The USD could peak in advance?

Since the beginning of this year, the Federal Reserve has raised interest rates sharply to combat inflation that has been at a high level in more than 40 years, and the USD index has soared, with a cumulative increase of more than 10% this year. At present, the expectation that the Fed will continue to raise interest rates sharply remains high, and the momentum for further upside for the USD is still strong.

However, top investment bank Goldman Sachs said in a latest report that the USD is likely to peak ahead of the Fed's easing. It might make sense to consider the mid-1970s and mid-1980s, when inflation was equally high. These similarities suggest that it may not be necessary to see the Fed have eased significantly or inflation has bottomed out for the USD to peak.

The report also pointed out that once it is clear that U.S. interest rate hikes may be close to a pause, or if the Federal Reserve’s voice about a policy shift is credible, even if U.S. economic activity is still slowing, it may peak early.

Previously, Goldman Sachs had pointed out that the USD's all-time highs coincided with bottoming in U.S. and global economic growth and easing by the Federal Reserve. So, Goldman Sachs said at the time that it indicated that the current peak in the USD was far from happening, as the bank did not expect the Fed to start cutting rates until 2024.

But in this week's report, Goldman Sachs changed that view, and sometime in the first half of 2023, we may see these factors come together: We may be through the worst of the winter recession in Europe, Japan The central bank's new leadership may gradually begin to tighten policy, at the same time as U.S. interest rates have finally peaked and U.S. inflation and labor markets have moderated. But we haven't done that yet.

In fact, just the day after Goldman Sachs issued the report, San Francisco Fed President Daly hinted that it was time to start talking about slowing the pace of interest rate hikes. Daly's remarks reversed a sharp rise in 10-year U.S. Treasury yields, while the USD began to weaken against a basket of currencies including the euro, yen and pound.

Goldman Sachs expects the USD to peak as soon as next year, rather than 2024, as other historical examples suggest. Sometime in the first half of 2023, we may see these factors come together.

“We may be through the worst of the European winter recession, the new leadership of the Bank of Japan may start to tighten policy gradually, and at the same time, U.S. interest rates finally peak and U.S. inflation and labor markets moderate. But we It hasn't reached that stage yet."

Will this be the case?

However, will this really be the case? Industry insiders pointed out that in the face of the substantial interest rate hike by the Federal Reserve, the global financial market is now facing a major problem - the USD shortage, which may become a new upward driving force for the trend of the USD.

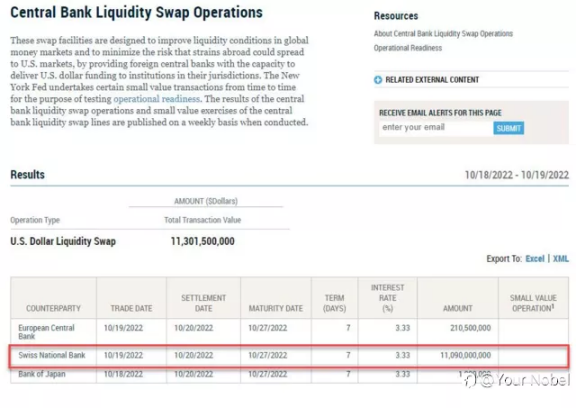

Recently, the central bank liquidity swap operation record on the official website of the New York Fed shows that the Fed continued to conduct a total of $11.3 billion in USD liquidity swap operations with the Swiss National Bank, the European Central Bank and the Bank of Japan. Mainly to provide 11.09 billionUSD of liquidity for the Swiss National Bank.

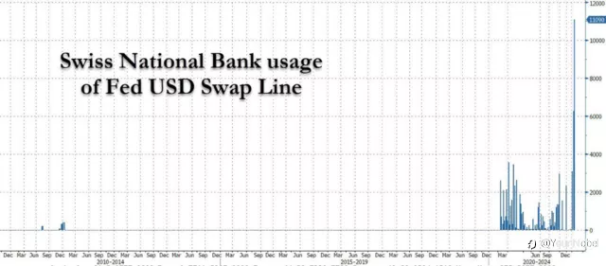

It is worth noting that this is not only the third consecutive USD liquidity transfer from the Fed to the SNB this year, but also the largest single USD swap transfer in history. The Fed's liquidity swap line to the SNB has doubled almost weekly in recent weeks.

On October 5, the Federal Reserve provided the Swiss National Bank with 3.1 billion USD of liquidity, which was the first time the Federal Reserve provided USD to the Swiss National Bank this year, and it was also the first time that the Federal Reserve used liquidity swap lines for overseas central banks on a large scale; on October 12, The Fed doubled the swap line, providing the SNB with $6.27 billion in liquidity.

According to the Fed, a central bank liquidity swap refers to a temporary reciprocal currency arrangement between the Fed and certain overseas central banks to help provide USD liquidity to overseas markets. Analysts had previously warned that the Fed was expected to use the swap line more widely due to a global USD shortage.

Bob Michele, chief investment officer at JPMorgan Asset Management, has repeatedly warned that a stronger USD will open the way for the next market turmoil. Michele believes that foreign investors have snapped up USD assets in order to get higher yields than most markets outside the U.S.

A large portion of these assets are hedged against local currencies such as the euro and yen through derivatives contracts, which involve shorting the USD; and when the contract rolls over, if the USD moves higher, investors must pay a price and they may have to sell other assets to cover losses .

He warned that a sharply stronger USD would create a lot of pressure, especially in terms of hedging USD assets back into local currencies. The Federal Reserve has been injecting USD liquidity into other central banks around the world recently to fill the USD's overnight funding loophole. This fact reflects that a strong USD has already done some damage to market liquidity.

The USD continued to strengthen as the Fed continued to tighten policy. The interbank market is also under increasing pressure: one of the most important indicators of funding tensions in the interbank market and money market risks, the FRA-OIS spread has once again surged to a new high in 2022, which is also the best example .

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.