© 2026 Followme

Liked

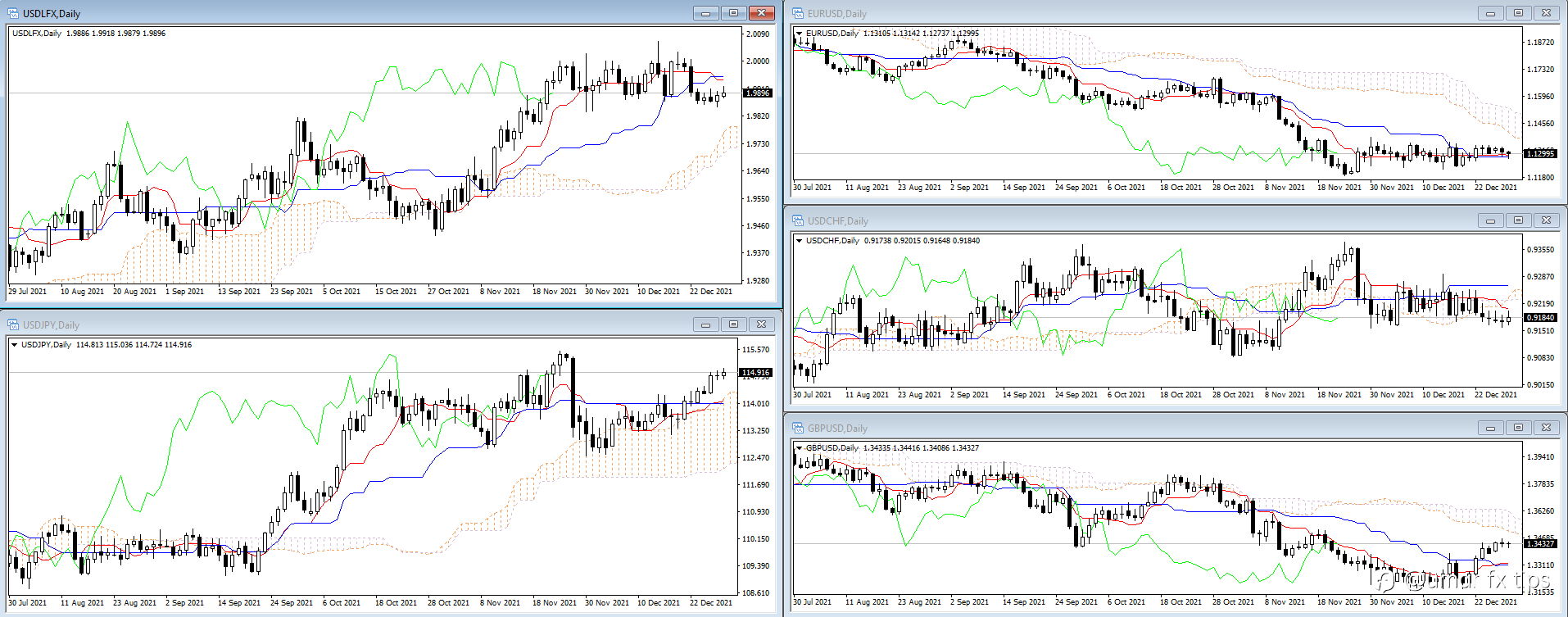

US Dollar Index bounces off lows near 93.20, looks to data

DXY meets support in the 93.20/15 band post-FOMC.

The Fed kept the FFTR unchanged at its meeting on Wednesday.

Weekly Claims and advanced Q2 GDP figures next of relevance.

The greenback, when tracked by the US Dollar Index (DXY), is recovering some ground lost after bottoming out in the 93.20/15 ba

USD/JPY risks a potential breach of 105.00 – UOB

FX Strategists at UOB Group believe USD/JPY still faces a probable break below the 105.00 level in the next weeks.

Key Quotes

24-hour view: “Yesterday, we held the view that USD ‘could grind lower to 104.80’ and ‘the next support at 104.40 is unlikely to come into the picture’. Our view was not wron

Silver to surge above $35 after taking a breather – Credit Suisse

Silver has established its looked for base and has already moved to the first resistance at $26.09/22. Whilst strategists at Credit Suisse look for a pause here, they see scope for further gains ahead, ideally to $35.23/365.

