© 2026 Followme

Liked

China's investment crash raises credit risks for homebuilders, banks, government: Fitch

China's sharp investment downturn is amplifying credit risks across the economy, particularly homebuilders, real estate, banks and construction sectors, Fitch Ratings has warned, as a slowing economy crimps their growth and the ability to repay debt. Fixed-asset investment in China, or FAI, declined

Liked

Liked

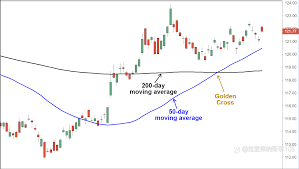

Moving Average Strategy in Forex: A Simple Trend-Following System That Works

#OPINIONLEADER# “Moving Averages help you trade with the trend, not against it. Learn the 50 & 200 Moving Average strategy used by professional Forex traders.” Introduction Many traders lose money because they fight the market. Moving Averages (MA) solve this problem by showing th

Liked

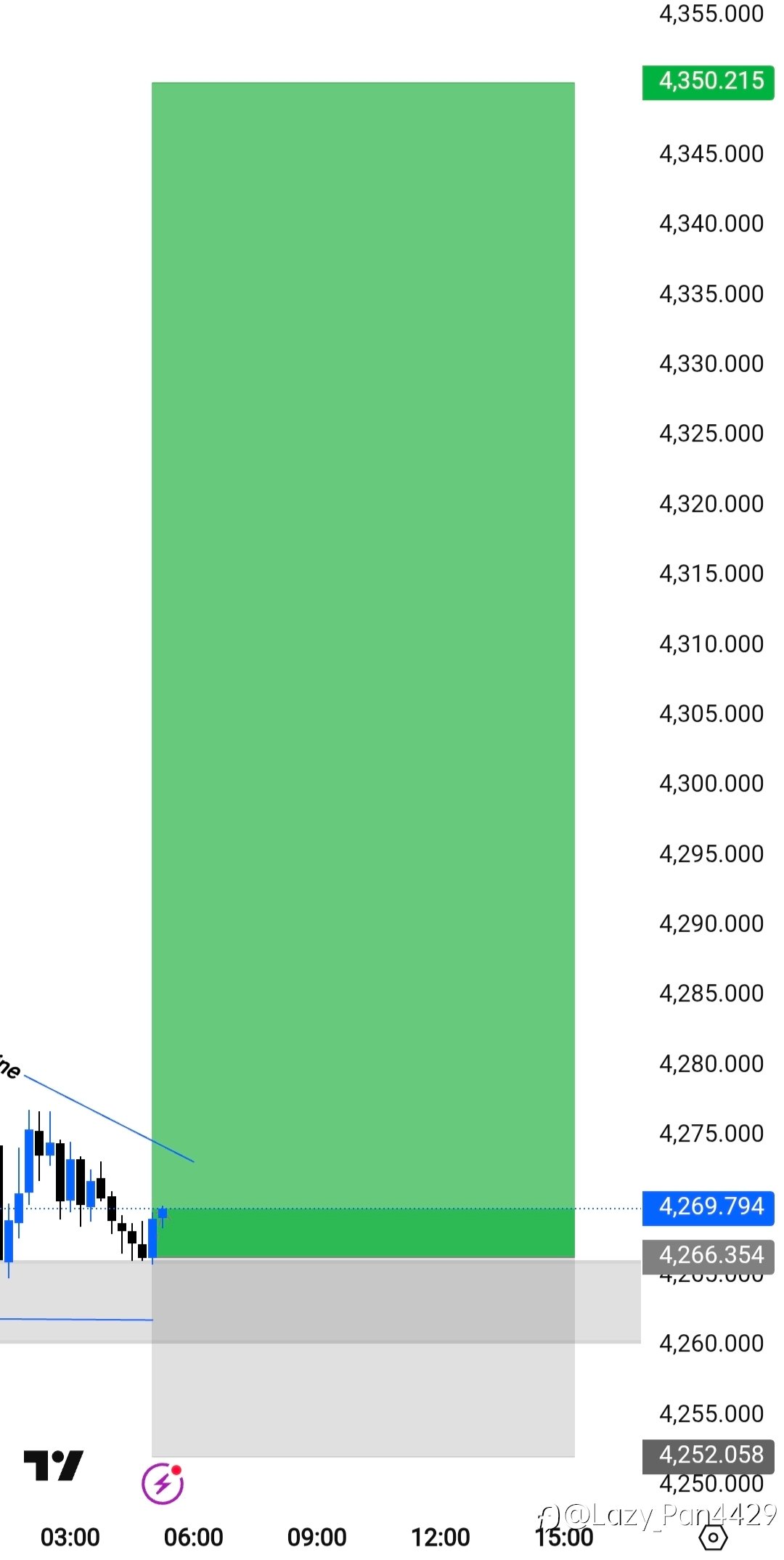

XAUUSD Accuracy Check 📊

Yesterday’s buy zone (4400–4420) played out perfectly. Gold dipped to 4407 and pushed up to 4479 — a solid 720+ pips move 📈 Clear levels, patient execution, and disciplined planning made the difference. Chart shared for transparency. 💬 Always open to DMs for market discussion.

