Research on the Appreciation and Depreciation Cycle of the US Dollar

Written by@匠鑫学院 click to check the original article

According to the latest data released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), in May 2021, in the ranking of global payment currencies based on total amount, the euro, US dollar, British pound and Japanese yen accounted for 39.03%, 38.35%, 5.78% and 3.02% respectively, ranking in the top 4, and CNY ranks the 5th, up one place from April.

In fact, it is not the first time that the euro has overtaken the US dollar, although it is still difficult to shake the US dollar’s global dominance in the short term. As data shows, the U.S. dollar still accounted for 42.2% of global trade in 2019, surpassing the sum of the euro, the British pound and the Japanese yen, and the U.S. dollar’s advantages in North America, Asia-Pacific and Australia are particularly obvious. However, in the medium to long term, the ongoing depreciation cycle of the U.S. dollar is likely to eventually affect the entire foreign exchange market.

So, how did the depreciation of the U.S. dollar come into being?

The Federal Reserve started its interest rate hike cycle at the end of 2015., which was paused in 2019 and it made a complete reversal in 2020. Two unconventional interest rate cuts in March 2020 lowered the Federal Reserve's federal funds rate to 0-0.25%, which made the interest rate returned to the lowest level in history. Along with the Fed's interest rate cut, the yield on the 10-year US Treasury note also fell rapidly, and its spread with Germany, Japan and Australia has taken a big step down from 2018 and 2019. According to history data, the Fed's rate cuts often mark the beginning of a new round of dollar decline cycles.

In addition to the historical low benchmark interest rate level, in response to the impact of the pandemic, the Federal Reserve and the US Treasury Department have joined hands to push up the US debt level in an unprecedented way, which is one of the important factors leading to the depreciation of the US dollar.

Data shows that in response to the impact of the pandemic and pressure from the Trump administration, the Fed’s balance sheet in 2020 has expanded from US$4.2 trillion at the beginning of the year to US$7.26 trillion in November. In 2021, after Biden came to office, he successively proposed a series of fiscal stimulus measures such as the "American Relief Program", "U.S. Employment Program" and "American Family Plan", with a total amount of more than 6 trillion U.S. dollars. Such lenient fiscal measures have doubled the size of the Fed's balance sheet, surpassing $8 trillion.

Some institutions even predict that although the Fed may reduce the size of its debt purchases in the future, its expansion of the balance sheet has not yet ended. It is estimated that by 2035, the size of the Fed's balance sheet will increase nearly five times, soaring to around US$40 trillion.

