RBNZ – The Countdown To Rate Hike Begins

ByJin Dao Tai

JUN 3, 2021

A surprise forecast.

During its monetary policy meeting last Wednesday, the Reserve Bank of New Zealand (RBNZ) held interest rate at 0.25% while keeping its Large Scale Asset Purchase (LSAP) programme and Funding for Lending Programme (FLP) unchanged. What stood out in this meeting was the surprise delivered by the central bank – a rate-hike forecast.

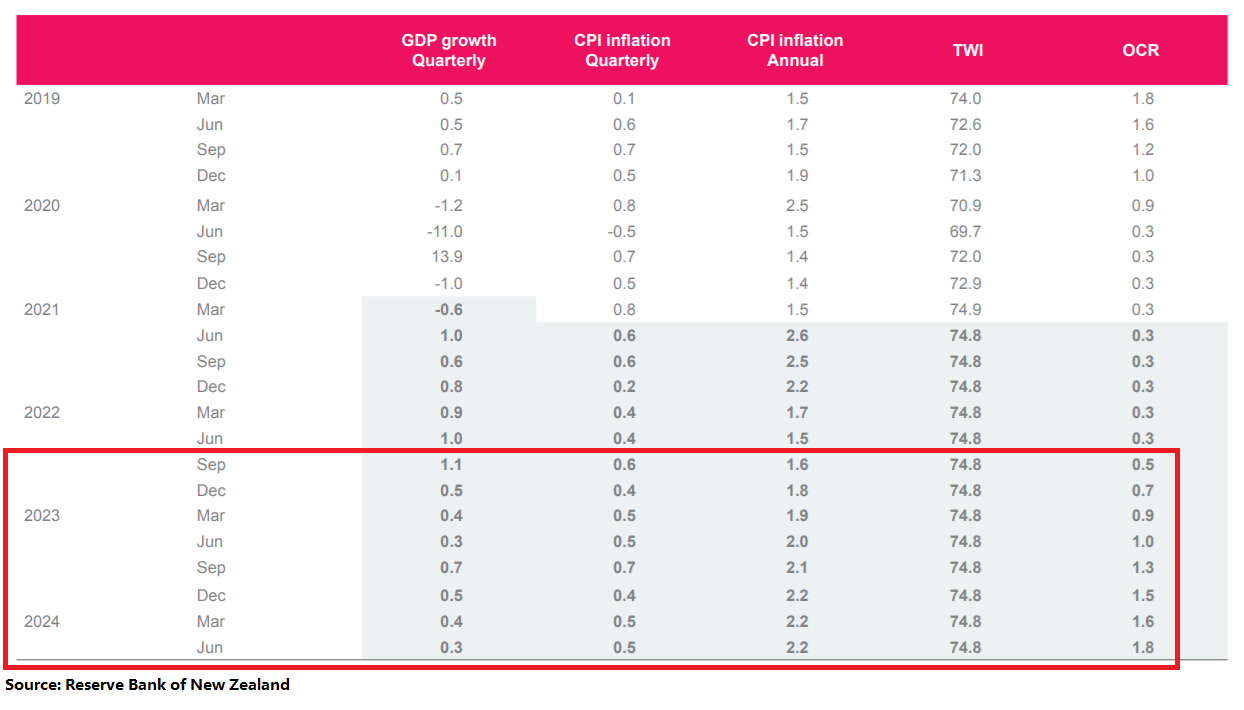

Since the May meeting last year, the RBNZ has stopped providing forecasts for its Overnight Cash Rate (OCR), aka interest rate, from June 2021 onwards due to the highly uncertain economic outlook caused by the COVID-19 pandemic. Fast-forward one year, the RBNZ is now forecasting its first rate-hike in September 2022. Furthermore, the central bank is also forecasting rate hike to continue on a quarterly basis up until June 2024. (Refer to the chart below) Based on the forecast, interest rate will be back to the pre-pandemic level of 1.00% by June 2023. This forecast has illustrated the RBNZ’s confidence in its country’s economic recovery and is also ahead of the market’s expectation of the first-rate hike in 2023. As a result, the New Zealand dollar appreciated across the board.

Improved forecast and forward guidance.

Adding on to the hawkishness, the RBNZ has upgraded its overall medium-term economic projections since the February meeting. The New Zealand economy is now expected to grow by 4.4% in 2022 as compared to the previous forecast of 3.8%. Inflation projection for 2022 was revised upwards to 1.7% from the previous 1.5%. It is also noteworthy that inflation is expected to revolve around the central bank’s 2% midpoint target in 2023 and 2024 with a projection of 1.9% and 2.2% respectively. Finally, unemployment rate projection for 2022 has been revised downward to 4.7% from the previous 5.1%.

Apart from the upgraded projections, the RBNZ’s forward guidance has also provided some hawkishness. During the February meeting, the central bank deemed its medium-term growth outlook as “highly uncertain, determined in large part by both health-related restrictions, and business and consumer confidence”. This growth outlook has since improved with the revision of the sentence to “Confidence in the outlook is rising as the more extreme negative health scenarios wane given the vaccination progress globally”. Also, the central bank ended its February’s interest rate statement with the sentence “The Committee agreed that it was prepared to lower the OCR if required”. However, this sentence was omitted from the recent statement, possibly indicating its redundancy and verifying that the RBNZ is in the rate-hike mood right now.

A non-eventful QE tapering.

The LSAP programme mentioned at the beginning of this article aims to reduce borrowing costs to households and businesses through injection of money into the economy. Last August, the RBNZ expanded the LSAP programme from NZ$60 billion to NZ$100 billion and extended the length of the programme to June 2022 due to ongoing pandemic uncertainty. Since then, the actual and projected issuance of government bonds has fallen, making it no longer possible for the central bank to purchase up to NZ$100 billion of bonds under its quantitative easing (QE) programme by June 2022.

With that, we may start hearing from the RBNZ on QE tapering soon. However, bear in mind that the motivation behind this discussion may be due to the reduced bond issuance from the New Zealand government, leading to the inability of the central bank to complete the LSAP programme in next June. Hence, unless the RBNZ explicitly state that discussion on QE tapering is driven by the progress made in economic recovery, otherwise, such discussion may not lead to a prolonged strengthening of the New Zealand dollar.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.