Liked

Liked

Liked

Liked

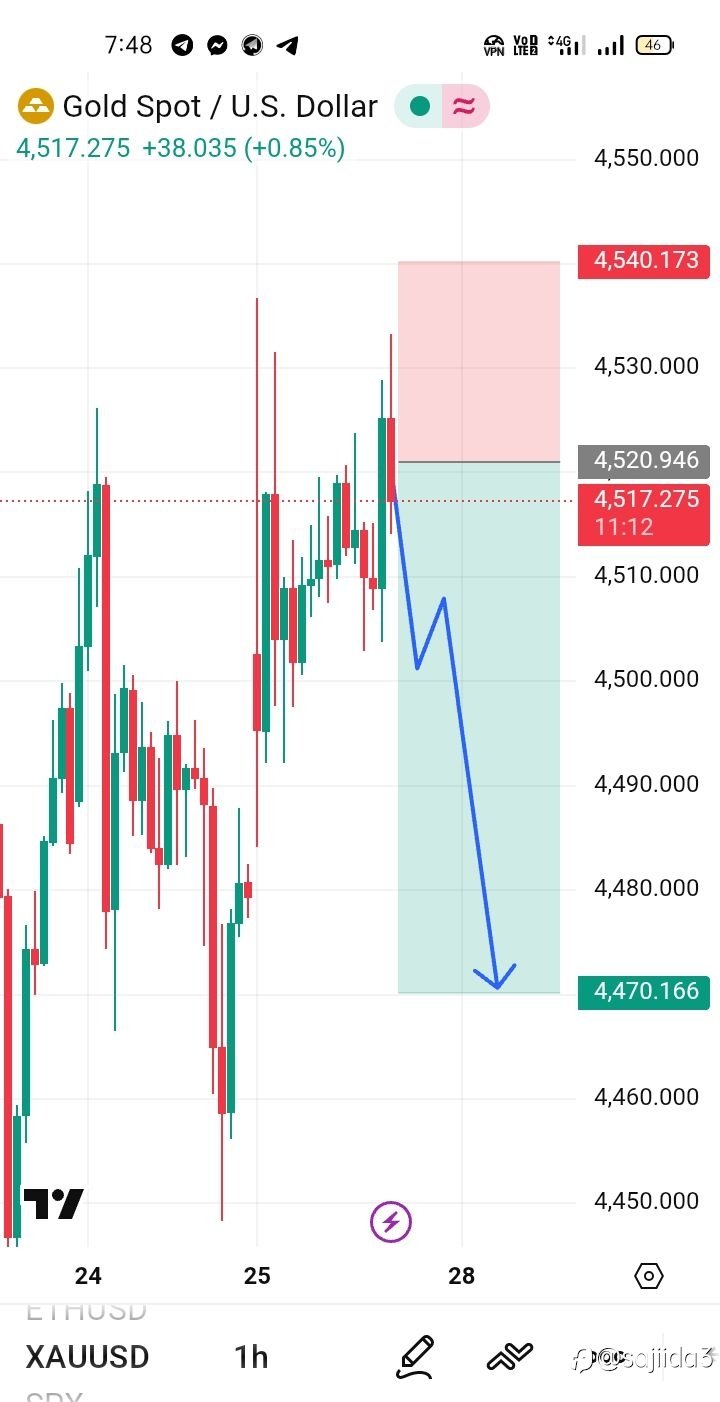

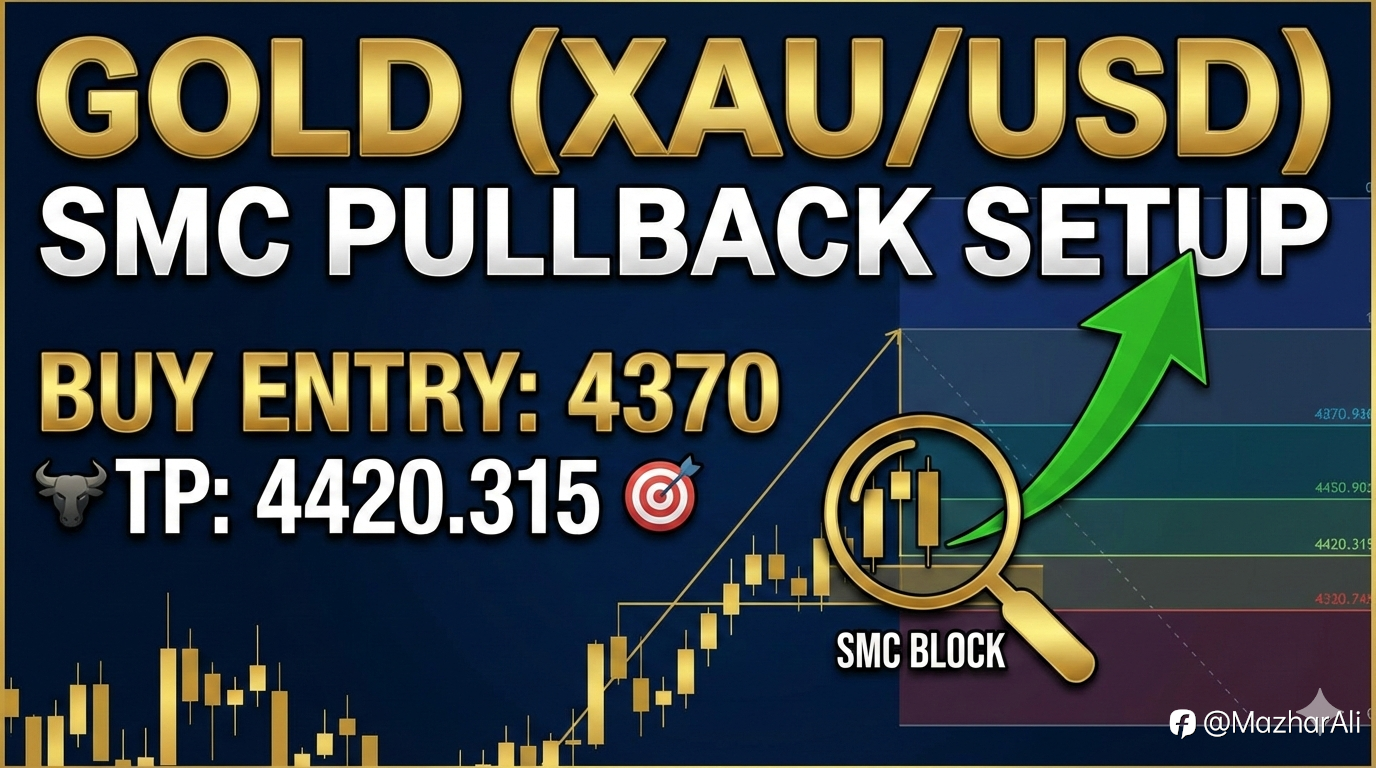

GOLD (XAU/USD) SMC Pullback Setup

Trade Analysis: Type: BUY (Long) Symbol: GOLD (Spot or Futures) 1. Trade Idea Summary · Entry (BUY): 4370 · Take Profit (TP): 4420.315 · Stop Loss (SL): Placed below the low of the triggering candle on M5-M1 after confirmation. · Concept: SMC (Single Candle Stick Block) – Price is expec

Liked

2026 Forex Industry Outlook: Compliance + Technology as Dual Drivers

In 2026, the forex industry will be shaped by stricter compliance regulations, AI-driven smart trading, and the widespread adoption of stablecoins and cross-border payment tools. Major global events such as iFX EXPO Dubai (Feb 10–12), TradeTech FX Miami (Feb 9–11), and Vision Forex Forum Cyprus (Mar

