Price Action for Major Pairs GBP/USD, EUR/USD, AUS/USD

USD weakness has been back for a couple of weeks now. The possibility of continuation should at least be entertained, and this is something that could add allure to the long side of GBP/USD, similar to what was looked at last week and the week before.

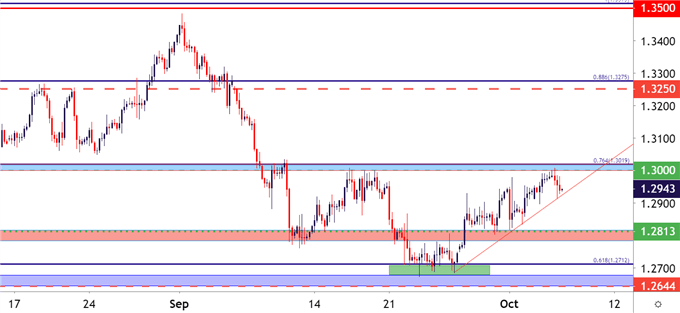

GBP/USD FOUR-HOUR PRICE CHART

On the short side of USD, that support bounce continued all the way into this morning when prices in the pair re-tested the vaulted 1.3000 figure. But, that bullish run may not yet be done, especially if USD support cannot hold, and a bullish trendline pulled from the four-hour chart can provide a bit of framework to use for topside approaches in GBP/USD.

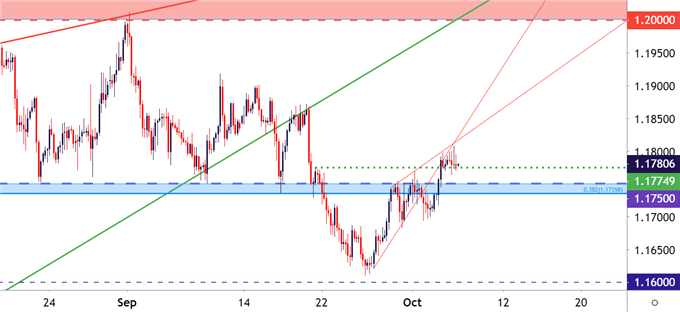

EUR/USD FOUR-HOUR PRICE CHART

The two resistance levels that were being tracked in EUR/USD last week did not hold. What did end up coming into play on the resistance side was the 1.1800 figure, which showed up overnight and has since helped to bring in a pattern of indecision, as shown on the four-hour chart above. With a series of dojis and spinning tops over the past few four-hour bars, buyers may be losing steam as sellers take a stronger swing. This can keep the door open for bearish scenarios but for traders looking for a bit of confirmation, re-encroachment below the 1.1750 big figure could start to make the short side of the pair look attractive again.

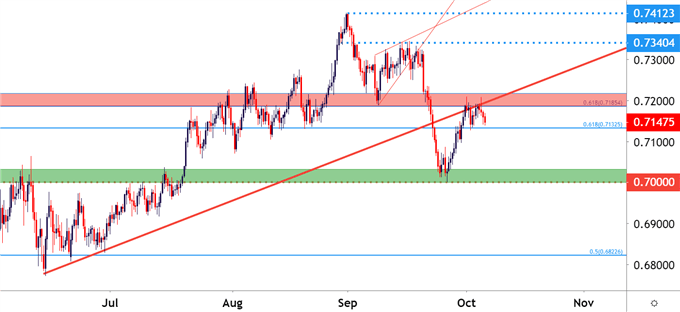

AUS/USD EIGHT-HOUR PRICE CHART

Perhaps more attractive on the long side of the U.S. Dollar, at least at this point, is AUD/USD. The pair has pushed up to the 0.7185 level that was looked at last week, and this is confluent with a prior bullish trendline connecting early-June swing lows. This can keep the door open on the short side of the pair, looking for a push back down towards the 0.7000 handles and, perhaps a bit deeper if the USD bullish run can continue.

Edited 07 Oct 2020, 12:12

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.