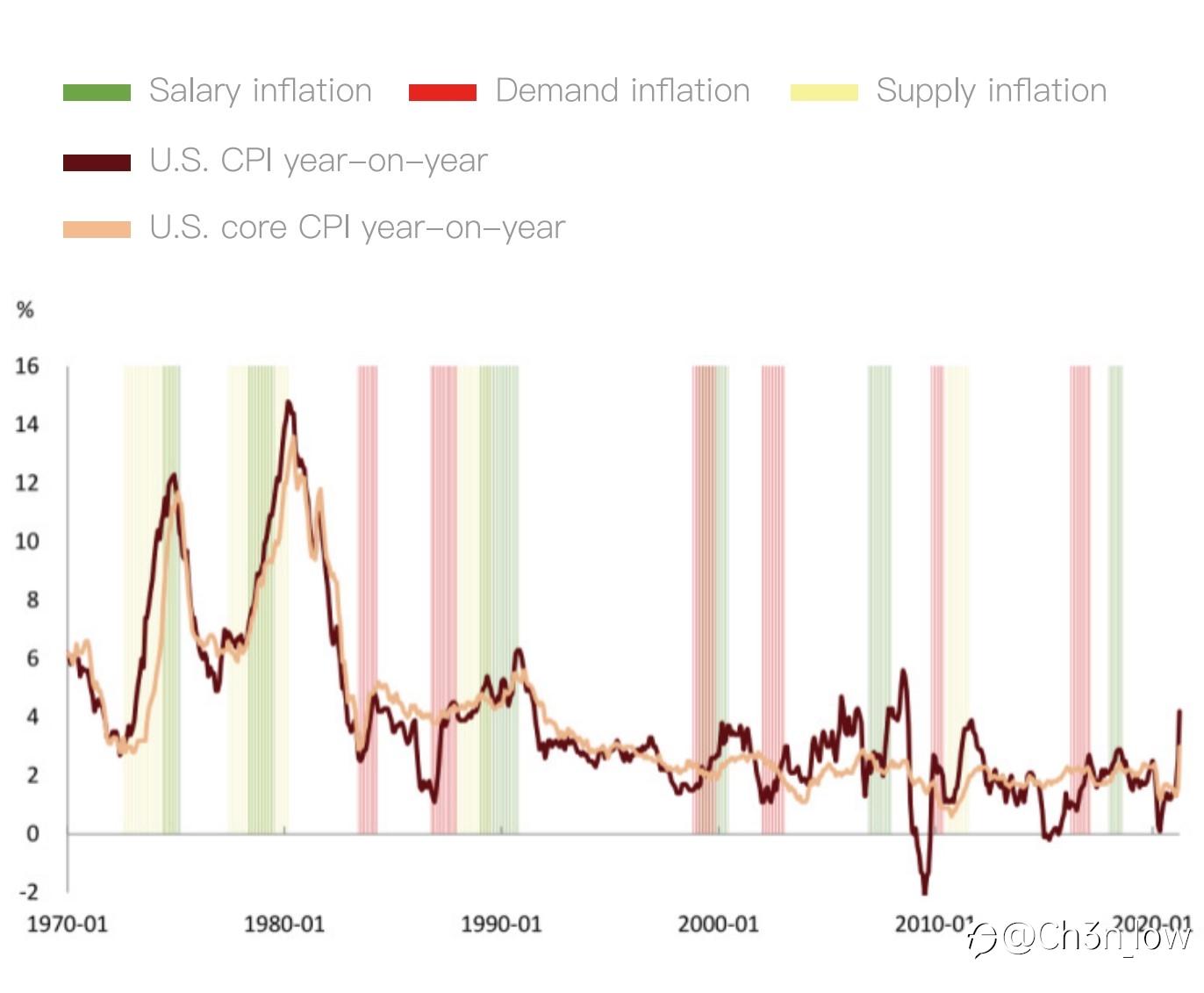

I believe that you get what you grow. The result of the unprecedented loose stimulus is unprecedented inflation. The current U.S. CPI, PPI, and PCE data are consistently higher than expected. The U.S. is facing a triple impact of supply-based inflation, demand-based inflation, and wage inflation. The Fed has to raise inflation expectations at June’s meeting. The dot-map shows that interest rate hikes are expected to rise in advance, which is also a helpless move in the face of the new situation. To some extent, the market's expectations are correct, and the Fed's previous statement about "short-term controllable inflation" has compromised.

To make matters worse, with the rapid expansion of the Fed's balance sheet, the market is increasingly concerned about the decline in the US dollar's global reserve currency status. Under this circumstance, countries have begun to reduce US dollar assets to control risk, such as reducing their holdings of US Treasury bonds.

According to the latest Treasury International Capital Report (TIC) released by the U.S. Department of the Treasury, the scale of U.S. debt held by foreign investors in the U.S. in March 2021 was US$7,028.4 billion, which shows a reduction of US$70.3 billion, among which seven major buyers like China, Japan and Britain sold US$50.5 billion of US debt.

In addition to the above fundamental situation, let's take a look at the current state of the US dollar index through a technical point of view.

The U.S. dollar index peaked at 164.72 in 1985, followed by a weak cycle of about 7 years, until it bottomed in the 78-80 area in 1991; the strong cycle of 1991-2001 gradually increased from 78-80 to 120-121; the weak cycle from 2001 to 2008 fell to 70-72; the strong cycle from 2008 to 2017 rose to 100-103; from 2017 to around 2024, it was a new round of weak cycle of about 7 years.

Therefore, from the figure we can observe the fluctuations, that is, the dollar appreciation is usually a 9-10 year cycle, and the depreciation is a 6-7 year cycle, and we are currently in a major cycle of dollar depreciation. .

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.