Liked

Trust these numbers? Economists see a lot of flaws in delayed CPI report showing downward inflation

Thursday saw the release of a much lighter-than-expected consumer price report for November, breaking from the recent trend of sticky inflation. Stocks jumped. Yields fell. Odds of a Federal Reserve rate increased. And many economists scratched their heads. The Bureau of Labor Statistics reported th

Liked

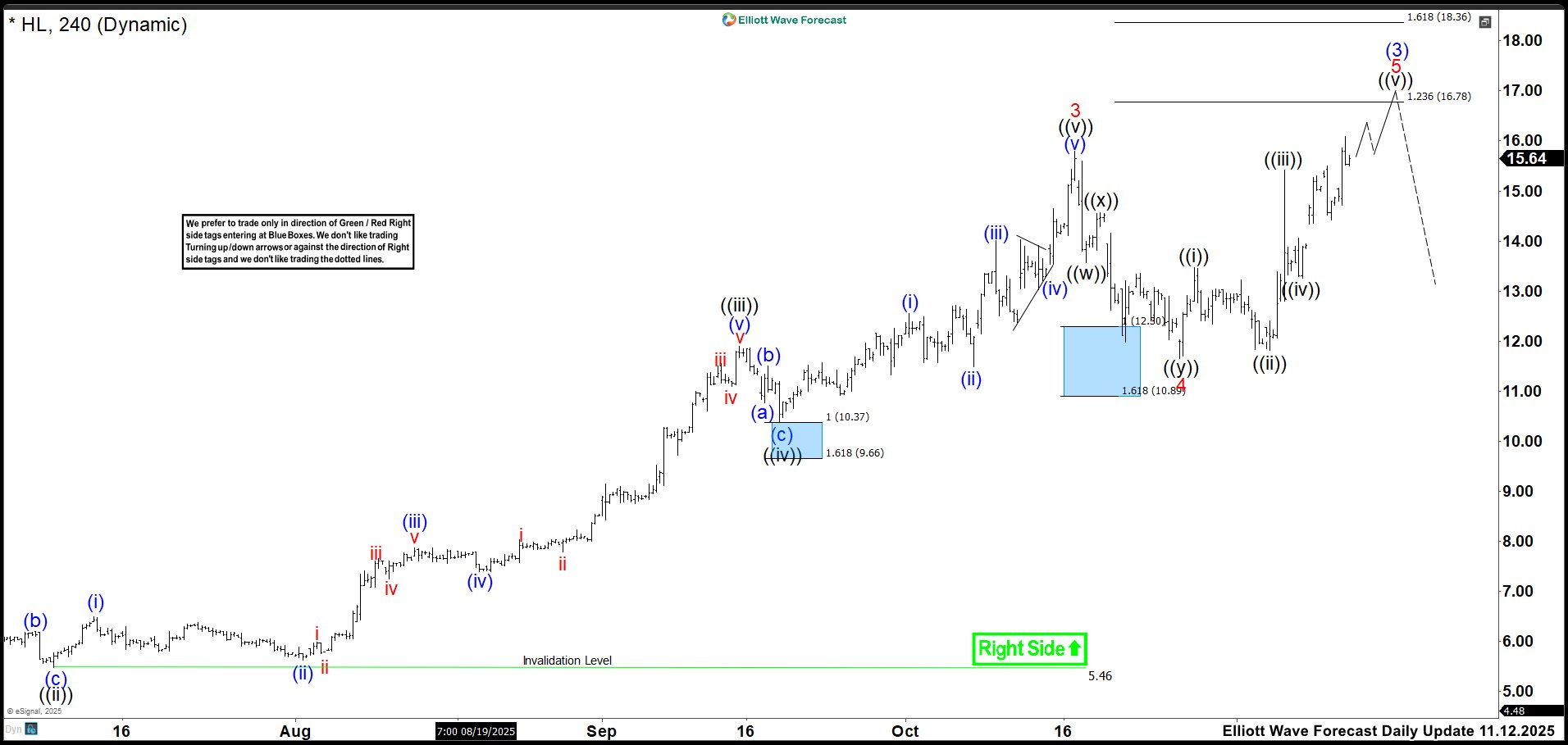

