Signal | Annualized Return of 32% with a Profit of $3,290

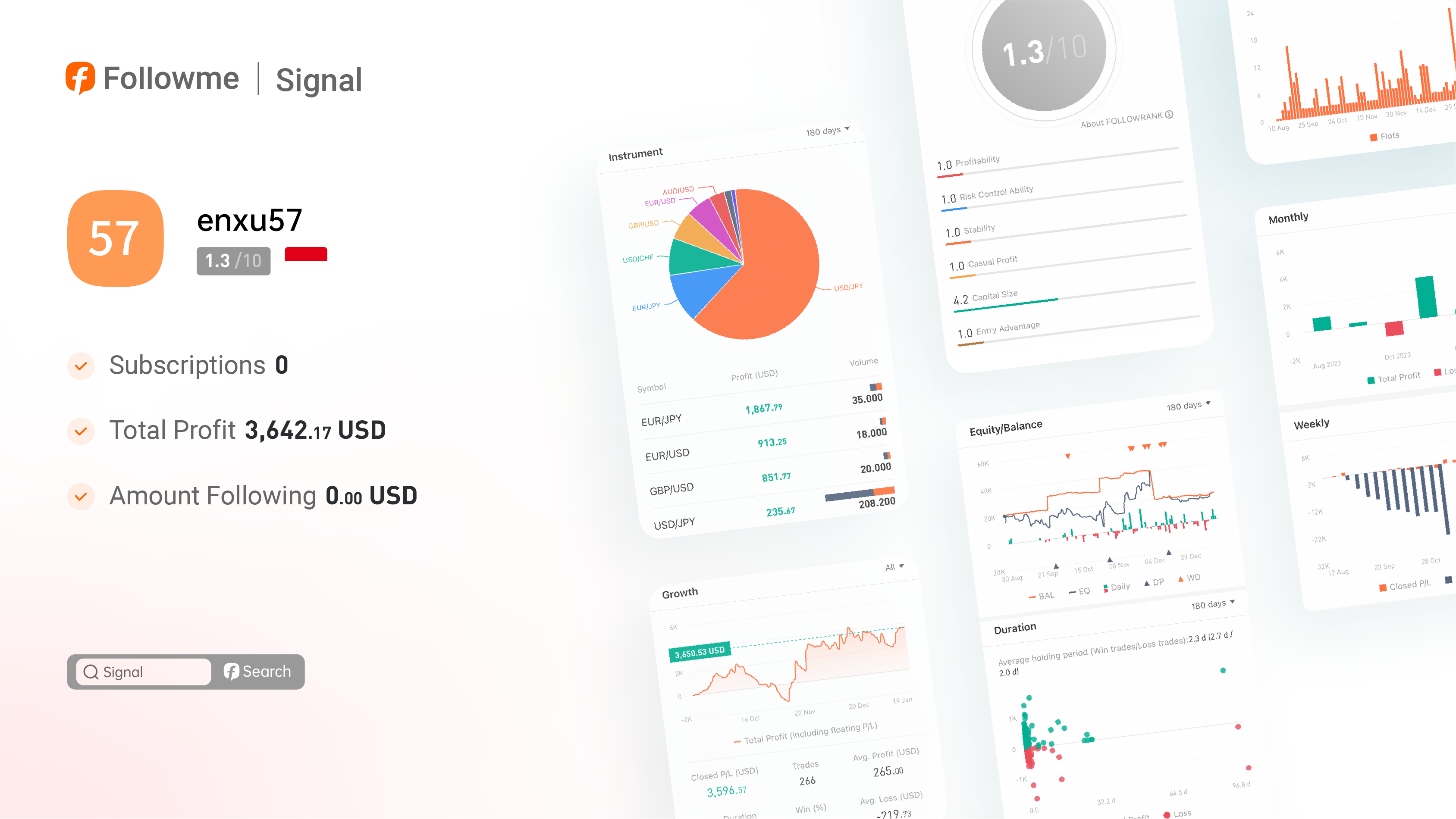

𝙉𝙞𝙘𝙠𝙣𝙖𝙢𝙚: @enxu57

𝙉𝙞𝙘𝙠𝙣𝙖𝙢𝙚: @enxu57

Country: Indonesia

𝘽𝙧𝙤𝙠𝙚𝙧: #DCFX #

𝘽𝙧𝙞𝙚𝙛 𝙘𝙤𝙢𝙢𝙚𝙣𝙩:

Just a week after New Year's Day, the community recorded a high volume of transactions, totaling 190,000, which reflects a 10% decrease compared to the previous month. The market was relatively inactive, and it is possible that pessimism influenced by inflationary factors played a role. However, it is important to note that professional traders prefer to avoid emotionally-driven trading. Interestingly, the most profitable account for followers that week was one that operated based on emotionless trading signal, represented by the username @enxu57.

Let's delve into the growth curve chart, where gains and losses alternate, with gains accumulating rapidly and losses occurring more gradually. Furthermore, let's consider the average profit of $273 and the average loss of $218, indicating a higher number of winning trades than losing ones. This particular account has been active for 22 weeks and, although it exhibits a relatively high drawdown and appears somewhat unstable as a signal, it demonstrates potential with an annualized return of 32%.

Why do I make this claim? The recorded data reveals a realized profit of $3,290 from closed positions, with over 250 trades executed, resulting in an average profit of approximately $13 per trade. Most positions were 1 lot, meaning an average profit of 13 points. From a quantitative standpoint (in an environment without manual intervention), this approach seems viable.

However, upon examining the periods of loss in FollowQuant, it becomes apparent that risk control is achieved through hedging during volatile phases, while in longer-term trends, the strategy relies on increasing positions to enhance profits. Consequently, significant gains as well as significant losses are likely to occur. The fact that the account remains in a floating loss for more than 90% of the time, with a maximum drawdown of 91.70%, provides substantial evidence in support of this observation.

If in 2024, @enxu57 can optimize trading timing and position density, there is no doubt that it will lead to an improvement in trading performance.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-