the logic that fatalities remain low and the vast majority of facilities in the affected areas are operating within normal public health parameters, preferring to attend to the generally good second quarter earnings reports and further government economic support forthcoming in the EU and the United States.

The dollar has eroded substantially over the last two weeks as questions about the vitality of the US recovery have arisen.

The euro reached 1.1540 on Tuesday above its pandemic high of early March as the EU agreed on a 750 billion euro economic recovery package.

The USD/JPY dropped to 106.68 in the lowest part of its 106.50 to 108.00 range of the past six weeks, though it is far from the panic low of 101.18 from March 9.

After several months of improvement the recent hesitation in initial claims underlines uncertain state of the US economy. With vast amounts of stimulus and economic support already deployed in the US the dollar needs the support of a positive result from that effort to regain its footing.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.