Japanese Candlestick Anatomy

Let’s break down the different parts of a Japanese candlestick.

Sexy Bodies

Just like humans, candlesticks have different body sizes. And when it comes to forex trading, there’s nothing naughtier than checking out the bodies of candlesticks!

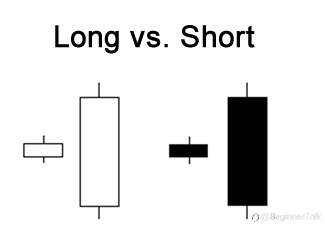

Long bodies indicate strong buying or selling.

The longer the body is, the more intense the buying or selling pressure. This means that either buyers or sellers were stronger and took control.

Short bodies imply very little buying or selling activity. In trading lingo, bulls mean buyers and bears mean sellers.

Long white Japanese candlesticks show strong buying pressure.

The longer the white candlestick, the further the close is above the open.

This indicates that prices increased considerably from open to close and buyers were aggressive. In other words, the bulls were kicking the bears’ butts big time!

Long black (filled) candlesticks show strong selling pressure.The longer the black Japanese candlestick, the further the close is below the open.

This indicates that prices fell a great deal from the open and sellers were aggressive. In other words, the bears were grabbing the bulls by their horns and body-slamming them.

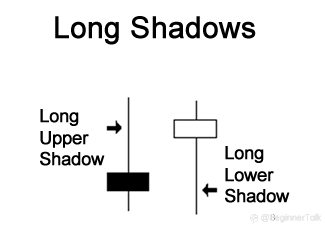

Mysterious Shadows

No, we’re not talking about wearing dark smokey eye shadow.

The upper and lower shadows on Japanese candlesticks provide important clues about the trading session.

Upper shadows signify the session high.

Lower shadows signify the session low.

Candlesticks with long shadows show that trading action occurred well past the open and close.

Japanese candlesticks with short shadows indicate that most of the trading action was confined near the open and close.

If a Japanese candlestick has a long upper shadow and short lower shadow, this means that buyers flexed their muscles and bid prices higher.But for one reason or another, sellers came in and drove prices back DOWN to end the session back near its open price.

If a Japanese candlestick has a long lower shadow and short upper shadow, this means that sellers flashed their washboard abs and forced the price lower.

But for one reason or another, buyers came in and drove prices back UP to end the session back near its open price.

Reprinted from Babypips,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.