The threat of a second wave of a new coronavirus infection caused a fall in the Euro and British Pound indices, against which the US dollar turned out to be much more positive.

On September 16, on Fed Minutes, Chairman Jerome Powell made it clear that success in the fight against coronavirus will be the determining factor recovery of the US and World economy. The announced figures in the FOMC materials on the economic forecasts of the FRB presidents and members of the FOMC were more positive than in July, the dollar after the release of the data began to gain rapidly, despite the drop in American indices.

The Federal Reserve has taken what Mr. Powell called “drastic” steps in response, including cutting interest rates to near-zero and buying about $ 2 trillion in US government debt. The bank also said last month that it was loosening its approach to managing inflation, targeting higher price increases to try to spur growth and maintain employment.

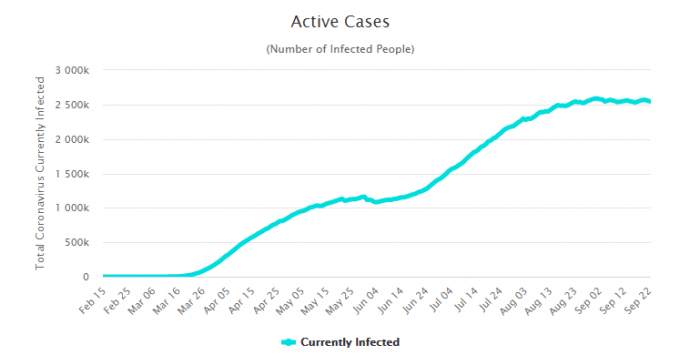

The chart of the active Covid-19 cases in the United States at the moment looks like this:

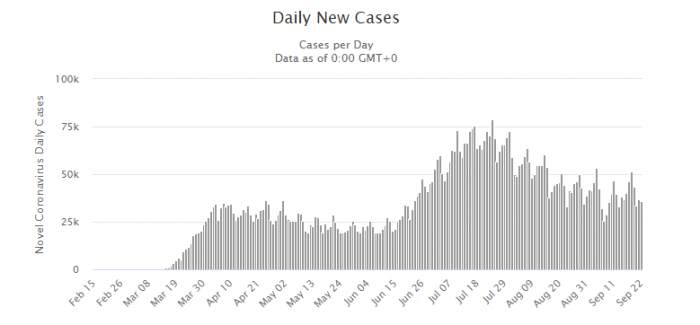

New daily cases of Covid-19 infections in the United States

From the charts above it is clear that so far the United States has managed to keep the number of infected at the level of 2.5 million, which makes it possible to clearly assess the recovery, taking into account the priorities of the Fed – keeping inflation at 2% and reducing unemployment, the total number of infected at a certain level, despite the daytime infections.

Further growth of the US dollar against other currencies was also served by the announcements of the central bank. The Bank of England in the minutes of the meeting reported that the interest rate would remain at a historically low level of 0.1%, adding that the outlook for the economy remains “unusually uncertain”. Adding fuel to the fire Prime Minister Boris Johnson stated at the beginning of the week, and yesterday, September 22, announced the introduction of additional restrictions, which were considered by public as a return of lockdowns and negatively affected the GBP.

Europe has been reporting for a month about the introduction of additional restrictive ones because of fears of a second wave, so Hungary became the first country in the bloc. Great Britain, in turn, is listing more European states to the list of “restricted countries to travel”, while the issue of trade relations with the EU after Brexit remains unresolved.

Thus, the FTSE100 Index fell 4.21% from September 16 to September 21, with the largest losses falling on the shares of the owners of airlines, hotels, restaurants and pubs traded on the London Stock Exchange.

The FTSE was able to recover today and continue yesterday’s gains on the UK Manufacturing and Services Index (PMI) publishing fund.

Chart from TradingView

Despite the growth of the FTSE100 index of the London Stock Exchange, the British pound remains weak against the US dollar. Most likely bearish trend, against the background of the introduction of restrictions and closing borders. As of this writing, GBP/USD on Overbit is trading just below the 0.618 Fibonacci retracement of the previous support level at 1.27130, the decline is likely to continue to the 1.26570 support level, where a slight recovery is expected for the pound, and a possible further fall to the 1.25200 mark towards the Fibonacci 0.786 level.

GBP/USD Quote on Overbit

Since the successful projection of the economic recovery and the success in the fight against coronavirus are accompanied, Europe is about to take strict measures to hold the virus spread as states are suffering from Wave 2. Peak values for infected COVID19 were recorded in August in Albania, Bulgaria, Czech Republic, Montenegro. France, Holland, Spain and Poland recorded peaks in those infected per day. EU Central Bank President Christine Lagarde also noted that economic recovery remains unclear and uneven, and additional stimulus will be required to support the economy.

German DAX as main indices of the EU’s economic projection fell sharply yesterday after new high numbers of infected reported, though was able to recover today after the publication of Manufacturing Indexes (PMI) of the EU, Germany, France and Spain. expected PMI data from the US to be released later today.

Chart from TradingView

The euro against the US dollar, at the time of this writing, is trading above an important support level at 1.17120, at 1.17165. Most likely EUR / USD will test 1.17630, where dynamic and static resistance is set, as well as EMA20, and continue to fall.

EUR/USD quotes on Overbit

The chart shows an interesting pattern, discovered by crypto traders back in 2018, called the “Bart Simpson” pattern, due to the similarity of the price movement with a hair-style of the character. In fact, this pattern shows the fatigue of the bulls, despite the drop in the quote currency. It should be noted that the President of the EU Central Bank herself has repeatedly said that one should closely monitor the rapid growth of the Euro, because in the context of economic recovery and the resumption of business and tourism, the expensive Euro may negatively affect the inertia of economic recovery. #euro##Sterling##USDollarIndex#

Reprinted from FXEmpire,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now