Drawdown and Maximum Drawdown Explained

So we know that risk management will make us money in the long run, but now we’d like to show you the other side of things.

What would happen if you didn’t use risk management rules?

Consider this example:

Let’s say you have $100,000 and you lose $50,000. What percentage of your account have you lost?

The answer is 50%.

Simple enough.

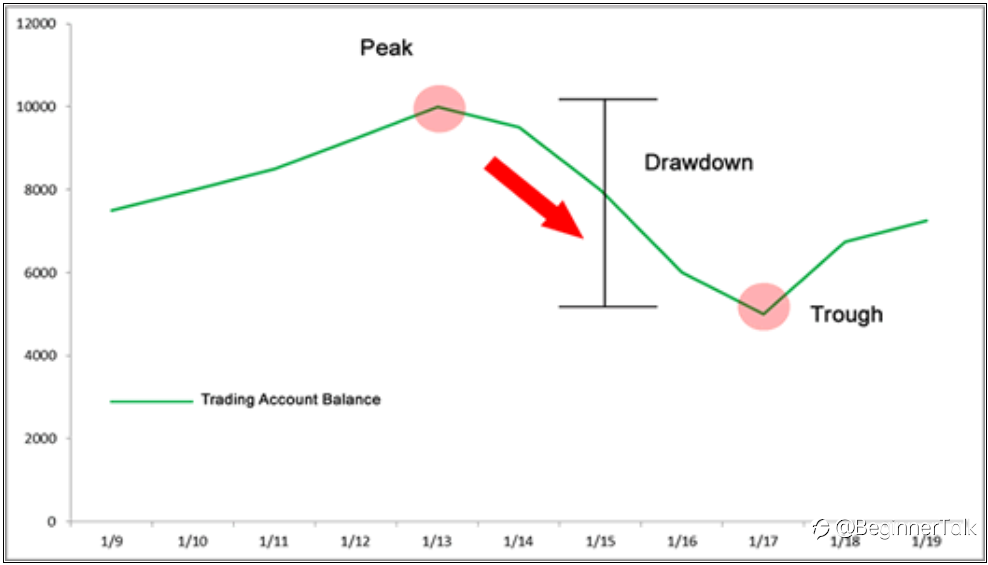

This is what traders call a drawdown.

A drawdown is the reduction of one’s capital after a series of losing trades.

This is normally calculated by getting the difference between a relative peak in capital minus a relative trough.

Traders normally note this down as a percentage of their trading account.

Losing Streak

In trading, we are always looking for an EDGE. That is the whole reason why traders develop systems.

A trading system that is 70% profitable sounds like a very good edge to have. But just because your trading system is 70% profitable, does that mean for every 100 trades you make, you will win 7 out of every 10?

Not necessarily! How do you know which 70 out of those 100 trades will be winners?

The answer is that you don’t. You could lose the first 30 trades in a row and win the remaining 70.

That would still give you a 70% profitable system, but you have to ask yourself, “Would you still be in the game if you lost 30 trades in a row?”

This is why risk management is so important. No matter what system you use, you will eventually have a losing streak.

Even professional poker players who make their living through poker go through horrible losing streaks, and yet they still end up profitable.

The reason is that good poker players practice risk management because they know that they will not win every tournament they play.

Instead, they only risk a small percentage of their total bankroll so that they can survive those losing streaks.

This is what you must do as a trader.

Drawdowns are part of trading.

The key to being a successful forex trader is coming up with trading plan that enables you to withstand these periods of large losses. And part of your trading plan is having risk management rules in place.

Only risk a small percentage of your “trading bankroll” so that you can survive your losing streaks.

Remember that if you practice strict money management rules, you will become the casino and in the long run, “you will always win.”

In the next section, we will illustrate what happens when you use the proper risk management and when you don’t.

Reprinted from Babypips, the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.