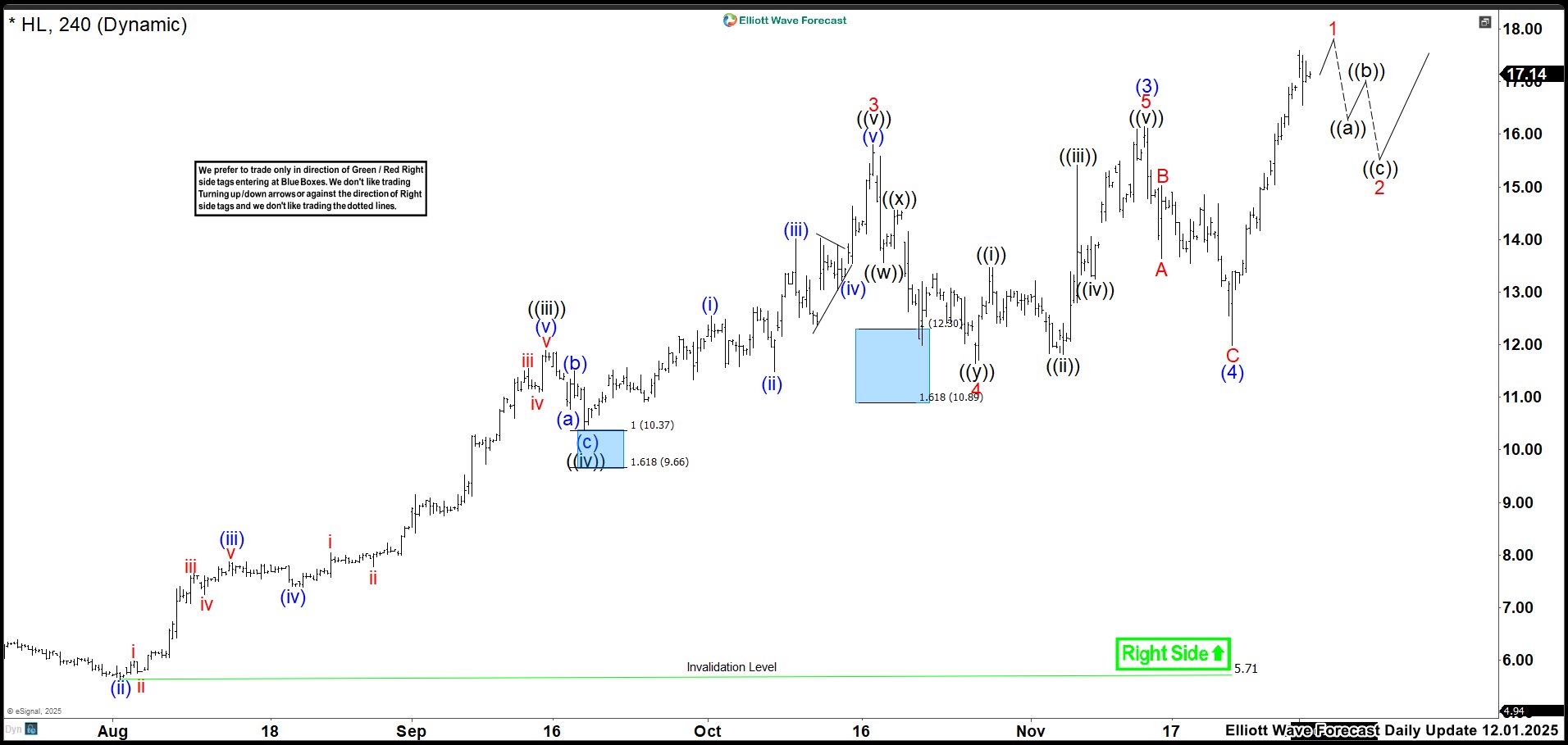

Surfing the Market Waves: How the Blue Box Shapes Hecla Mining (HL)

Hecla Mining (HL) has shown strong revenue growth in 2025, climbing to $1.33 billion, up 43% year-over-year, while earnings per share surged to $0.38 from $0.06. This performance highlights the company’s ability to capitalize on favorable silver and gold prices, as well as operational improvements a

Liked

Liked