Key quotes

“Silver has seen an even more dramatic move higher than Gold ov

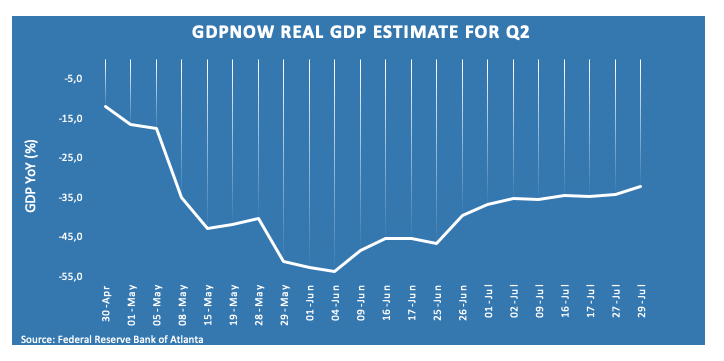

Gold: Lousy US GDP data to trigger a sell the fact

Gold (XAU/USD) witnessed another attempt to the upside on Wednesday and tested the record highs of $1981.34 after the US Federal Reserve (Fed) struck a dovish tone. On Thursday, the yellow metal is easing, as the Fed’s dovishness lifted the sentiment on the global markets, although the optimism was

Powell speech: High-frequency data showing pace of recovery slowed since mid-June

Following the Federal Open Market Committee's (FOMC) decision to keep the policy rate unchanged within the target range of 0-0.25%, Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, is delivering his comments on the policy outlook.

Key quotes

"High-frequency data is showi

GBP/USD loses some of its shine after Powell comments

GBP/USD is trading 0.29% higher on Wednesday despite some recent weakness.

Powell noted that some data had suggested the recovery could be fragile.

Fundamental backdrop

Some key comments from Powell:

On the balance, it looks like some of the data are pointing to a slower pace of recovery.

Fed wi

US COVID-19 deaths surpass 150,000 - John Hopkins University

US coronavirus virus cases have risen 1.9%, above last week's 1.6% average as deaths surpass 150,000.

Meanwhile, the Federal Reserve's chairman, Jerome Powell, said today that the central bank will sustain historic monetary policy until it’s confident the economy has navigated through the Covid-19 p

Wall Street Close: Stocks continued to recover despite likely expiration of relief funds for US citizens

Dow Jones Industrial Average climbed 160.29 points, or 0.61%, to 26,539.57.

S&P 500 added 40.0points, or 1.24%, to 3,258.45.

Nasdaq Composite put on 140.85 points, o1.35%, to 10,542.94.

US stocks added to their recoveries on Wednesday on a session that provided the long-anticipated Federal Re

AUD/USD again battles 0.7200 following dovish Fed

AUD/USD seesaws around the fresh high since April 2019.

US Federal Reserve announcement came out as anticipated with Chairman Jerome Powell stressing fiscal support.

Dismal prints of Aussie CPI, an announcement from Queensland failed to defy the Aussie bulls.

Australia’s Export-Import Price Index an

McConnell said in recent trade that he hopes to reach a deal on unemployment by this Friday

A key federal programme for the millions of Americans rendered jobless by the coronavirus pandemic expires on Friday.

However, that has not stopped Speaker Nancy Pelosi and Senate Majority Leader Mitch McConnell ratcheting up their combative rhetoric today.

Both leaders appear to be as far apart as

GBP/AUD Price Analysis: Bulls looking for a daily H&S completion

GBP/AUD has been in a strong downtrend on the longer-term charts but has found a base at critical support structure.

The price can be expected to hold and turn higher.

Price action is bullish and a bullish case is on the cards judging by the currency price action.

Both GBP and the Aussie have pick

UK government to expand Covid-19 rescue loan scheme

The Guardian has reported that the government is expanding its Covid-19 rescue loan scheme to cover small businesses on the edge of collapse, a move that Labour warned would come too late for many troubled firms.

Lead paragraphs

With less than a week before the furlough scheme covering 9 million e

GBP/USD Price Analysis: Consolidates gains below 1.3000

GBP/USD recedes from the highest since March 10.

Break of two-day-old support line, MACD/RSI conditions push the sellers to take the risk.

1.2775/80 becomes the key support, bulls may aim for mid-February highs beyond 1.3000.

GBP/USD eases to 1.2980 during Thursday’s Asian session. In doing so, the

USD/CHF Price Analysis: Hits lowest since May 2015

USD/CHF slips to multi-year lows below 0.9120 on broad-based dollar sell-off.

Technical indicators like the RSI suggest extreme oversold conditions.

The USD/CHF pair fell to 0.9116 during Thursday's Asian trading hours to hit the lowest level since May 2015.

The pair has dropped by over 3.6% this