EUR/USD Records Lowest Daily Close Since July 12 Amid Economic Weakness in Eurozone

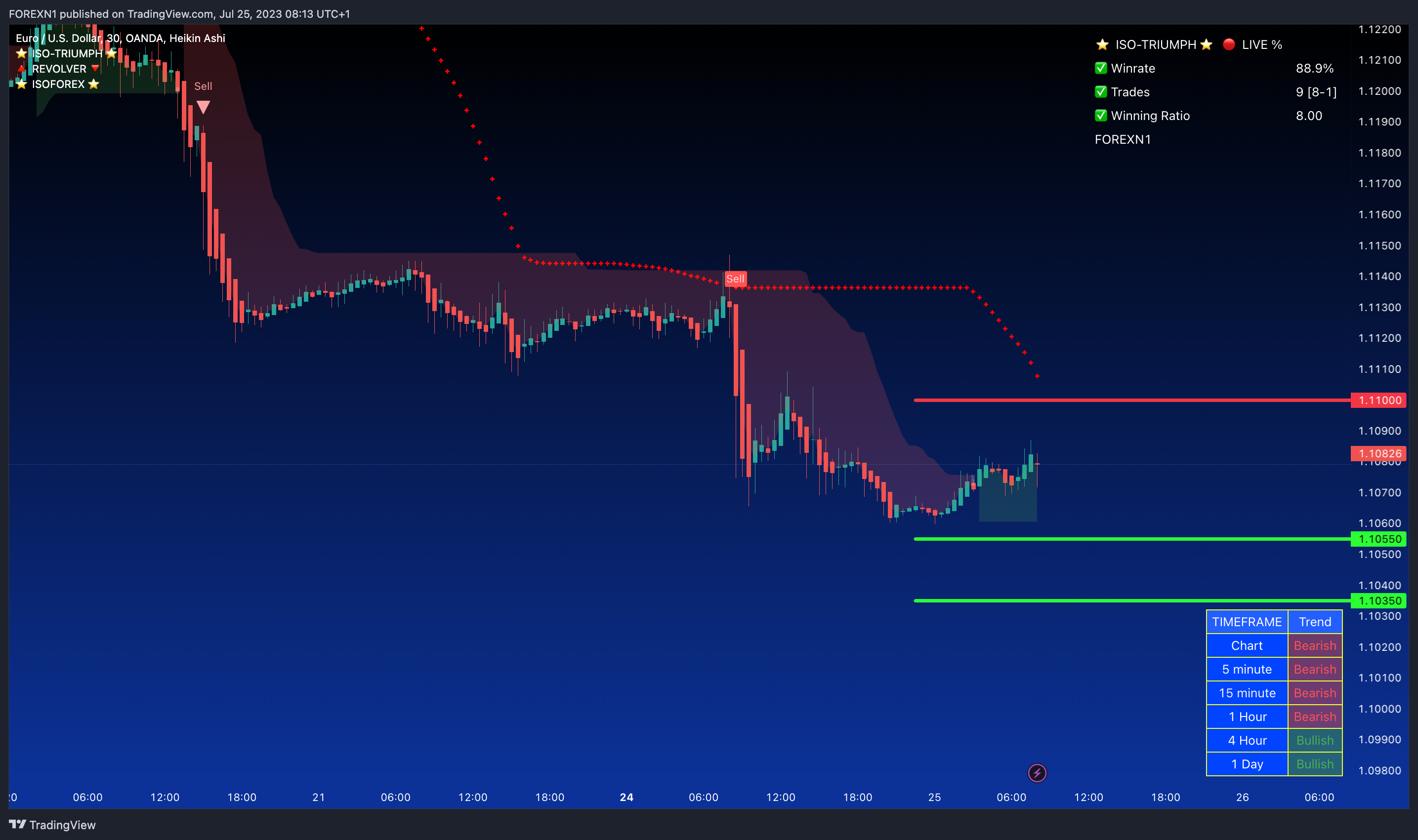

The EUR/USD pair faced another decline, marking its lowest daily close since July 12. Continuing its downward trend for the fifth consecutive day, the pair is undergoing a corrective phase after reaching its highest level in over a year, near 1.1300, earlier this month. The drop was primarily influenced by weaker-than-expected economic data from the Eurozone, leading market attention towards central banks' actions.

Eurozone's Purchasing Managers' Indexes (PMIs) fell below expectations, with the Manufacturing PMI dropping to 42.7 in June, while the Services PMI stood at 51.1. The Composite Index recorded a reading of 48.9, marking its lowest level since November. Both Germany and France experienced Composite Indexes below 50, signaling heightened risks of a recession. Despite these indications of economic weakness, the European Central Bank (ECB) is anticipated to raise interest rates by 25 basis points during its upcoming meeting on Thursday. Investors will closely analyze the messaging from the central bank for further insights.

On the other hand, US Treasury yields rose as market participants positioned themselves ahead of the Federal Reserve's decision. The Fed is expected to implement a 25 basis points rate hike on Wednesday. The central bank's communication will be of utmost importance, not only for the US Dollar but also for financial markets. The US PMI data presented mixed results, with the Services PMI declining from 54.4 to 52.4 in July, falling short of the anticipated 54. However, the Manufacturing PMI rebounded from 46.3 to 49, surpassing the market consensus of 46.4.

The strengthening US Dollar Index (DXY) has been pressuring the EUR/USD pair downwards. While the pair is expected to stabilize in anticipation of the Fed meeting, increased volatility is anticipated in the coming sessions. On Tuesday, the German IFO survey and US housing data are scheduled for release, adding further potential for market movement. #OPINIONLEADER#

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

If you like, reward to support.

Hot

No comment on record. Start new comment.